Question: I'm doing adjusting entries. However, I don't know how I can get the answers for the questions number 1 and 10. I have answers to

I'm doing adjusting entries. However, I don't know how I can get the answers for the questions number 1 and 10. I have answers to those. Can you explain the formulas and steps to get the answers? (1) would be the questions and (2) would be the answered entries for that.

(1)

(2)

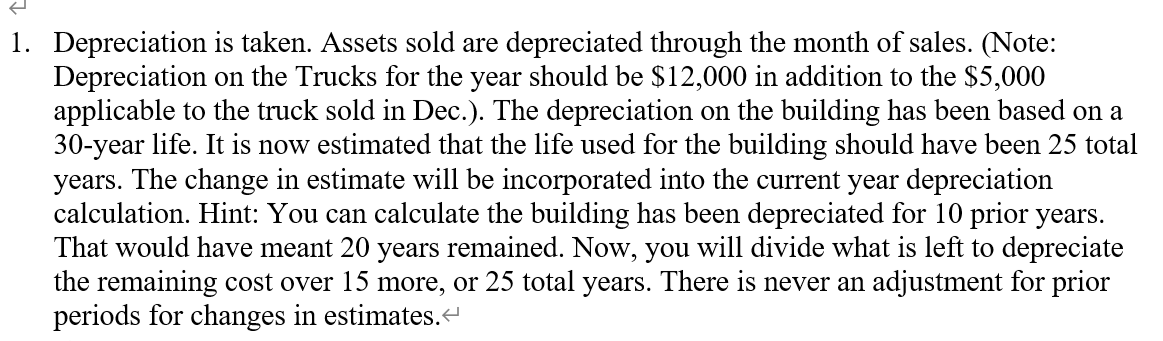

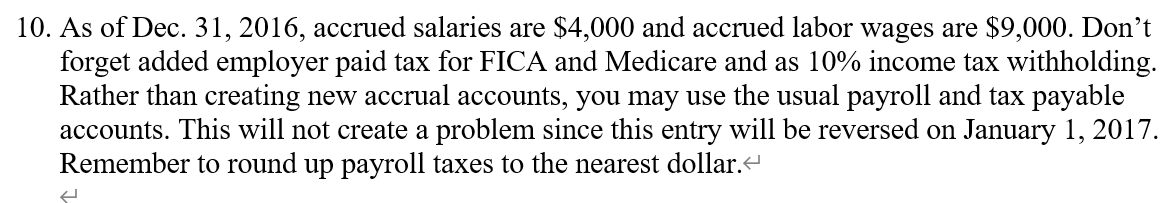

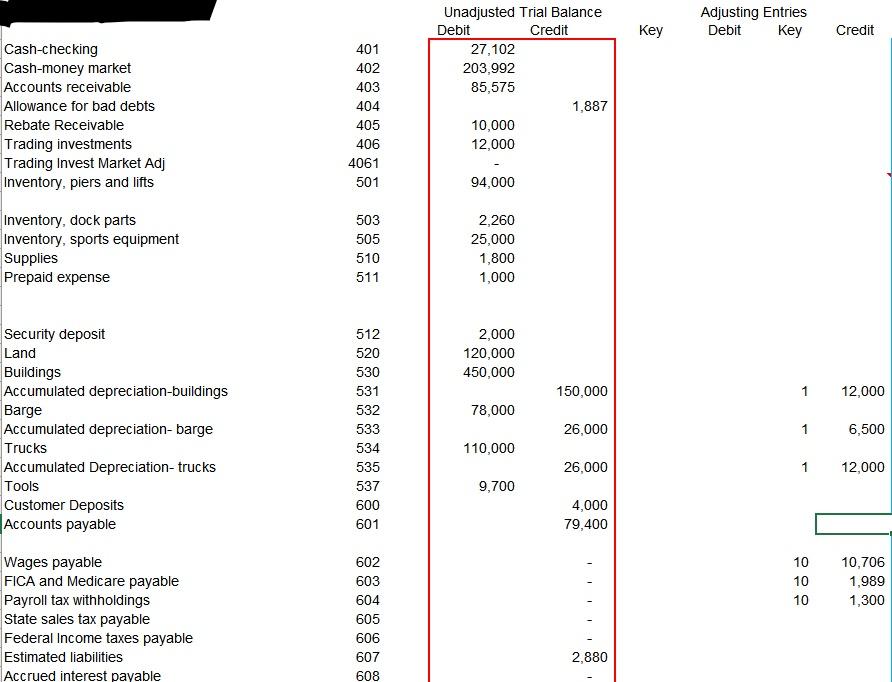

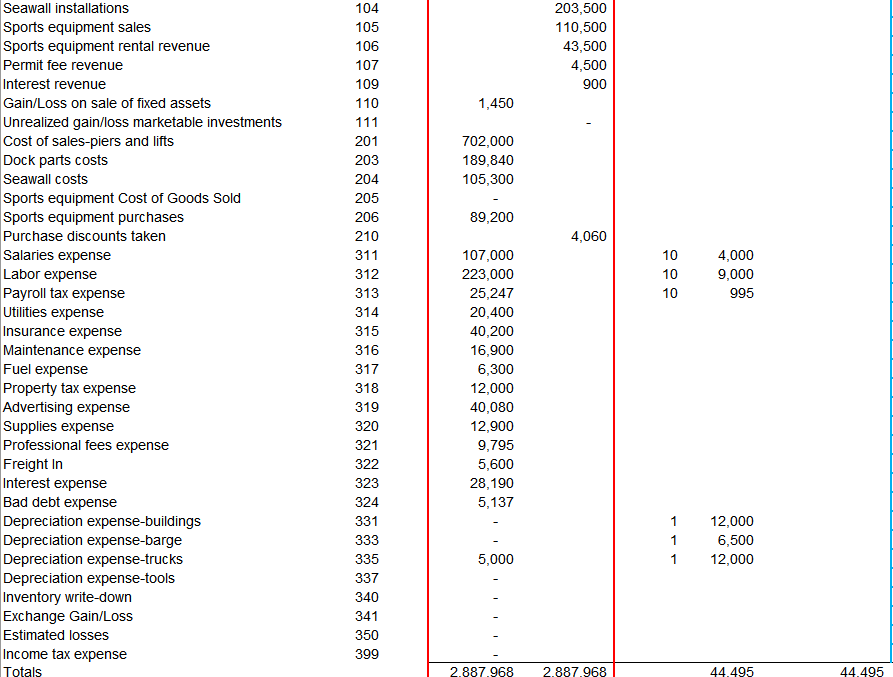

1. Depreciation is taken. Assets sold are depreciated through the month of sales. (Note: Depreciation on the Trucks for the year should be $12,000 in addition to the $5,000 applicable to the truck sold in Dec.). The depreciation on the building has been based on a 30-year life. It is now estimated that the life used for the building should have been 25 total years. The change in estimate will be incorporated into the current year depreciation calculation. Hint: You can calculate the building has been depreciated for 10 prior years. That would have meant 20 years remained. Now, you will divide what is left to depreciate the remaining cost over 15 more, or 25 total years. There is never an adjustment for prior periods for changes in estimates. 10. As of Dec. 31, 2016, accrued salaries are $4,000 and accrued labor wages are $9,000. Don't forget added employer paid tax for FICA and Medicare and as 10% income tax withholding. Rather than creating new accrual accounts, you may use the usual payroll and tax payable accounts. This will not create a problem since this entry will be reversed on January 1, 2017. Remember to round up payroll taxes to the nearest dollar. Adjusting Entries Debit Key Key Credit Cash-checking Cash-money market Accounts receivable Allowance for bad debts Rebate Receivable Trading investments Trading Invest Market Adj Inventory, piers and lifts 401 402 403 404 405 406 4061 501 Unadjusted Trial Balance Debit Credit 27,102 203,992 85,575 1,887 10,000 12,000 94,000 Inventory, dock parts Inventory, sports equipment Supplies Prepaid expense 503 505 510 511 2,260 25,000 1,800 1,000 2,000 120,000 450,000 150,000 1 12,000 78,000 Security deposit Land Buildings Accumulated depreciation-buildings Barge Accumulated depreciation-barge Trucks Accumulated Depreciation-trucks Tools Customer Deposits Accounts payable 512 520 530 531 532 533 534 535 537 600 601 26,000 1 6,500 110,000 26,000 1 12,000 9,700 4,000 79,400 10 10 10 10,706 1,989 1,300 Wages payable FICA and Medicare payable Payroll tax withholdings State sales tax payable Federal Income taxes payable Estimated liabilities Accrued interest payable 602 603 604 605 606 607 608 2,880 203,500 110,500 43,500 4,500 900 1,450 702,000 189,840 105,300 89,200 4,060 10 10 10 4,000 9,000 995 Seawall installations Sports equipment sales Sports equipment rental revenue Permit fee revenue Interest revenue Gain/Loss on sale of fixed assets Unrealized gain/loss marketable investments Cost of sales-piers and lifts Dock parts costs Seawall costs Sports equipment Cost of Goods Sold Sports equipment purchases Purchase discounts taken Salaries expense Labor expense Payroll tax expense Utilities expense Insurance expense Maintenance expense Fuel expense Property tax expense Advertising expense Supplies expense Professional fees expense Freight In Interest expense Bad debt expense Depreciation expense-buildings Depreciation expense-barge Depreciation expense-trucks Depreciation expense-tools Inventory write-down Exchange Gain/Loss Estimated losses Income tax expense Totals 104 105 106 107 109 110 111 201 203 204 205 206 210 311 312 313 314 315 316 317 318 319 320 321 322 323 324 331 333 335 337 340 341 350 399 107,000 223,000 25,247 20,400 40,200 16,900 6,300 12,000 40,080 12,900 9,795 5,600 28,190 5,137 1 1 1 12,000 6,500 12,000 5,000 2.887.968 2.887.968 44.495 44.495 1. Depreciation is taken. Assets sold are depreciated through the month of sales. (Note: Depreciation on the Trucks for the year should be $12,000 in addition to the $5,000 applicable to the truck sold in Dec.). The depreciation on the building has been based on a 30-year life. It is now estimated that the life used for the building should have been 25 total years. The change in estimate will be incorporated into the current year depreciation calculation. Hint: You can calculate the building has been depreciated for 10 prior years. That would have meant 20 years remained. Now, you will divide what is left to depreciate the remaining cost over 15 more, or 25 total years. There is never an adjustment for prior periods for changes in estimates. 10. As of Dec. 31, 2016, accrued salaries are $4,000 and accrued labor wages are $9,000. Don't forget added employer paid tax for FICA and Medicare and as 10% income tax withholding. Rather than creating new accrual accounts, you may use the usual payroll and tax payable accounts. This will not create a problem since this entry will be reversed on January 1, 2017. Remember to round up payroll taxes to the nearest dollar. Adjusting Entries Debit Key Key Credit Cash-checking Cash-money market Accounts receivable Allowance for bad debts Rebate Receivable Trading investments Trading Invest Market Adj Inventory, piers and lifts 401 402 403 404 405 406 4061 501 Unadjusted Trial Balance Debit Credit 27,102 203,992 85,575 1,887 10,000 12,000 94,000 Inventory, dock parts Inventory, sports equipment Supplies Prepaid expense 503 505 510 511 2,260 25,000 1,800 1,000 2,000 120,000 450,000 150,000 1 12,000 78,000 Security deposit Land Buildings Accumulated depreciation-buildings Barge Accumulated depreciation-barge Trucks Accumulated Depreciation-trucks Tools Customer Deposits Accounts payable 512 520 530 531 532 533 534 535 537 600 601 26,000 1 6,500 110,000 26,000 1 12,000 9,700 4,000 79,400 10 10 10 10,706 1,989 1,300 Wages payable FICA and Medicare payable Payroll tax withholdings State sales tax payable Federal Income taxes payable Estimated liabilities Accrued interest payable 602 603 604 605 606 607 608 2,880 203,500 110,500 43,500 4,500 900 1,450 702,000 189,840 105,300 89,200 4,060 10 10 10 4,000 9,000 995 Seawall installations Sports equipment sales Sports equipment rental revenue Permit fee revenue Interest revenue Gain/Loss on sale of fixed assets Unrealized gain/loss marketable investments Cost of sales-piers and lifts Dock parts costs Seawall costs Sports equipment Cost of Goods Sold Sports equipment purchases Purchase discounts taken Salaries expense Labor expense Payroll tax expense Utilities expense Insurance expense Maintenance expense Fuel expense Property tax expense Advertising expense Supplies expense Professional fees expense Freight In Interest expense Bad debt expense Depreciation expense-buildings Depreciation expense-barge Depreciation expense-trucks Depreciation expense-tools Inventory write-down Exchange Gain/Loss Estimated losses Income tax expense Totals 104 105 106 107 109 110 111 201 203 204 205 206 210 311 312 313 314 315 316 317 318 319 320 321 322 323 324 331 333 335 337 340 341 350 399 107,000 223,000 25,247 20,400 40,200 16,900 6,300 12,000 40,080 12,900 9,795 5,600 28,190 5,137 1 1 1 12,000 6,500 12,000 5,000 2.887.968 2.887.968 44.495 44.495

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts