Question: solve these problems pls 9 questions Question 1 You've borrowed $20,000 on margin to buy shares in Disney, which is now selling at $40 per

solve these problems pls 9 questions

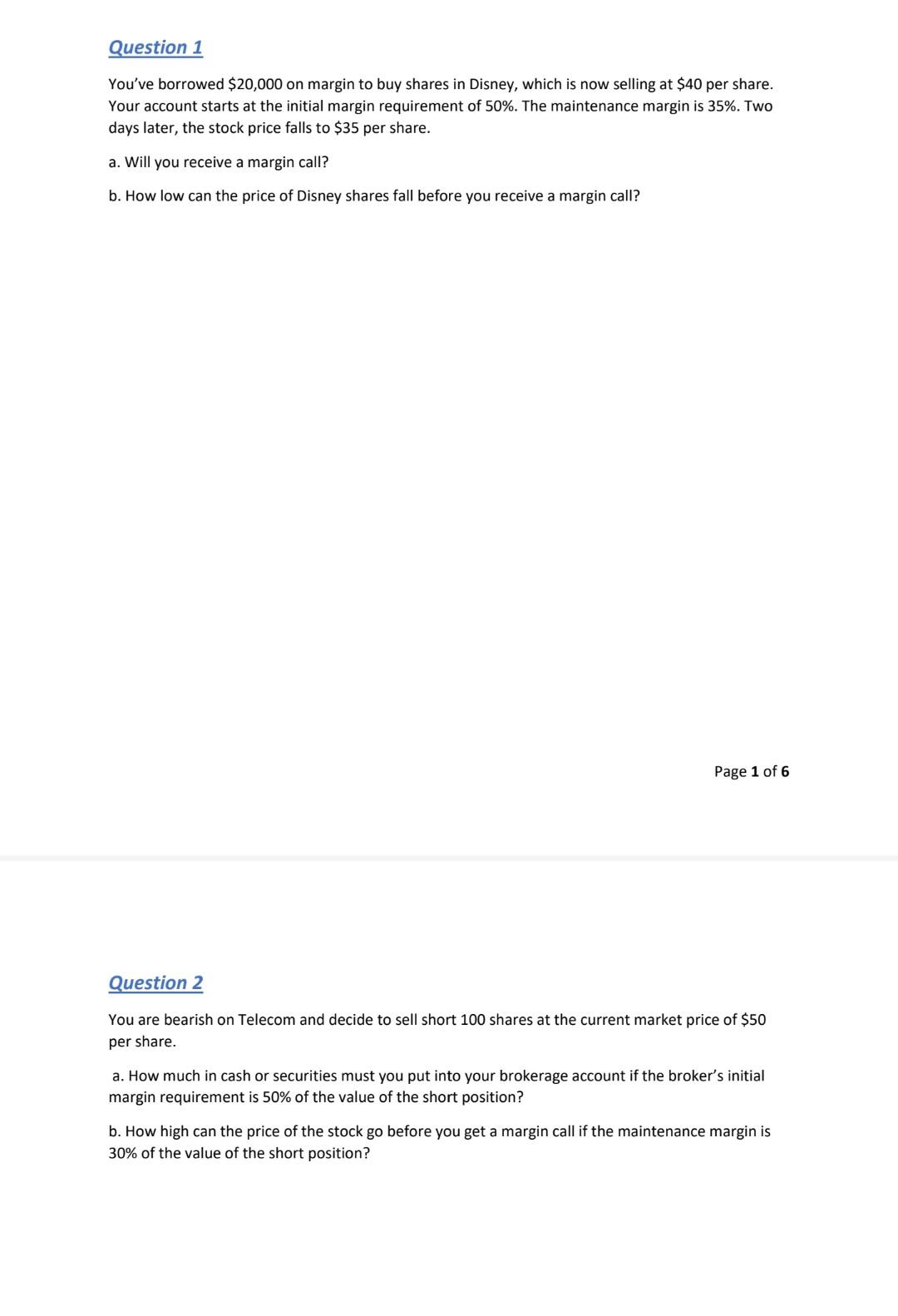

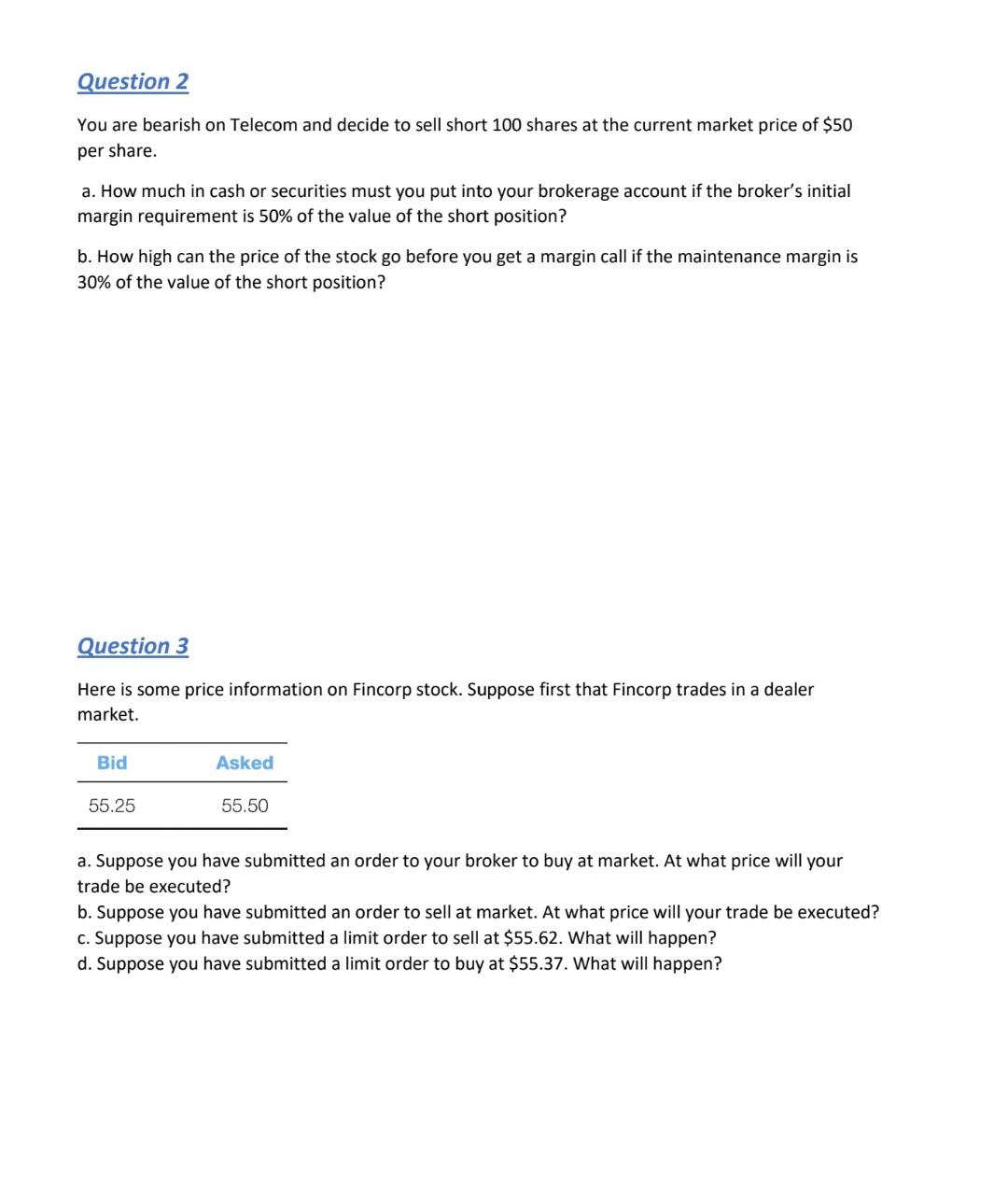

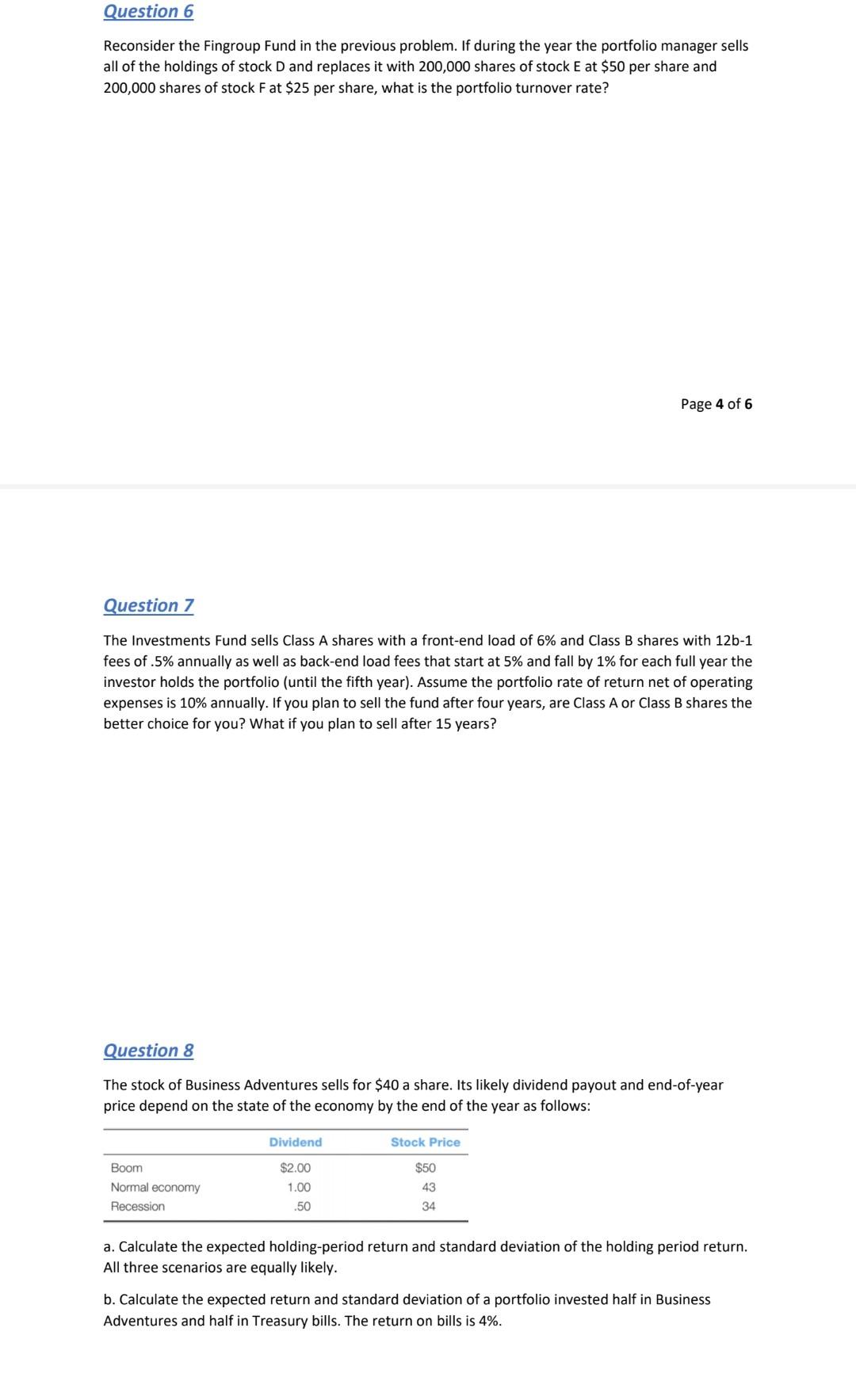

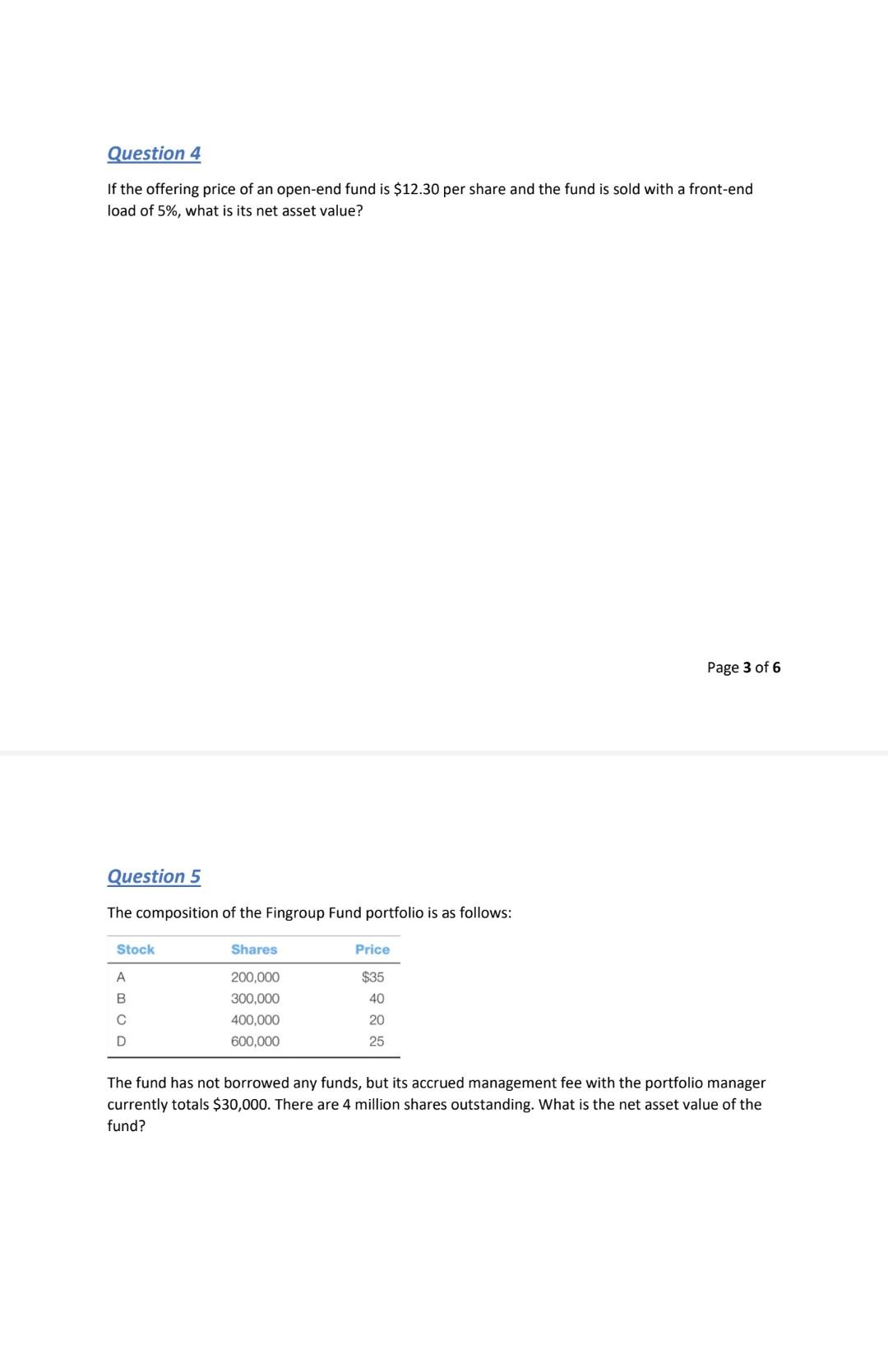

Question 1 You've borrowed $20,000 on margin to buy shares in Disney, which is now selling at $40 per share. Your account starts at the initial margin requirement of 50%. The maintenance margin is 35%. Two days later, the stock price falls to $35 per share. a. Will you receive a margin call? b. How low can the price of Disney shares fall before you receive a margin call? Question 2 You are bearish on Telecom and decide to sell short 100 shares at the current market price of $50 per share. a. How much in cash or securities must you put into your brokerage account if the broker's initial margin requirement is 50% of the value of the short position? b. How high can the price of the stock go before you get a margin call if the maintenance margin is 30% of the value of the short position? Question 2 You are bearish on Telecom and decide to sell short 100 shares at the current market price of $50 per share. a. How much in cash or securities must you put into your brokerage account if the broker's initial margin requirement is 50% of the value of the short position? b. How high can the price of the stock go before you get a margin call if the maintenance margin is 30% of the value of the short position? Question 3 Here is some price information on Fincorp stock. Suppose first that Fincorp trades in a dealer market. a. Suppose you have submitted an order to your broker to buy at market. At what price will your trade be executed? b. Suppose you have submitted an order to sell at market. At what price will your trade be executed? c. Suppose you have submitted a limit order to sell at $55.62. What will happen? d. Suppose you have submitted a limit order to buy at $55.37. What will happen? Question 6 Reconsider the Fingroup Fund in the previous problem. If during the year the portfolio manager sells all of the holdings of stock D and replaces it with 200,000 shares of stock E at $50 per share and 200,000 shares of stock F at $25 per share, what is the portfolio turnover rate? Page 4 of 6 Question 7 The Investments Fund sells Class A shares with a front-end load of 6% and Class B shares with 12b1 fees of .5% annually as well as back-end load fees that start at 5% and fall by 1% for each full year the investor holds the portfolio (until the fifth year). Assume the portfolio rate of return net of operating expenses is 10% annually. If you plan to sell the fund after four years, are Class A or Class B shares the better choice for you? What if you plan to sell after 15 years? Question 8 The stock of Business Adventures sells for $40 a share. Its likely dividend payout and end-of-year price depend on the state of the economy by the end of the year as follows: a. Calculate the expected holding-period return and standard deviation of the holding period return. All three scenarios are equally likely. b. Calculate the expected return and standard deviation of a portfolio invested half in Business Adventures and half in Treasury bills. The return on bills is 4%. Question 4 If the offering price of an open-end fund is $12.30 per share and the fund is sold with a front-end load of 5%, what is its net asset value? Page 3 of 6 Question 5 The composition of the Fingroup Fund portfolio is as follows: The fund has not borrowed any funds, but its accrued management fee with the portfolio manager currently totals $30,000. There are 4 million shares outstanding. What is the net asset value of the fund? Question 9 You manage an equity fund with an expected risk premium of 10% and a standard deviation of 14%. The rate on Treasury bills is 6%. Your client chooses to invest $60,000 of her portfolio in your equity fund and $40,000 in a T-bill money market fund. What is the expected return and standard deviation of return on your client's portfolio? What is the reward-to-volatility ratio for the equity fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts