Question: solve these problems:- A recent environmental engineering graduate is try- ing to decide whether he should keep his presently owned car or purchase a more

solve these problems:-

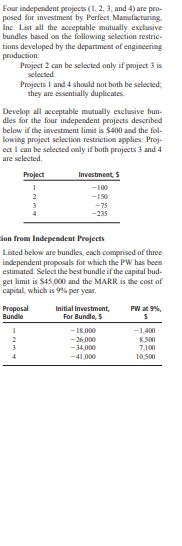

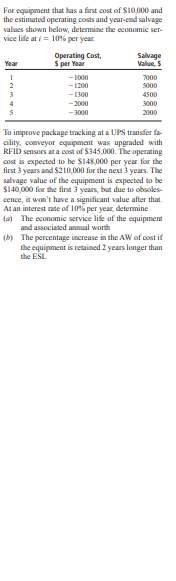

A recent environmental engineering graduate is try- ing to decide whether he should keep his presently owned car or purchase a more environmentally friendly hybrid. A new car will cost $26,000 and have annual operation and maintenance costs of $1200 per year with an $8000 salvage value in 3 years ( which is its estimated connomic service life) The presently owned car has a resale value now of $5000; one year from now it will be $3000, two years from now $2500, and 3 years from now $2200. Its operating cost is expected to be $1900 this year, with costs increasing by $200 per year. The presently owned car will definitely not be kept longer than 3 more years. Assuming used cars like the one presently owned will always be available, should the presently owned car be sold now, I year from now, 2 years from now, or 3 years from now? Use annual worth calculations at I = 10% per year and show your work.Four independent projects ( 1, 2, 3, and 4) are pro- posed for investment by Perfect Manufacturing Inc. List all the acceptable mutually exclusive bundles based on the following selection restric tions developed by the department of engineering production: Project 2 can be selected only if project 3 is selected. Projects 1 and 4 should not both be selected; they are essentially duplicates Develop all acceptable mutually exclusive bun- dles for the four independent projects described below if the investment limit is $400 and the fol- lowing project selection restriction applies: Proj- ect I can be selected only if both projects 3 and 4 are selected. Project Investment, $ -100 -75 -235 ion from Independent Projects Listed below are bundles, each comprised of three independent proposals for which the PW has been estimated. Select the best bundle if the capital bud- get limit is $45,000 and the MARK is the cost of capital, which is 9% per year. Proposal Initial Investment, Bundle For Bundle, $ -1,400 -36 000 8 50O -34 000 -41 000 10.500The independent project estimates below have been developed by the engineering and finance managers. The corporate MARR is 8%% per year, and the capital investment limit is $4 million. Se- lect the economically best projects using the PW method and (a) hand solution and (b) spreadsheet solution. Project NCF, Project Cost, 5 M Life, Years $ per Year -15 360,00D -3.0 10 600,000 -13 520,000 -20 820,GOD Use the PW method to evaluate four independent projects. Select as many as three of the four proj- ects. The MARR is 12% per year, and up to $16,000 in capital investment fiands are available. Project ment, 5 -5000 -8,000 -9,000 - 10,000 cars 5 NOF Estimates, $ per Wear 1000 500 50DO 1700 SODO 2400 500 2000 3000 500 17,00D 3900 10,500Two equivalent pieces of quality inspection equipment are being considered for purchase by Square D Electric. Machine 2 is expected to be versatile and technologically advanced enough to provide net income longer than machine 1. Machine 1 Machine 2 First cool, $ 12000 8.000 Annual NCF, 5 3,000 1,000 (years 1-5). 3,000 (years 6-14) Maximum life, years The quality manager used a return of 13% per year and software that incorporates Equa- tions (13.8] and [13.9] to recommend machine I because it has a shorter payback period of 657 years at 1 = 15%. The computations are summarized here $30306 per year Cash flow neglected by peryback analysis Machine I - 6.57 $12.DO0 Cash flows neglected $5000 per year by payback aralysis $1006 per year Machine 2 1, - 952 Figure 13-7 Illustration of payback periods and neglected net cash flows, Example 13.5. Machine 1: 0. = 657 years, which is less than the 7-year life Equation used: 0 = -12,000 + 3000(P/4,13%,a) Machine 2: 0, = 9.52 years, which is less than the 14-year life. Equation used 0 = -8000 + 1000(P/4,15%,5) + 3000( P/A,15%on, -5KP/F.15%%,5) Recommendation: Select machine 1 w, use a 13%% PW analysis to compare the machines and comment on any difference in the ommendation.For equipment that has a first cost of $10 000 and the estimated operating costs and year-end salvage values shown below, determine the economic ser- vice life at f = 10% per year Operating Cost, Salvage Year $ per Year Value, $ - 1030 7000 - 1700 5000 - 1300 4500 -2000 3000 2000 To improve package tracking at a UPS transfer fa- cility, conveyor equipment was upgraded with RFID sensors at a cost of $345,000. The operating cost is expected to be $148 000 per year for the first 3 years and $210,000 for the next 3 years. The salvage value of the equipment is expected to be $140,000 for the first 3 years, but due to obsoles- cence, it won't have a significant value after that. At an interest rate of 10% per year, determine (al The economic service life of the equipment and associated annual worth (b) The percentage increase in the AW of cost if the equipment is retained 2 years longer than the ESL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts