Question: solve this asap using the formula given below [Q 10). A quarry has reserves worth $ 100 million. The management invested $ 40 million in

solve this asap using the formula given below

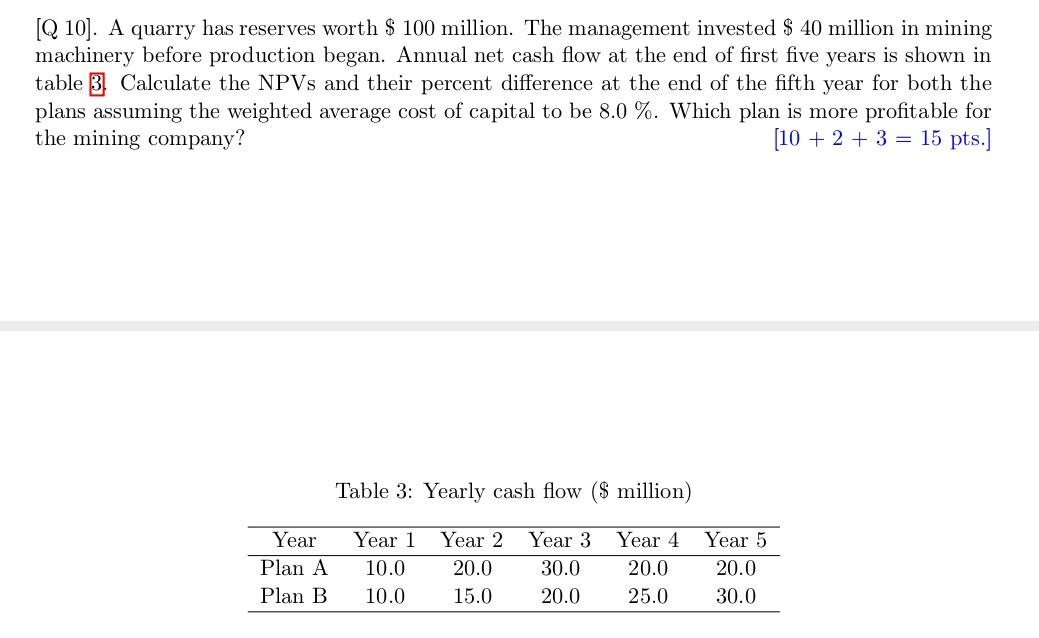

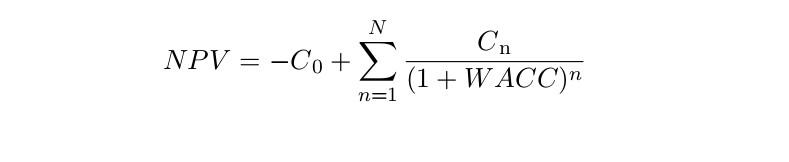

[Q 10). A quarry has reserves worth $ 100 million. The management invested $ 40 million in mining machinery before production began. Annual net cash flow at the end of first five years is shown in table 3 Calculate the NPVs and their percent difference at the end of the fifth year for both the plans assuming the weighted average cost of capital to be 8.0 %. Which plan is more profitable for the mining company? [10 + 2 + 3 = 15 pts.] Table 3: Yearly cash flow ($ million) Year Plan A Plan B Year 1 10.0 10.0 Year 2 20.0 15.0 Year 3 30.0 20.0 Year 4 20.0 25.0 Year 5 20.0 30.0 N Cn NPV = -Co + (1 + W ACC) n=1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts