Question: solve the question as soon as possible Question MusicMagic not Lid specializes in sound equipment. Because each Inventory item is expensive, MusicMagic uses a perpetual

solve the question as soon as possible

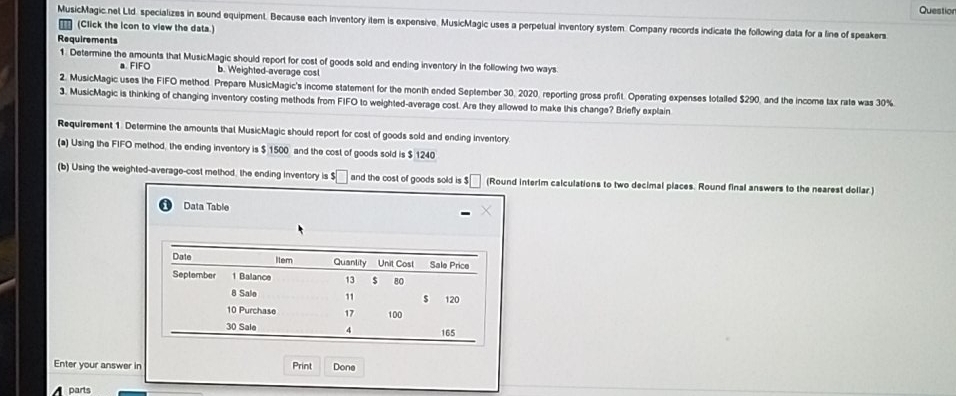

Question MusicMagic not Lid specializes in sound equipment. Because each Inventory item is expensive, MusicMagic uses a perpetual Inventory system Company records indicate the following data for a line of speaker 11 (Click the icon to view the data.) Requirements 1 Determine the amounts that Music Magic should report for cost of goods sold and ending inventory in the following two ways FIFO b. Weighted average cost 2. MusicMagic uses the FIFO method Prepare MusicMagic's income statement for the month ended September 30, 2020 reporting gross profit Operating expenses totalled $290, and the income tax rate was 30% 3. MusicMagic is thinking of changing inventory costing methods from FIFO to weighted-average cost. Are they allowed to make this change? Briefly explain Requirement 1 Determine the amounts that Music Magic should report for cost of goods sold and ending inventory (a) Using the FIFO method, the ending inventory is $ 1500 and the cost of goods sold is $ 1240 (b) Using the weighted-average-cost method. the ending inventory is $ and the cost of goods sold is $ (Round interim calculations to two decimal places, Round final answers to the nearest dollar) 1 Data Table X Date Item Quantity Unit Cost Sale Price September 1 Balance 13 BO 8 Sale 120 10 Purchase 17 100 30 Sale 165 Enter your answer In Print Done parts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts