Question: Solve the problem using 6.2%, up to $128,400 for Social Security tax and using 1.45%, no wage limit, for Medicare tax. Kristy Dunaway has biweekly

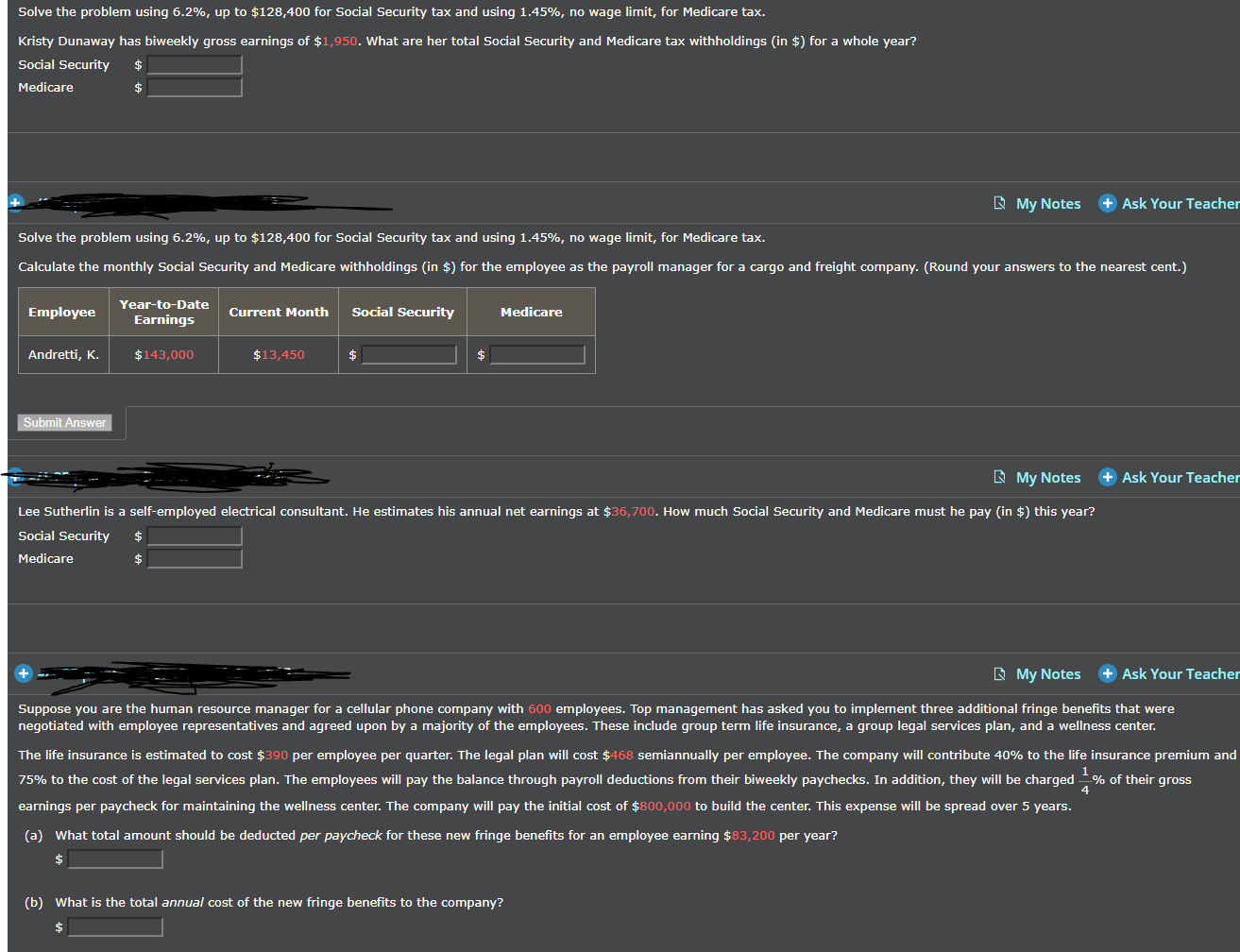

Solve the problem using 6.2%, up to $128,400 for Social Security tax and using 1.45%, no wage limit, for Medicare tax. Kristy Dunaway has biweekly gross earnings of $1,950. What are her total Social Security and Medicare tax withholdings (in $) for a whole year? Social Security $ Medicare RMy Notes + Ask Your Teacher Solve the problem using 6.2%, up to $128,400 for Social Security tax and using 1.45%, no wage limit, for Medicare tax, Calculate the monthly Social Security and Medicare withholdings (in $) for the employee as the payroll manager for a cargo and freight company. (Round your answers to the nearest cent.) Employee Year-to-Date Earnings Current Month Social Security Medicare Andretti, K. $ 143,000 $13,450 Submit Answer My Notes + Ask Your Teacher Lee Sutherlin is a self-employed electrical consultant. He estimates his annual net earnings at $36,700. How much Social Security and Medicare must he pay (in $) this year? Social Security $ Medicare My Notes + Ask Your Teacher Suppose you are the human resource manager for a cellular phone company with 600 employees. Top management has asked you to implement three additional fringe benefits that were negotiated with employee representatives and agreed upon by a majority of the employees. These include group term life insurance, a group legal services plan, and a wellness center. The life insurance is estimated to cost $390 per employee per quarter. The legal plan will cost $468 semiannually per employee. The company will contribute 40% to the life insurance premium and 75% to the cost of the legal services plan. The employees will pay the balance through payroll deductions from their biweekly paychecks. In addition, they will be charged 2% of their gross earnings per paycheck for maintaining the wellness center. The company will pay the initial cost of $800,000 to build the center. This expense will be spread over 5 years. (a) What total amount should be deducted per paycheck for these new fringe benefits for an employee earning $83,200 per year? (b) What is the total annual cost of the new fringe benefits to the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts