Question: Solve the problem using the template 6.5 Comprehensive Financial Ratio Analysis Financial statements for Wertenbroch Company, a distributor of kitchenware, are presented below (all amounts

Solve the problem using the template

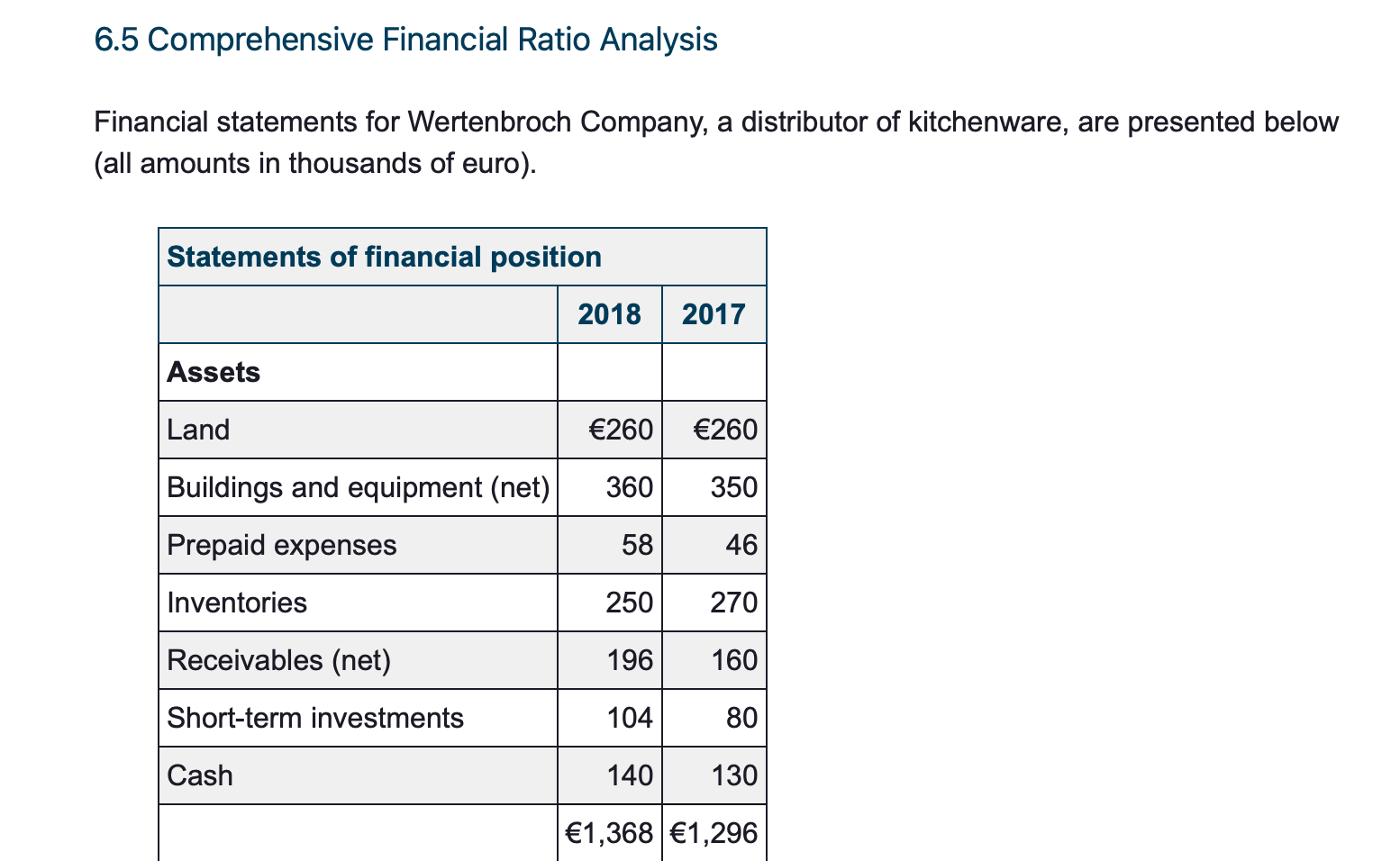

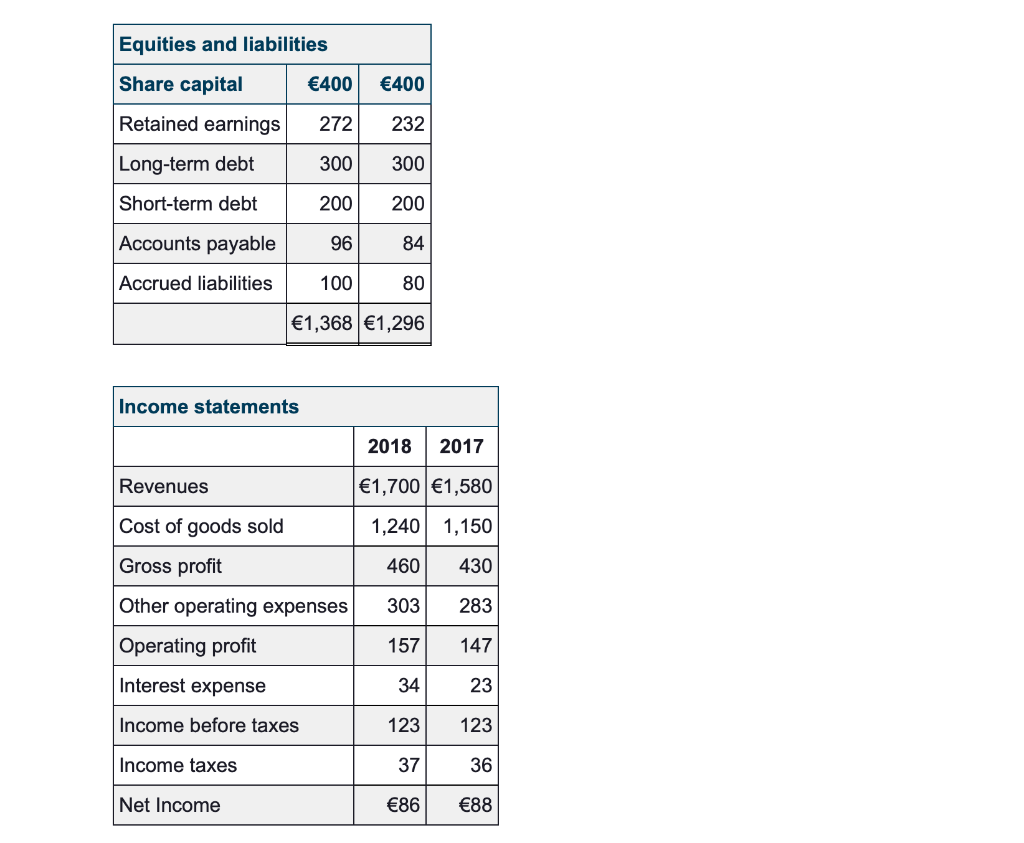

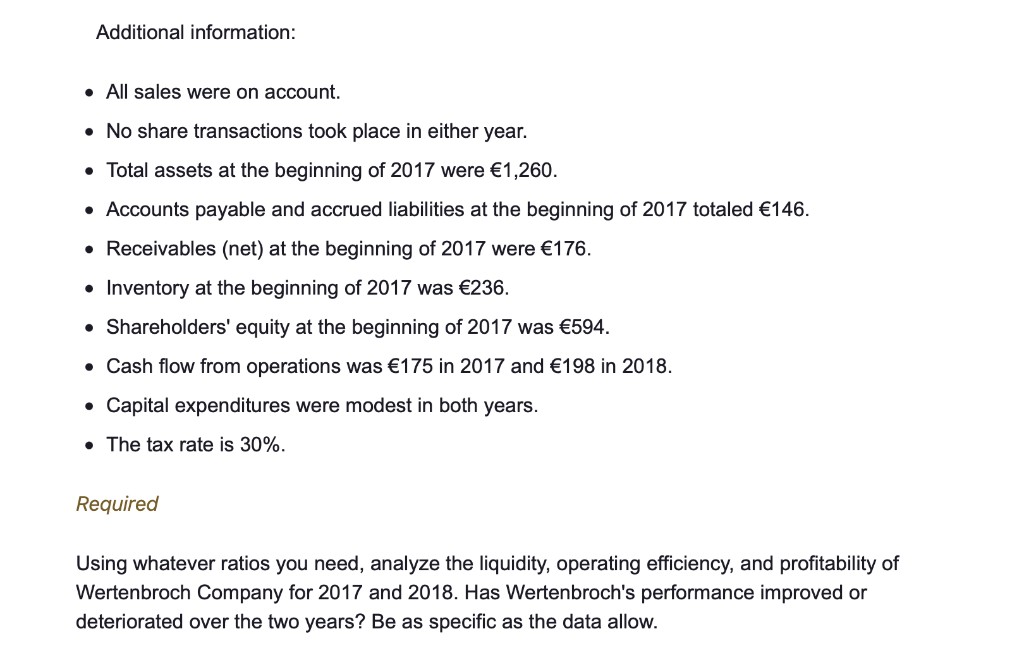

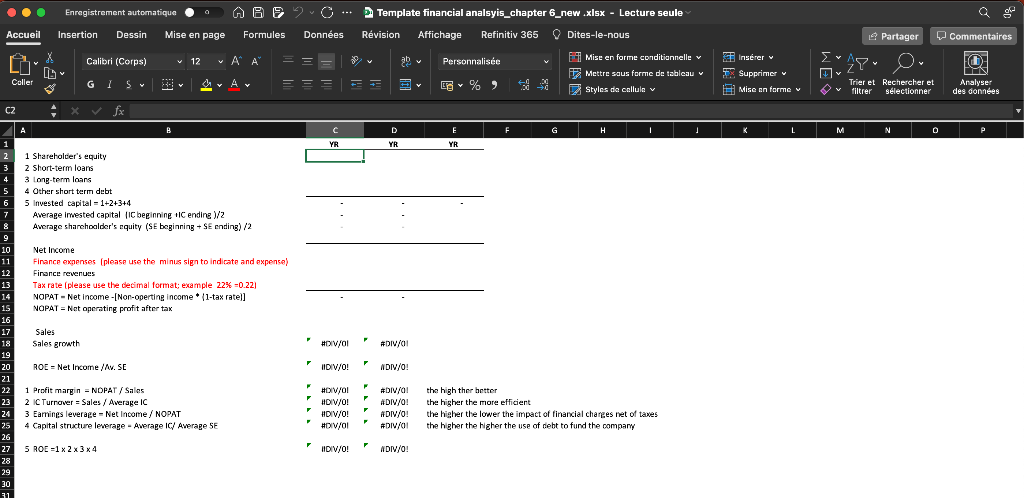

6.5 Comprehensive Financial Ratio Analysis Financial statements for Wertenbroch Company, a distributor of kitchenware, are presented below (all amounts in thousands of euro). \begin{tabular}{|l|r|r|} \hline \multicolumn{3}{|l|}{ Equities and liabilities } \\ \hline Share capital & 400 & 400 \\ \hline Retained earnings & 272 & 232 \\ \hline Long-term debt & 300 & 300 \\ \hline Short-term debt & 200 & 200 \\ \hline Accounts payable & 96 & 84 \\ \hline Accrued liabilities & 100 & 80 \\ \hline & 1,368 & 1,296 \\ \hline \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline Income statements & \multicolumn{2}{|l|}{} \\ \hline & 2018 & 2017 \\ \hline Revenues & 1,700 & 1,580 \\ \hline Cost of goods sold & 1,240 & 1,150 \\ \hline Gross profit & 460 & 430 \\ \hline Other operating expenses & 303 & 283 \\ \hline Operating profit & 157 & 147 \\ \hline Interest expense & 34 & 23 \\ \hline Income before taxes & 123 & 123 \\ \hline Income taxes & 37 & 36 \\ \hline Net Income & 86 & 88 \\ \hline \end{tabular} Additional information: - All sales were on account. - No share transactions took place in either year. - Total assets at the beginning of 2017 were 1,260. - Accounts payable and accrued liabilities at the beginning of 2017 totaled 146. - Receivables (net) at the beginning of 2017 were 176. - Inventory at the beginning of 2017 was 236. - Shareholders' equity at the beginning of 2017 was 594. - Cash flow from operations was 175 in 2017 and 198 in 2018. - Capital expenditures were modest in both years. - The tax rate is 30%. Required Using whatever ratios you need, analyze the liquidity, operating efficiency, and profitability of Wertenbroch Company for 2017 and 2018 . Has Wertenbroch's performance improved or deteriorated over the two years? Be as specific as the data allow. Sales Sales growth ROE = Net Income / Av. SE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts