Question: solve this case study it .will be expected to analyse and evaluate the sustainability of the case study organisations supply chain and apply a tool

solve this case study it .will be expected to analyse and evaluate the sustainability of the case study organisations supply chain and apply a tool that will facilitate improvement. Using the case study, you will develop a written report that provides an analysis of the case study organisation, benchmarking with another organisation and provides application of a model ofsustainability for improvement.

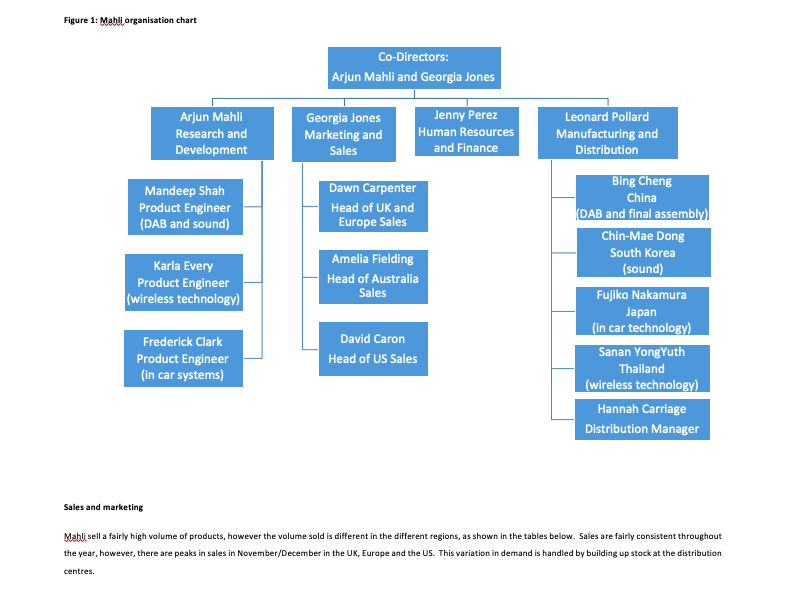

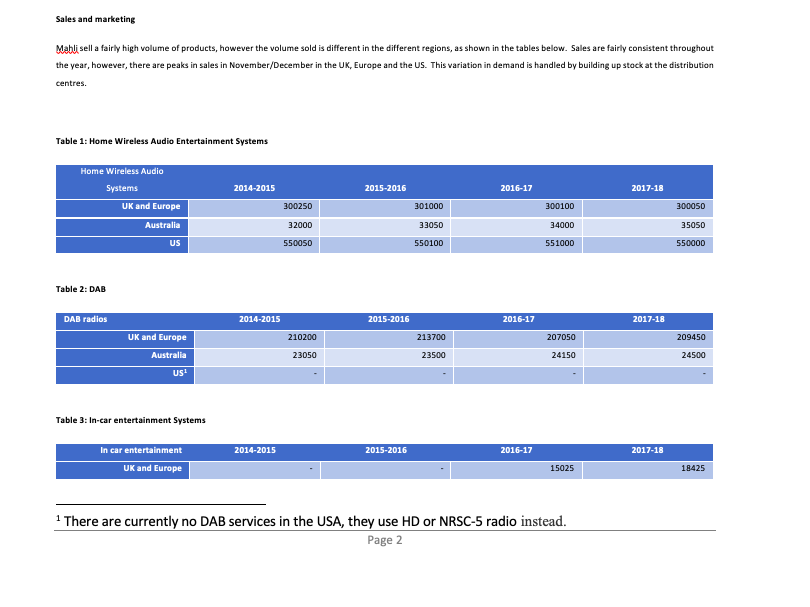

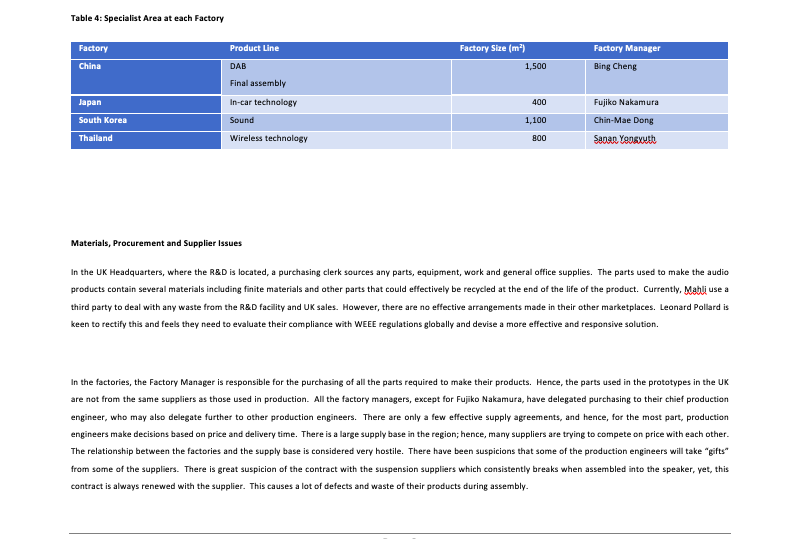

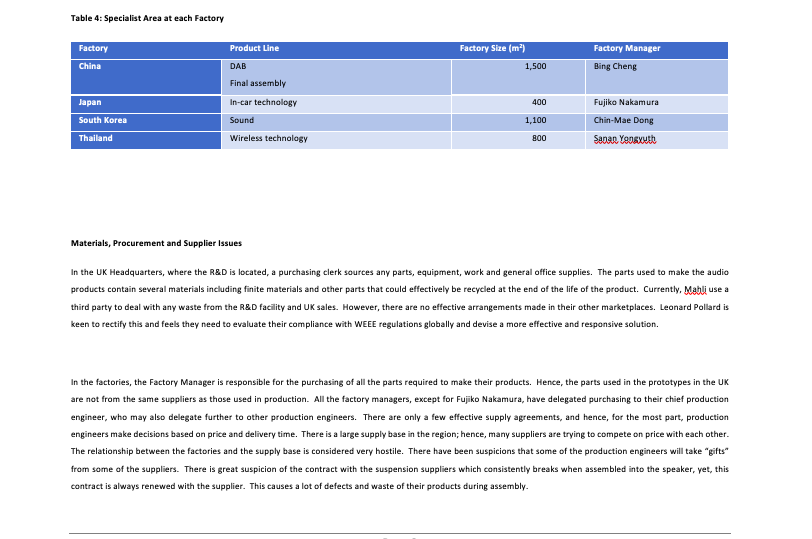

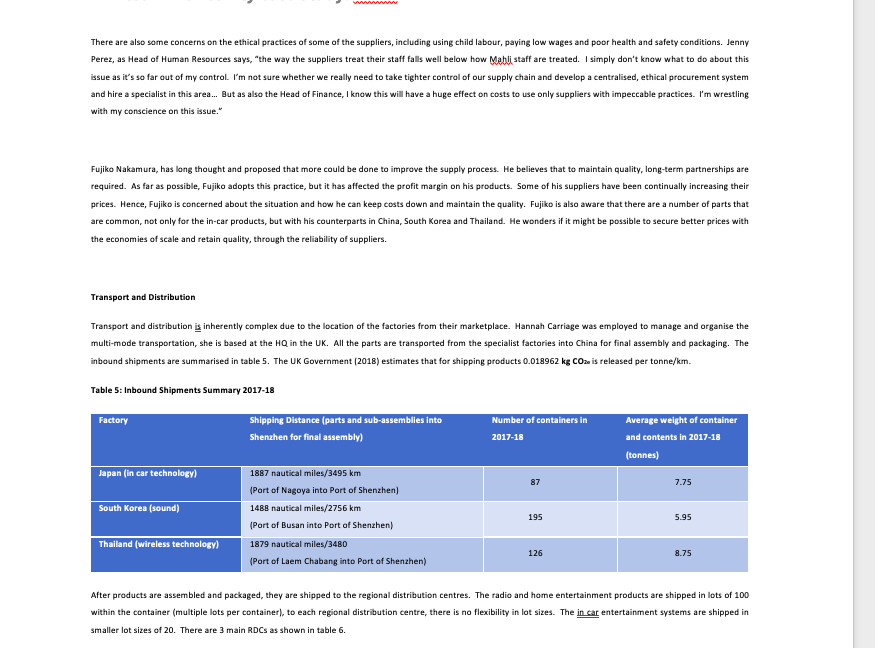

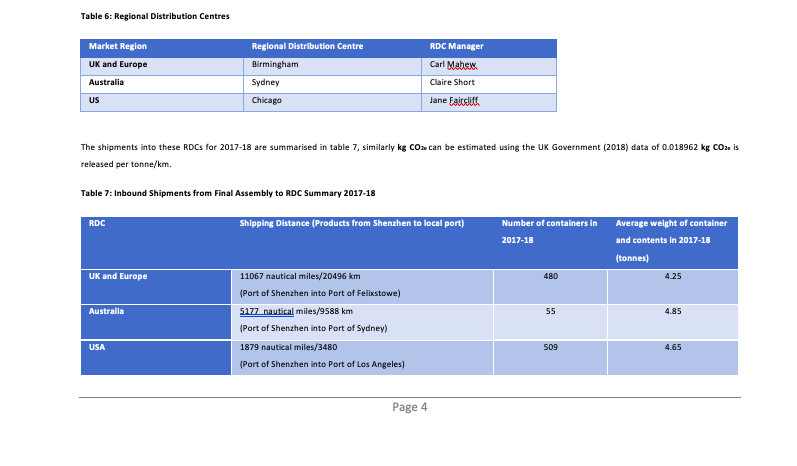

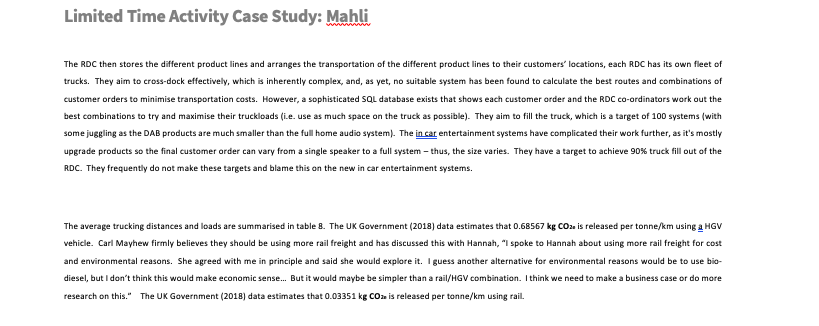

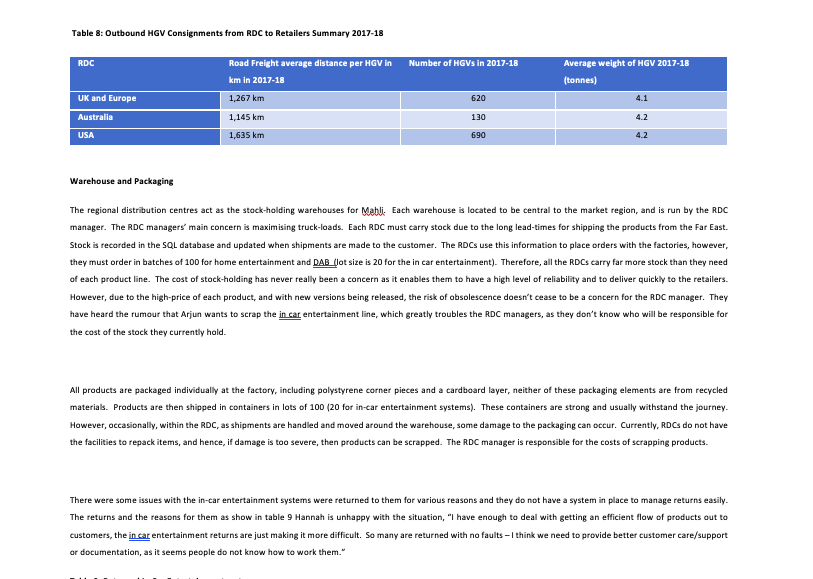

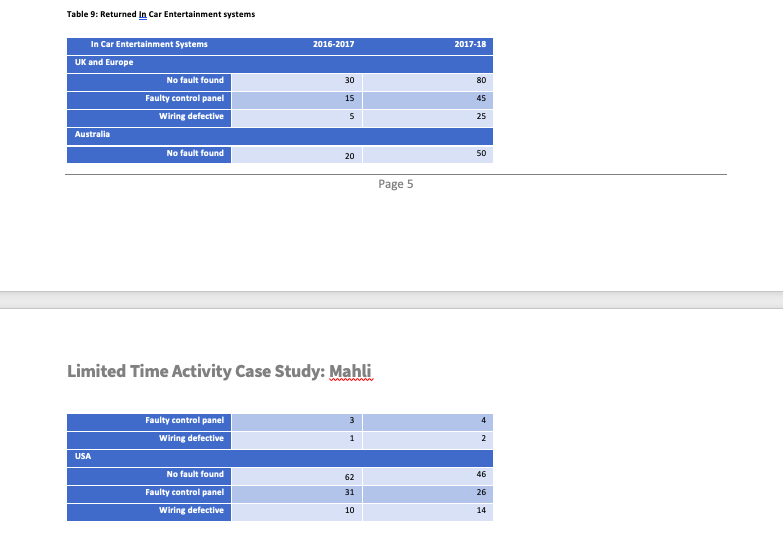

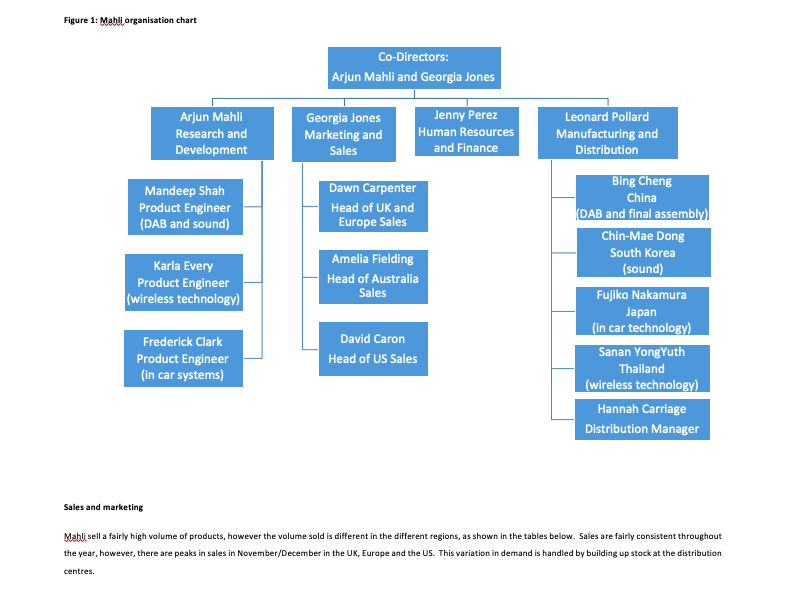

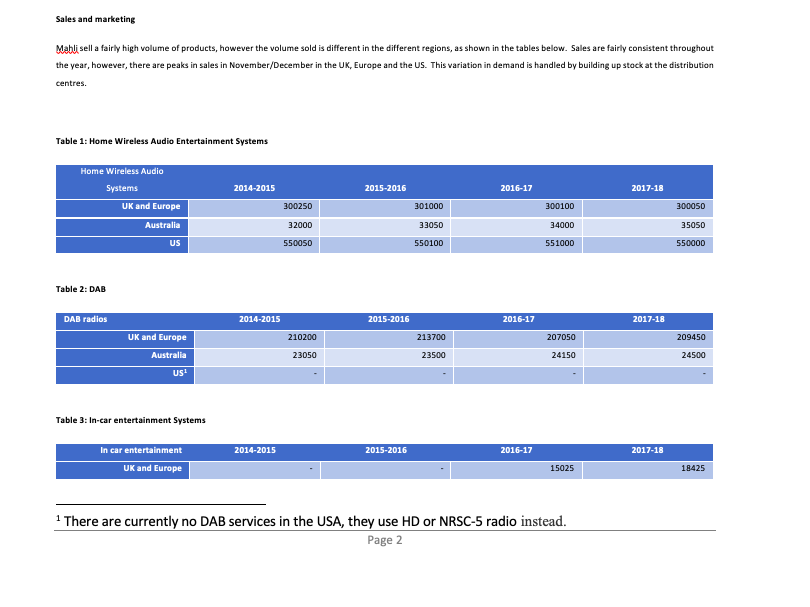

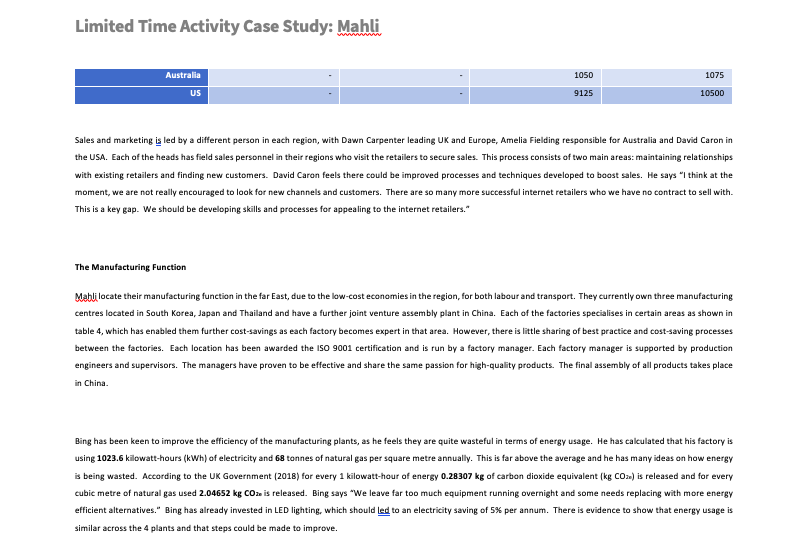

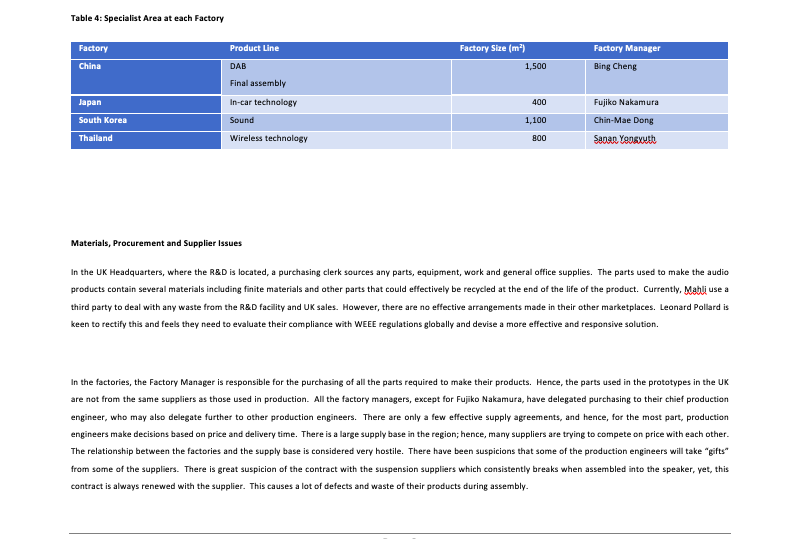

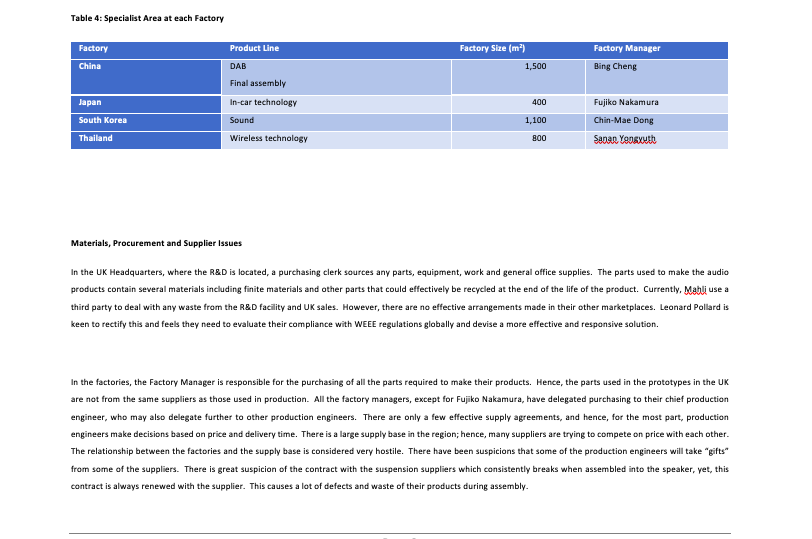

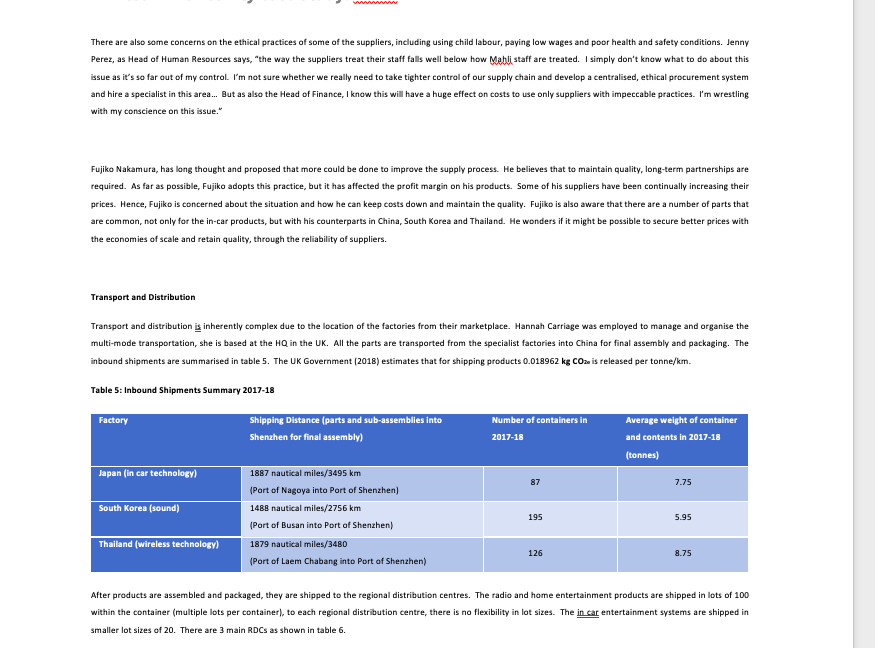

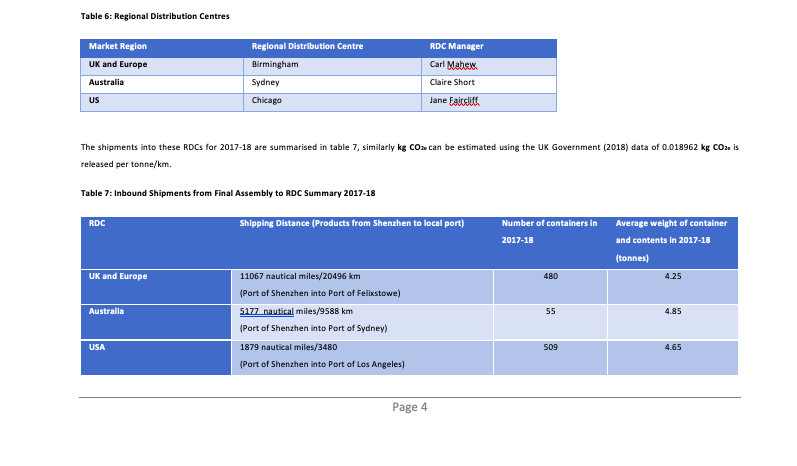

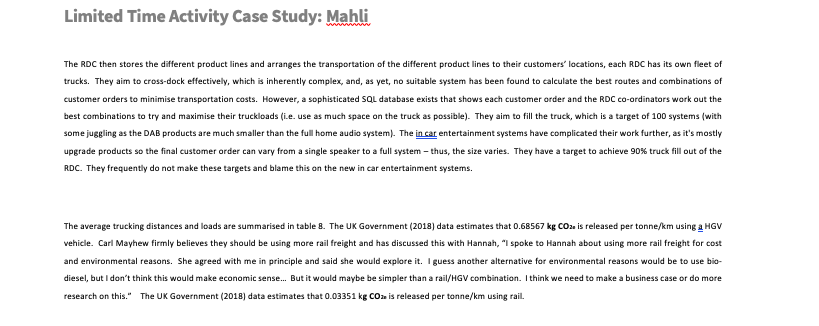

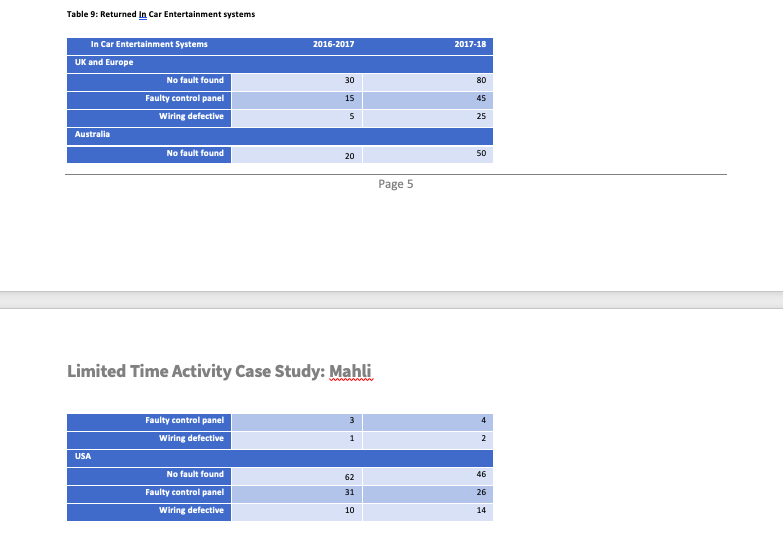

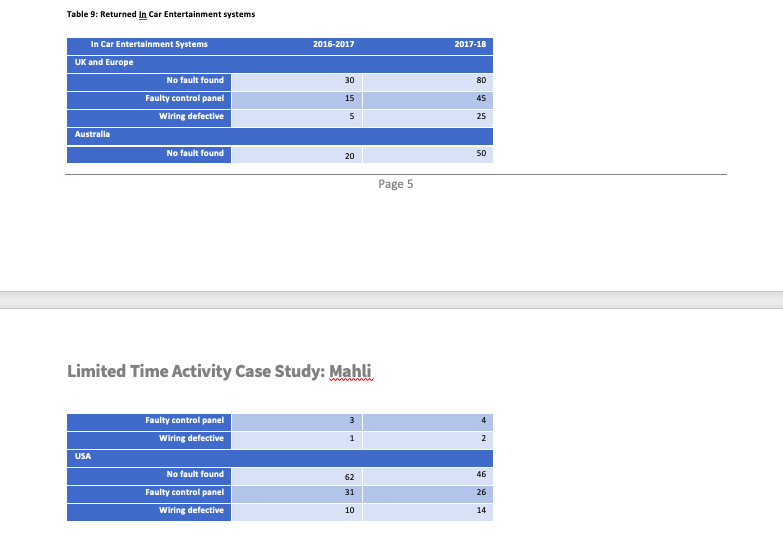

Background Ilal lll Mahli was founded in 2006 by Arjun Mahli and Georgia Jones, to manufacture and market home audio devices and equipment, including: wireless home speaker systems and DAB radios and more recently, car entertainment systems. Both Arjun and Georgia had previously worked for a major electronics manufacturer, Arjun as a design engineer and Georgia as a sales executive. Arjun and Georgia were firm friends and with Arjun's design skills and Georgia's marketing and sales skills, after a slow start the company saw great success. Mahli was founded because Arjun had designed a revolutionary speaker design, which he and Georgia knew was not only provided unique sound quality, but also, outperformed others in the market place, in terms of its compactness. Georgia had the idea that the compactness of the speaker and its ability to produce quality sound meant that they could develop some unique casings to appeal to different markets. Together, they researched these possibilities and the wireless speaker market, which made for a strong business case. It took a while for Mahli to get the finances in place and develop reliable manufacturing facilities. However, once established, Mahli had developed a strong niche in the marketplace, seen by customers as innovative and producing high quality sound. Mahli - The Brand Mahli's success was largely due to the unique styling of their products, which made them fashionable in the marketplace. Other strengths were evident beyond this unique sleek styling, with Arjun's design skills, Mahli's products were consistently producing high quality sound. Their first product, the DAB radio, quickly became fashionable and they developed improved models based on its success. Georgia developed a strong marketing campaign and sales in the UK and internationally followed, sales were particularly strong in Australia. By 2008, Mahli had extended their product line, and manufactured DAB radios and home wireless entertainment systems. All products maintained a uniqueness of design and high-performance sound, and hence, drew a price premium. Mahli's strategically continue to focus on high-quality, top-end of the market products. In 2015, Georgia and her marketing department, saw a potential opportunity for launching a new product line, in car entertainment systems. Arjun was initially reluctant to enter into this product line, he felt that some of their success in the home wireless entertainment and DAB markets was down to getting into the marketplace early. He had concerns that the in-car entertainment market was already dominated by strong players, who have contracts with major car manufacturers and they would not be able to compete. "We have focused on selling to individuals via retailers - I think the only way to really profit from the in car entertainment system market is to sell to the car manufacturers and we do not have any relationships like that.". Georgia felt more confident that they would be able to get into the marketplace. They employed a new Product Manager, Frederick Clark, who had worked as an in car entertainment engineer at Sony and they launched the new Mahli in car entertainment systems in late 2016. Despite their reputation for sound quality, they did not gain any contracts with car manufacturers, but, were achieving some sales for car system upgrades. These sales figures did not reach expectations and, furthermore, some of the in car equipment products were returned to them for various reasons. They do not have a systern in place to manage returns easily as they had never needed one. Arjun and Georgia know they must deal with this issue soon, as it is not only effecting company reputation, but there is a fear that Mahli will face difficulties proving compliance with the Waste Electrical and Electronic Equipment (WEEE) legislation. Mahli have yet to see a return on investment on the in car systems and Arjun was beginning to question the product line again, as their other product ranges were covering the costs. He wanted to pull back and specialise in their home audio and DAB radios. Arjun believes they should be moving in on the digital radio market in the US and start making HD radios, compatible with the digital radio platform in the US. However, Georgia and the new product manager were optimistic that sales for the in car systems would pick up. "We just need a break in the automotive market and once we get a deal with a major automotive manufacturer... We'll be seti Georgia says. Mahli - The Organisation Mahli is made up of four main divisions, research and development (R&D); Marketing and Sales; Human Resources and Finance; and Manufacturing the Distribution, as shown in figure 1. R&D and HR and Finance are located in the company head-quarters in the UK. The R&D department work on the product lines, developing prototypes and improving the product to release new versions using supporting CAD packages. Each product engineer communicates with the relevant factory, they usually visit the Figure 1: Mahli organisation chart Co-Directors: Arjun Mahli and Georgia Jones Arjun Mahli Research and Development Georgia Jones Marketing and Sales Jenny Perez Human Resources and Finance Leonard Pollard Manufacturing and Distribution Mandeep Shah Product Engineer (DAB and sound) Dawn Carpenter Head of UK and Europe Sales Bing Cheng China (DAB and final assembly Chin-Mae Dong South Korea (sound) Karla Every Product Engineer (wireless technology) Amelia Fielding Head of Australia Sales Fujiko Nakamura Japan (in car technology) Frederick Clark Product Engineer (in car systems) David Caron Head of US Sales Sanan Yong Yuth Thailand (wireless technology) Hannah Carriage Distribution Manager Sales and marketing Mahli sell a fairly high volume of products, however the volume sold is different in the different regions, as shown in the tables below. Sales are fairly consistent throughout the year, however, there are peaks in sales in November/December in the UK, Europe and the US. This variation in demand is handled by building up stock at the distribution centres. Sales and marketing Mahli sell a fairly high volume of products, however the volume sold is different in the different regions, as shown in the tables below. Sales are fairly consistent throughout the year, however, there are peaks in sales in November/December in the UK, Europe and the US. This variation in demand is handled by building up stock at the distribution centres. Table 1: Home Wireless Audio Entertainment Systems Home Wireless Audio Systems UK and Europe 2014-2015 2015-2016 2016-17 2017-18 300250 301000 300100 300050 Australia 32000 33050 34000 35050 US 550050 550100 551000 550000 Table 2: DAB DAB radios 2014-2015 2015-2016 2016-17 2017-18 210200 213700 UK and Europe Australia 207050 24150 209450 24500 23050 23500 USI Table 3: In-car entertainment Systems In car entertainment 2014-2015 2015-2016 2016-17 2017-18 UK and Europe 15025 18425 There are currently no DAB services in the USA, they use HD or NRSC-5 radio instead. Page 2 Limited Time Activity Case Study: Mahli 1075 Australia US 1050 9125 10500 Sales and marketing is led by a different person in each region, with Dawn Carpenter leading UK and Europe, Amelia Fielding responsible for Australia and David Caron in the USA. Each of the heads has field sales personnel in their regions who visit the retailers to secure sales. This process consists of two main areas: maintaining relationships with existing retailers and finding new customers. David Caron feels there could be improved processes and techniques developed to boost sales. He says "I think at the moment, we are not really encouraged to look for new channels and customers. There are so many more successful internet retailers who we have no contract to sell with This is a key gap. We should be developing skills and processes for appealing to the internet retailers." The Manufacturing Function Mahli locate their manufacturing function in the far East, due to the low-cost economies in the region, for both labour and transport. They currently own three manufacturing centres located in South Korea, Japan and Thailand and have a further joint venture assembly plant in China. Each of the factories specialises in certain areas as shown in table 4, which has enabled them further cost-savings as each factory becomes expert in that area. However, there is little sharing of best practice and cost-saving processes between the factories. Each location has been awarded the ISO 9001 certification and is run by a factory manager. Each factory manager is supported by production engineers and supervisors. The managers have proven to be effective and share the same passion for high-quality products. The final assembly of all products takes place in China. Bing has been keen to improve the efficiency of the manufacturing plants, as he feels they are quite wasteful in terms of energy usage. He has calculated that his factory is using 1023.6 kilowatt-hours (kWh) of electricity and 68 tonnes of natural gas per square metre annually. This is far above the average and he has many ideas on how energy is being wasted. According to the UK Government (2018) for every 1 kilowatt-hour of energy 0.28307 kg of carbon dioxide equivalent [kg CO2-) is released and for every cubic metre of natural gas used 2.04652 kg CO2 is released. Bing says "We leave far too much equipment running overnight and some needs replacing with more energy efficient alternatives." Bing has already invested in LED lighting, which should led to an electricity saving of 5% per annum. There is evidence to show that energy usage is similar across the 4 plants and that steps could be made to improve. Table 4: Specialist Area at each Factory Factory Product Line Factory Size (m) Factory Manager China DAB 1,500 Bing Cheng Final assembly Japan In-car technology 400 South Korea Sound 1,100 Fujiko Nakamura Chin-Mae Dong Sanan Vegexutt Thailand Wireless technology 800 Materials, Procurement and Supplier Issues In the UK Headquarters, where the R&D is located, a purchasing clerk sources any parts, equipment, work and general office supplies. The parts used to make the audio products contain several materials including finite materials and other parts that could effectively be recycled at the end of the life of the product. Currently, Mahli use a third party to deal with any waste from the R&D facility and UK sales. However, there are no effective arrangements made in their other marketplaces. Leonard Pollard is keen to rectify this and feels they need to evaluate their compliance with WEEE regulations globally and devise a more effective and responsive solution. In the factories, the Factory Manager is responsible for the purchasing of all the parts required to make their products. Hence, the parts used in the prototypes in the UK are not from the same suppliers as those used in production. All the factory managers, except for Fujiko Nakamura, have delegated purchasing to their chief production engineer, who may also delegate further to other production engineers. There are only a few effective supply agreements, and hence, for the most part, production engineers make decisions based on price and delivery time. There is a large supply base in the region; hence, many suppliers are trying to compete on price with each other. The relationship between the factories and the supply base is considered very hostile. There have been suspicions that some of the production engineers will take "gifts from some of the suppliers. There is great suspicion of the contract with the suspension suppliers which consistently breaks when assembled into the speaker, yet, this contract is always renewed with the supplier. This causes a lot of defects and waste of their products during assembly. Table 4: Specialist Area at each Factory Factory Product Line Factory Size (m) Factory Manager China DAB 1,500 Bing Cheng Final assembly Japan In-car technology 400 South Korea Sound 1,100 Fujiko Nakamura Chin-Mae Dong Sanan Vegexutt Thailand Wireless technology 800 Materials, Procurement and Supplier Issues In the UK Headquarters, where the R&D is located, a purchasing clerk sources any parts, equipment, work and general office supplies. The parts used to make the audio products contain several materials including finite materials and other parts that could effectively be recycled at the end of the life of the product. Currently, Mahli use a third party to deal with any waste from the R&D facility and UK sales. However, there are no effective arrangements made in their other marketplaces. Leonard Pollard is keen to rectify this and feels they need to evaluate their compliance with WEEE regulations globally and devise a more effective and responsive solution. In the factories, the Factory Manager is responsible for the purchasing of all the parts required to make their products. Hence, the parts used in the prototypes in the UK are not from the same suppliers as those used in production. All the factory managers, except for Fujiko Nakamura, have delegated purchasing to their chief production engineer, who may also delegate further to other production engineers. There are only a few effective supply agreements, and hence, for the most part, production engineers make decisions based on price and delivery time. There is a large supply base in the region; hence, many suppliers are trying to compete on price with each other. The relationship between the factories and the supply base is considered very hostile. There have been suspicions that some of the production engineers will take "gifts from some of the suppliers. There is great suspicion of the contract with the suspension suppliers which consistently breaks when assembled into the speaker, yet, this contract is always renewed with the supplier. This causes a lot of defects and waste of their products during assembly. There are also some concerns on the ethical practices of some of the suppliers, including using child labour, paying low wages and poor health and safety conditions. Jenny Perez, as Head of Human Resources says, "the way the suppliers treat their staff falls well below how Mahli staff are treated. I simply don't know what to do about this issue as it's so far out of my control. I'm not sure whether we really need to take tighter control of our supply chain and develop a centralised, ethical procurement system and hire a specialist in this area... But as also the Head of Finance, I know this will have a huge effect on costs to use only suppliers with impeccable practices. I'm wrestling with my conscience on this issue." Fujiko Nakamura, has long thought and proposed that more could be done to improve the supply process. He believes that to maintain quality, long-term partnerships are required. As far as possible, Fujiko adopts this practice, but it has affected the profit margin on his products. Some of his suppliers have been continually increasing their prices. Hence, Fujiko is concerned about the situation and how he can keep costs down and maintain the quality. Fujiko is also aware that there are a number of parts that are common, not only for the in-car products, but with his counterparts in China, South Korea and Thailand. He wonders if it might be possible to secure better prices with the economies of scale and retain quality, through the reliability of suppliers. Transport and Distribution Transport and distribution is inherently complex due to the location of the factories from their marketplace. Hannah Carriage was employed to manage and organise the multi-mode transportation, she is based at the HQ in the UK. All the parts are transported from the specialist factories into China for final assembly and packaging. The inbound shipments are summarised in table 5. The UK Government (2018) estimates that for shipping products 0.018962 kg CO2 is released per tonne/km. Table 5: Inbound Shipments Summary 2017-18 Factory Shipping Distance (parts and sub-assemblies into Number of containers in Average weight of container Shenzhen for final assembly) 2017-18 and contents in 2017-18 (tonnes) Japan (in car technology) 7.75 1887 nautical miles/3495 km (Port of Nagoya into Port of Shenzhen) 1488 nautical miles/2756 km (Port of Busan into Port of Shenzhen) South Korea (sound) 1955 .95 Thailand (wireless technology) 1879 nautical miles/3480 (Port of Laem Chabang into Port of Shenzhen) 126 8.75 After products are assembled and packaged, they are shipped to the regional distribution centres. The radio and home entertainment products are shipped in lots of 100 within the container (multiple lots per container), to each regional distribution centre, there is no flexibility in lot sizes. The in car entertainment systems are shipped in smaller lot sizes of 20. There are 3 main RDCs as shown in table 6. Table 6: Regional Distribution Centres Market Region Regional Distribution Centre RDC Manager UK and Europe Birmingham Carl Mahew Sydney Claire Short Australia US Chicago Jane Faitslitt. The shipments into these RDCs for 2017-18 are summarised in table 7, similarly kg COne can be estimated using the UK Government (2018) data of 0.018962 kg CO2. is released per tonne/km. Table 7: Inbound Shipments from Final Assembly to RDC Summary 2017-18 RDC Shipping Distance (Products from Shenzhen to local port) Number of containers in 2017-18 Average weight of container and contents in 2017-18 (tonnes) UK and Europe 4.25 11067 nautical miles/20496 km (Port of Shenzhen into Port of Felixstowe) 5177 nautical miles/9588 km (Port of Shenzhen into Port of Sydney) Australia 4.85 4.65 1879 nautical miles/3480 (Port of Shenzhen into Port of Los Angeles) Page 4 Limited Time Activity Case Study: Mahli The RDC then stores the different product lines and arranges the transportation of the different product lines to their customers' locations, each RDC has its own fleet of trucks. They aim to cross-dock effectively, which is inherently complex, and, as yet, no suitable system has been found to calculate the best routes and combinations of customer orders to minimise transportation costs. However, a sophisticated SQL database exists that shows each customer order and the RDC co-ordinators work out the best combinations to try and maximise their truckloads (i.e. use as much space on the truck as possible). They aim to fill the truck, which is a target of 100 systems (with some juggling as the DAB products are much smaller than the full home audio system). The in car entertainment systems have complicated their work further, as it's mostly upgrade products so the final customer order can vary from a single speaker to a full system - thus, the size varies. They have a target to achieve 90% truck fill out of the RDC. They frequently do not make these targets and blame this on the new in car entertainment systems. The average trucking distances and loads are summarised in table 8. The UK Government (2018) data estimates that 0.68567 kg CO2 is released per tonne/km using a HGV vehicle. Carl Mayhew firmly believes they should be using more rail freight and has discussed this with Hannah, "I spoke to Hannah about using more rail freight for cost and environmental reasons. She agreed with me in principle and said she would explore it. I guess another alternative for environmental reasons would be to use bio- diesel, but I don't think this would make economic sense... But it would maybe be simpler than a rail/HGV combination. I think we need to make a business case or do more research on this." The UK Government (2018) data estimates that 0.03351 kg CO2 is released per tonne/km using rail. Table 8: Outbound HGV Consignments from RDC to Retailers Summary 2017-18 RDC Number of HGVs in 2017-18 Road Freight average distance per HGV in km in 2017-18 Average weight of HGV 2017-18 (tonnes) UK and Europe 1,267 km 4.1 Australia 1,145 km 1,635 km 620 130 690 4.2 4.2 USA Warehouse and Packaging The regional distribution centres act as the stock-holding warehouses for Mahli. Each warehouse is located to be central to the market region, and is run by the RDC manager. The RDC managers main concern is maximising truck-loads. Each RDC must carry stock due to the long lead-times for shipping the products from the Far East. Stock is recorded in the SQL database and updated when shipments are made to the customer. The RDCs use this information to place orders with the factories, however, they must order in batches of 100 for home entertainment and DAB (lot size is 20 for the in car entertainment). Therefore, all the RDCs carry far more stock than they need of each product line. The cost of stock-holding has never really been a concern as it enables them to have a high level of reliability and to deliver quickly to the retailers. However, due to the high-price of each product, and with new versions being released, the risk of obsolescence doesn't cease to be a concern for the RDC manager. They have heard the rumour that Arjun wants to scrap the in car entertainment line, which greatly troubles the RDC managers, as they don't know who will be responsible for the cast of the stock they currently hold. All products are packaged individually at the factory, including polystyrene corner pieces and a cardboard layer, neither of these packaging elements are from recycled materials. Products are then shipped in containers in lots of 100 (20 for in-car entertainment systems). These containers are strong and usually withstand the journey. However, occasionally, within the RDC, as shipments are handled and moved around the warehouse, some damage to the packaging can occur. Currently, RDC do not have the facilities to repack items, and hence, if damage is too severe, then products can be scrapped. The RDC manager is responsible for the costs of scrapping products. There were some issues with the in-car entertainment systems were returned to them for various reasons and they do not have a system in place to manage returns easily. The returns and the reasons for them as show in table 9 Hannah is unhappy with the situation, "I have enough to deal with getting an efficient flow of products out to customers, the in car entertainment returns are just making it more difficult. So many are returned with no faults - I think we need to provide better customer care/support or documentation, as it seems people do not know how to work them." Table 9: Returned In Car Entertainment systems In Car Entertainment Systems 2016-2017 2017-18 UK and Europe No fault found 80 30 15 Faulty control panel 45 25 Wiring defective Australia No fault found 20 Page 5 Limited Time Activity Case Study: Mahli Faulty control panel Wiring defective USA No fault found Faulty control panel Wiring defective Table 9: Returned In Car Entertainment systems In Car Entertainment Systems 2016-2017 2017-18 UK and Europe No fault found 80 30 15 Faulty control panel 45 25 Wiring defective Australia No fault found 20 Page 5 Limited Time Activity Case Study: Mahli Faulty control panel Wiring defective USA No fault found Faulty control panel Wiring defective Systems and IT Currently Mahli use their website purely as a brand-building space. It includes only the contact details of the sales department for each region. Increasingly this has caused confusion, with some end customers making enquiries directly to Mahli and wanting to purchase from them. Mabli then directs the end customer to the appropriate retailer. However, as Dawn Carpenter says "We are spending a lot of time on incoming end customer telephone calls and emails. Sometimes it makes me wonder if we should sell directly, but this would erode our retailer partnerships." Their website contains no information about current stock position and is not used to co-ordinate sales with the retailers. Mahli have an established SQL database instead that handles customer orders and shipments at the RDCs. This database works very well in ensuring orders are met, but does not really help with truck fill, this is left to the knowledge of the transport planners at each RDC who report to Hannah Carriage. Hannah feels that the system could be developed, but more importantly, she would like better visibility of the production schedule. "Currently the production area is invisible to me. Usually, this is not a problem, but, increasingly, products are arriving late from South Korea. The sales team report similar thoughts, Amelia says "I would just like to know a bit more about what is going on. Sometimes we get the order early, which doesn't cause too many problems, but when it is late, my team have to go back to the customer and explain. But really, we do not know the reason why. All we can do is keep stock to prevent the embarrassment in front of the customer." N.B. In places, you will notice that you only have partial data to make your calculations - this is true to real life. State any assumptions or missing data in your report for clarity. Sources used to create this case study: Federal Communications Commission, 2019. [online] Digital Radio Available at: