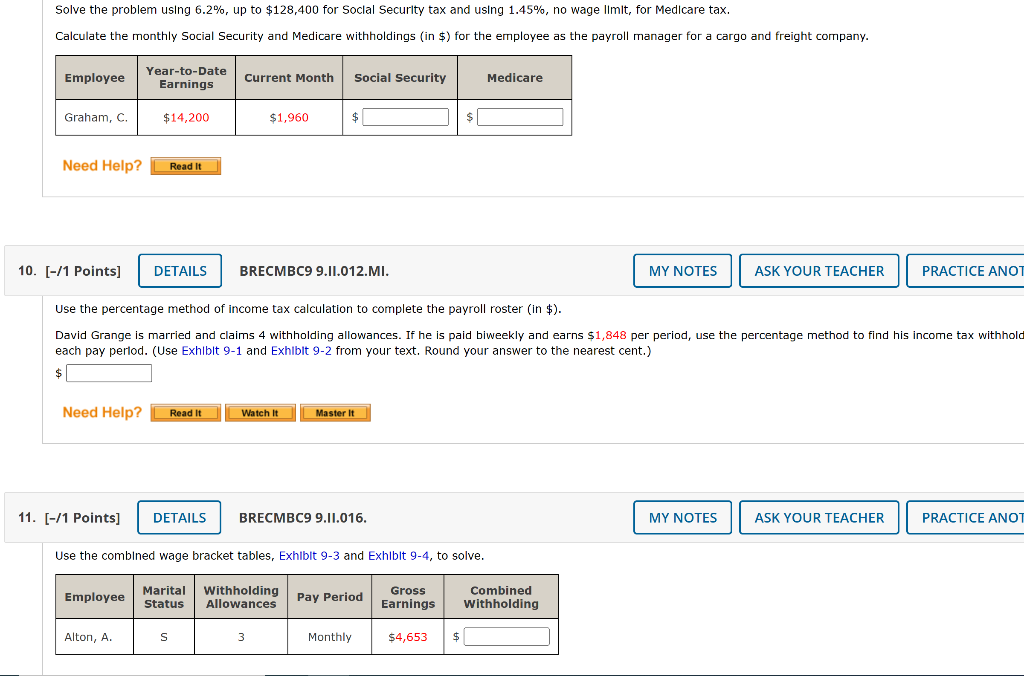

Question: Solve the problem using 6.2%, up to $128,400 for Soclal Securlty tax and using 1.45%, no wage Ilmit, for Medicare tax. Calculate the monthly Social

Solve the problem using 6.2%, up to $128,400 for Soclal Securlty tax and using 1.45%, no wage Ilmit, for Medicare tax. Calculate the monthly Social Security and Medicare withholdings (in \$) for the employee as the payroll manager for a cargo and freight company. [/1 Points] BRECMBC9 9.II.012.MI. Use the percentage method of income tax calculation to complete the payroll roster (in \$). David Grange is married and claims 4 withholding allowances. If he is paid biweekly and earns $1,848 per period, use the percentage method to find his income tax withhol each pay perlod. (Use Exhlblt 9-1 and Exhlblt 9-2 from your text. Round your answer to the nearest cent.) [11 Points ] BRECMBC9 9.II.016. Use the comblned wage bracket tables, Exhlbit 93 and Exhlblt 94, to solve

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts