Question: solve the question as soon as possible Music Magic. net Lid specializes in sound equipment Because each Inventory item is expensive. MusicMagic uses a perpetual

solve the question as soon as possible

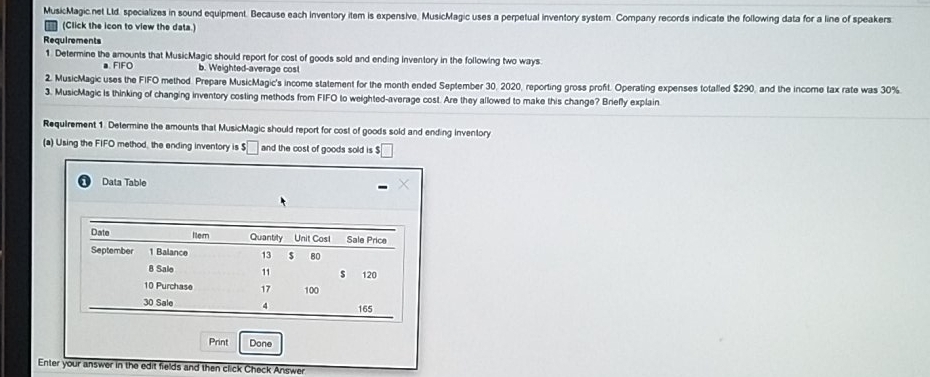

Music Magic. net Lid specializes in sound equipment Because each Inventory item is expensive. MusicMagic uses a perpetual inventory system. Company records indicate the following data for a line of speakers (Click the Icon to view the data.) Requirements 1 Determine the amounts that Music Magic should report for cost of goods sold and ending inventory in the following two ways. a FIFO b. Weighted-average cost 2. MusicMagic uses the FIFO method Prepare MusicMagic's income statement for the month ended September 30, 2020, reporting gross profit. Operating expenses totaled $290, and the income tax rate was 30% 3. MusicMagic is thinking of changing inventory costing methods from FIFO to weighted-average cost. Are they allowed to make this change? Briefly explain Requirement 1 Determine the amounts that MusicMagic should report for cost of goods sold and ending Inventory (a) Using the FIFO method, the ending inventory is $and the cost of goods sold is $ 1 Data Table O X Date Quantity Unit Cost Sale Price September 1 Balance 13 80 8 Sala 11 S 120 10 Purchase 17 100 30 Sale 165 Print Done Enter your answer in the edit fields and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts