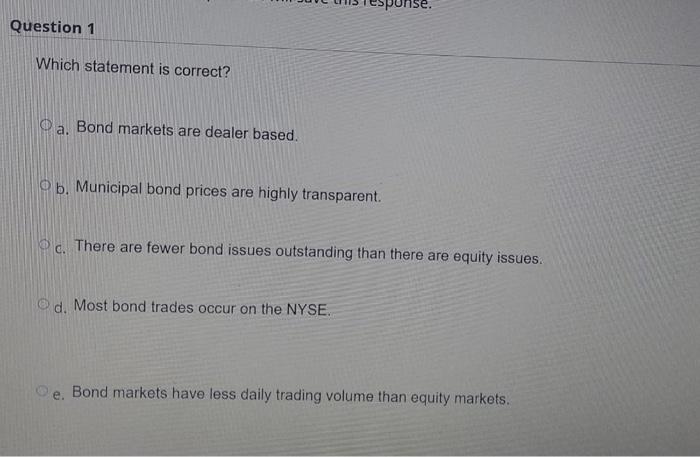

Question: solve them please hurry up please Which statement is correct? a. Bond markets are dealer based. b. Municipal bond prices are highly transparent. c. There

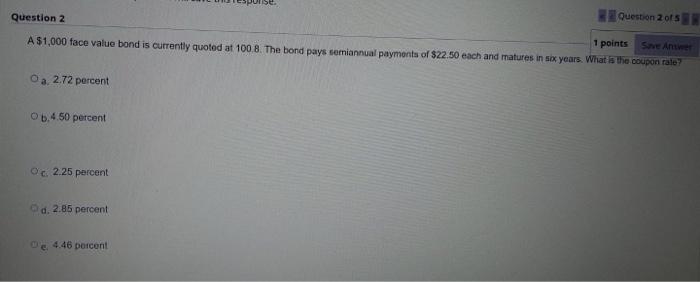

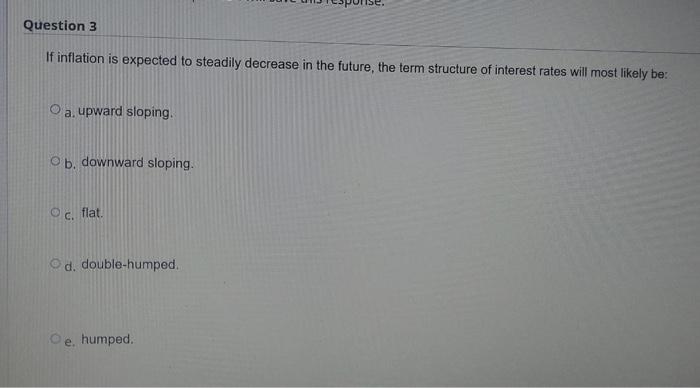

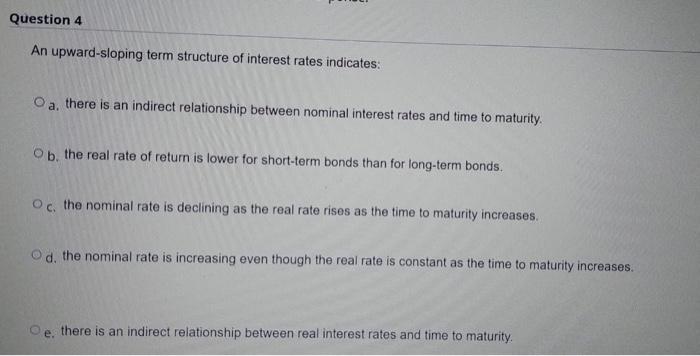

Which statement is correct? a. Bond markets are dealer based. b. Municipal bond prices are highly transparent. c. There are fewer bond issues outstanding than there are equity issues. d. Most bond trades occur on the NYSE. e. Bond markets have less daily trading volume than equity markets. A $1,000 face value bond is currently quoted at 100.8. The bond pays semiannual paymonts of $22.50 each and matures in six years. What is the cooppon rale? 3. 2.72 percent b. 4.50 percent c. 2.25 percent d. 2.85 percent the 4.46 porcent If inflation is expected to steadily decrease in the future, the term structure of interest rates will most likely be: a. upward sloping. b. downward sloping. c. flat. d. double-humped. e. humped. An upward-sloping term structure of interest rates indicates: a. there is an indirect relationship between nominal interest rates and time to maturity. b. the real rate of return is lower for short-term bonds than for long-term bonds. c. the nominal rate is declining as the real rate rises as the time to maturity increases. d. the nominal rate is increasing even though the real rate is constant as the time to maturity increases. e. there is an indirect relationship between real interest rates and time to maturity. The R in the Fisher effect formula represents the: a. inflation rate. b. coupon rate. c. current yield. d. nominal return e. real return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts