Question: Solve the RED cells. Do not copy answers from elsewhere on Chegg as the question is different. Solve it yourself. (1 pt) The value of

Solve the RED cells. Do not copy answers from elsewhere on Chegg as the question is different. Solve it yourself.

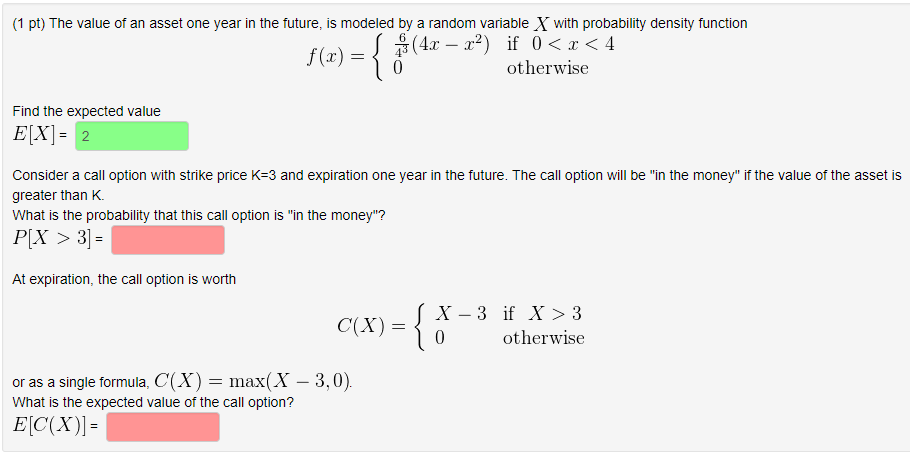

(1 pt) The value of an asset one year in the future, is modeled by a random variable X with probability density function otherwise Find the expected value Consider a call option with strike price K-3 and expiration one year in the future. The call option will be "in the money" if the value of the asset is greater than K. What is the probability that this call option is "in the money"? At expiration, the call option is worth X-3 if X>3 C(X)= 0 otherwise or as a single formula, C(X)- max(X- 3,0). What is the expected value of the call option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts