Question: solve the question A project to extend irrigation canals into an area that was recently cleared of mesquite trees (a nui- sance tree in Texas)

solve the question

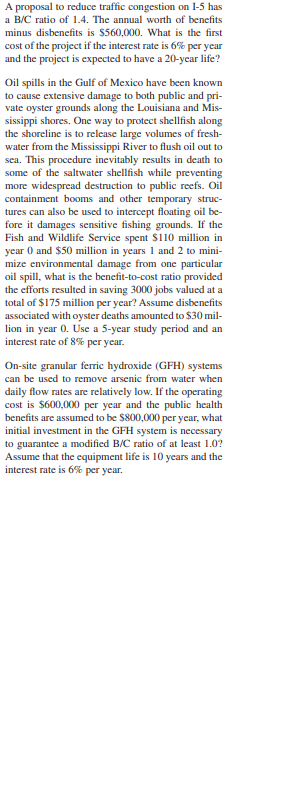

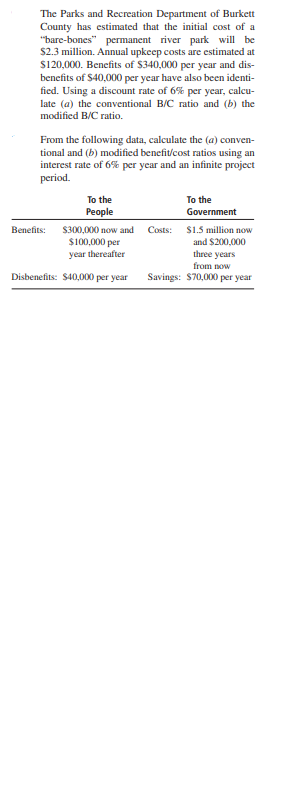

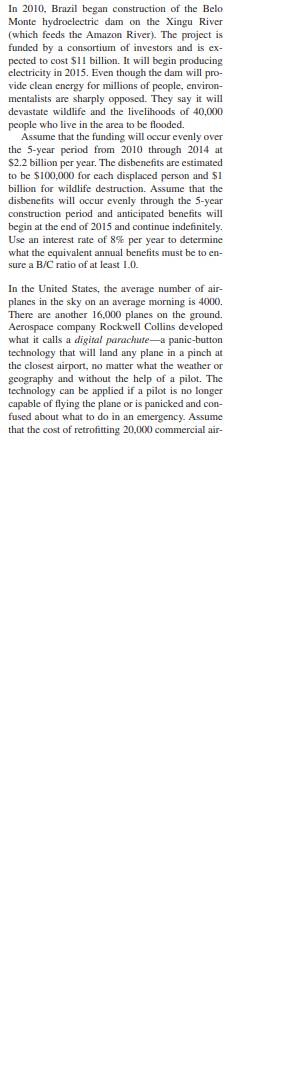

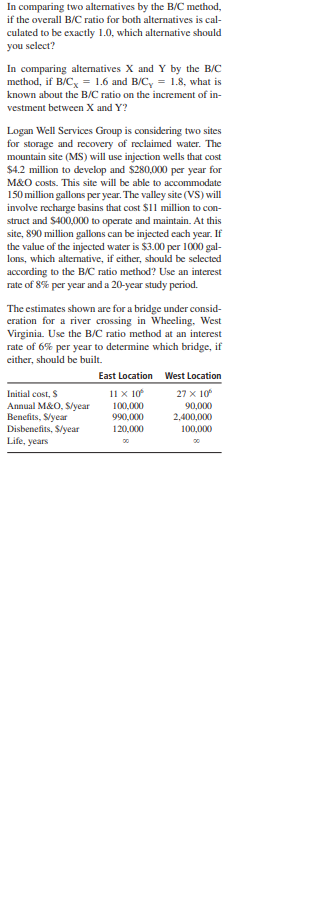

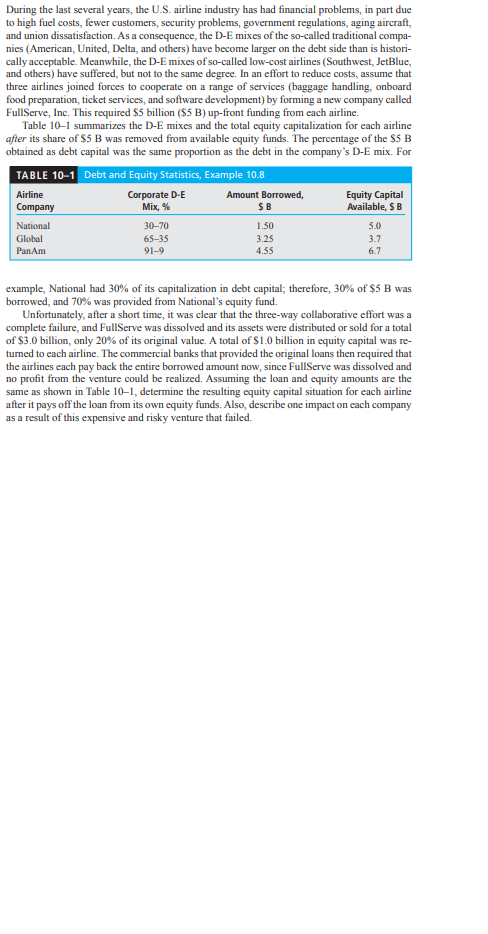

A project to extend irrigation canals into an area that was recently cleared of mesquite trees (a nui- sance tree in Texas) and large weeds is projected to have a capital cost of $2,000,000. Annual mainte- nance and operation costs will be $100,000 per year. Annual favorable consequences to the gen- cral public of $820,000 per year will be offset to some extent by annual adverse consequences of $400,000 to a portion of the general public. If the project is assumed to have a 20-year life, what is the B/C ratio at an interest rate of 8% per year? Calculate the B/C ratio for the following cash flow estimates at a discount rate of 7% per year. tem Cash Flow FW of benefits, $ 30,800,000 AW of disbenefits, $ per year 105,000 First cost, $ 1,200,000 M&O costs, $ per year 400,000 Life of project, years 20 The benefits associated with a nuclear power plant cooling water filtration project located on the Ohio River are $10,000 per year forever, starting in year 1. The costs are $50,000 in year 0 and $50,000 at the end of year 2. Calculate the B/C ratio at i = 10% per year.A proposal to reduce traffic congestion on 1-5 has a B/C ratio of 1.4. The annual worth of benefits minus disbenefits is $560,000. What is the first cost of the project if the interest rate is 6% per year and the project is expected to have a 20-year life? Oil spills in the Gulf of Mexico have been known to cause extensive damage to both public and pri- vate oyster grounds along the Louisiana and Mis- sissippi shores. One way to protect shellfish along the shoreline is to release large volumes of fresh- water from the Mississippi River to flush oil out to sea. This procedure inevitably results in death to some of the saltwater shellfish while preventing more widespread destruction to public reefs. Oil containment booms and other temporary struc tures can also be used to intercept floating oil be- fore it damages sensitive fishing grounds. If the Fish and Wildlife Service spent $110 million in year 0 and $50 million in years 1 and 2 to mini- mize environmental damage from one particular oil spill, what is the benefit-to-cost ratio provided the efforts resulted in saving 3000 jobs valued at a total of $175 million per year? Assume disbenefits associated with oyster deaths amounted to $30 mil- lion in year 0. Use a 5-year study period and an interest rate of 8% per year. On-site granular ferric hydroxide (GFH) systems can be used to remove arsenic from water when daily flow rates are relatively low. If the operating cost is $600,000 per year and the public health benefits are assumed to be $800,000 per year, what initial investment in the GFH system is necessary to guarantee a modified B/C ratio of at least 1.0? Assume that the equipment life is 10 years and the interest rate is 6% per year.The Parks and Recreation Department of Burkett County has estimated that the initial cost of a "bare-bones" permanent river park will be $2.3 million. Annual upkeep costs are estimated at $120,000. Benefits of $340,000 per year and dis- benefits of $40.000 per year have also been identi- fied. Using a discount rate of 6% per year, calcu- late (a) the conventional B/C ratio and (b) the modified B/C ratio. From the following data, calculate the (a) conven- tional and (b) modified benefit/cost ratios using an interest rate of 6% per year and an infinite project period. To the To the People Government Benefits: $300,000 now and Costs: $1.5 million now $100,000 per and $200,000 year thereafter three years from now Disbenefits: $40,000 per year Savings: $70,000 per yearIn 2010, Brazil began construction of the Belo Monte hydroelectric dam on the Xingu River (which feeds the Amazon River). The project is funded by a consortium of investors and is ex- pected to cost $11 billion. It will begin producing electricity in 2015. Even though the dam will pro- vide clean energy for millions of people, environ- mentalists are sharply opposed. They say it will devastate wildlife and the livelihoods of 40,000 people who live in the area to be flooded. Assume that the funding will occur evenly over the 5-year period from 2010 through 2014 at $2.2 billion per year. The disbenefits are estimated to be $100,000 for each displaced person and $1 billion for wildlife destruction. Assume that the disbenefits will occur evenly through the 5-year construction period and anticipated benefits will begin at the end of 2015 and continue indefinitely. Use an interest rate of 8% per year to determine what the equivalent annual benefits must be to en- sure a B/C ratio of at least 1.0. In the United States, the average number of air- planes in the sky on an average morning is 4000. There are another 16,000 planes on the ground. Acrospace company Rockwell Collins developed what it calls a digital parachute-a panic-button technology that will land any plane in a pinch at the closest airport, no matter what the weather or geography and without the help of a pilot. The technology can be applied if a pilot is no longer capable of flying the plane or is panicked and con- fused about what to do in an emergency. Assume that the cost of retrofitting 20,000 commercial air-In comparing two alternatives by the B/C method, if the overall B/C ratio for both alternatives is cal- culated to be exactly 1.0, which alternative should you select? In comparing alternatives X and Y by the B/C method, if B/Cy = 1.6 and B/Cy = 1.8, what is known about the B/C ratio on the increment of in- vestment between X and Y? Logan Well Services Group is considering two sites for storage and recovery of reclaimed water. The mountain site (MS) will use injection wells that cost $4.2 million to develop and $280.000 per year for M&O costs. This site will be able to accommodate 150 million gallons per year. The valley site (VS) will involve recharge basins that cost $11 million to con- struct and $400,000 to operate and maintain. At this site, 890 million gallons can be injected each year. If the value of the injected water is $3.00 per 1000 gal- Ions, which alternative, if either, should be selected according to the B/C ratio method? Use an interest rate of 8% per year and a 20-year study period. The estimates shown are for a bridge under consid cration for a river crossing in Wheeling, West Virginia. Use the B/C ratio method at an interest rate of 6% per year to determine which bridge, if either, should be built. East Location West Location Initial cost, $ 11 x 10 27 x 10 Annual M&O, $/year 100,000 90,000 Benefits, $/year 990.000 2,400,000 Disbenefits, $/year 120,000 100,000 Life, years DOAn alternative with an infinite life has a B/C ratio of 1.5. The alternative has benefits of $50,000 per year and annual maintenance costs of $10,000 per year. The first cost of the alternative at an interest rate of 10% per year is closest to: (a) $23,300 (b) $85.400 (c) $146,100 (ad) $233,000 Cost-effectiveness analysis (CEA) differs from cost-benefit (B/C) analysis in that: (a) CEA cannot handle multiple alternatives. (b) CEA expresses outcomes in natural units rather than in currency units. (c) CEA cannot handle independent alternatives. (d) CEA is more time-consuming and resource- intensive. Several private colleges claim to have programs that are very effective at teaching enrollees how to become entrepreneurs. Two programs, identi- fied as program X and program Y, have produced 4 and 6 persons per year, respectively, who were recognized as entrepreneurs. If the total cost of the programs is $25,000 and $33,000, respec- tively, the incremental cost-effectiveness ratio is closest to: (a) 6250 (b) 5500 (c) 4000 (d) 1333During the last several years, the U.S. airline industry has had financial problems, in part due to high fuel costs, fewer customers, security problems, government regulations, aging aircraft, and union dissatisfaction. As a consequence, the D-E mixes of the so-called traditional compa- nies (American, United, Delta, and others) have become larger on the debt side than is histori- cally acceptable. Meanwhile, the D-E mixes of so-called low-cost airlines (Southwest, JetBlue, and others) have suffered, but not to the same degree. In an effort to reduce costs, assume that three airlines joined forces to cooperate on a range of services (baggage handling, onboard food preparation, ticket services, and software development) by forming a new company called FullServe, Inc. This required $5 billion ($5 B) up-front funding from each airline. Table 10-1 summarizes the D-E mixes and the total equity capitalization for each airline after its share of $5 B was removed from available equity funds. The percentage of the $5 B obtained as debt capital was the same proportion as the debt in the company's D-E mix. For TABLE 10-1 Debt and Equity Statistics, Example 10.8 Airline Corporate D-E Amount Borrowed, Equity Capital Company Mix, % $ B Available, $ B National 30-70 1.50 5.0 Global 65-35 3.25 3.7 PanAm 91-9 1.55 6.7 example, National had 30% of its capitalization in debt capital; therefore, 30% of $5 B was borrowed, and 70% was provided from National's equity fund. Unfortunately, after a short time, it was clear that the three-way collaborative effort was a complete failure, and FullServe was dissolved and its assets were distributed or sold for a total of $3.0 billion, only 20% of its original value. A total of $1.0 billion in equity capital was re- turned to each airline. The commercial banks that provided the original loans then required that the airlines each pay back the entire borrowed amount now, since FullServe was dissolved and no profit from the venture could be realized. Assuming the loan and equity amounts are the same as shown in Table 10-1, determine the resulting equity capital situation for each airline after it pays off the loan from its own equity funds. Also, describe one impact on each company as a result of this expensive and risky venture that failed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts