Question: solve this experts please it's my third time i m posting solve this experts Current Attempt in Progress On December 31, 2019, Clean and White

solve this experts please it's my third time i m posting

solve this experts

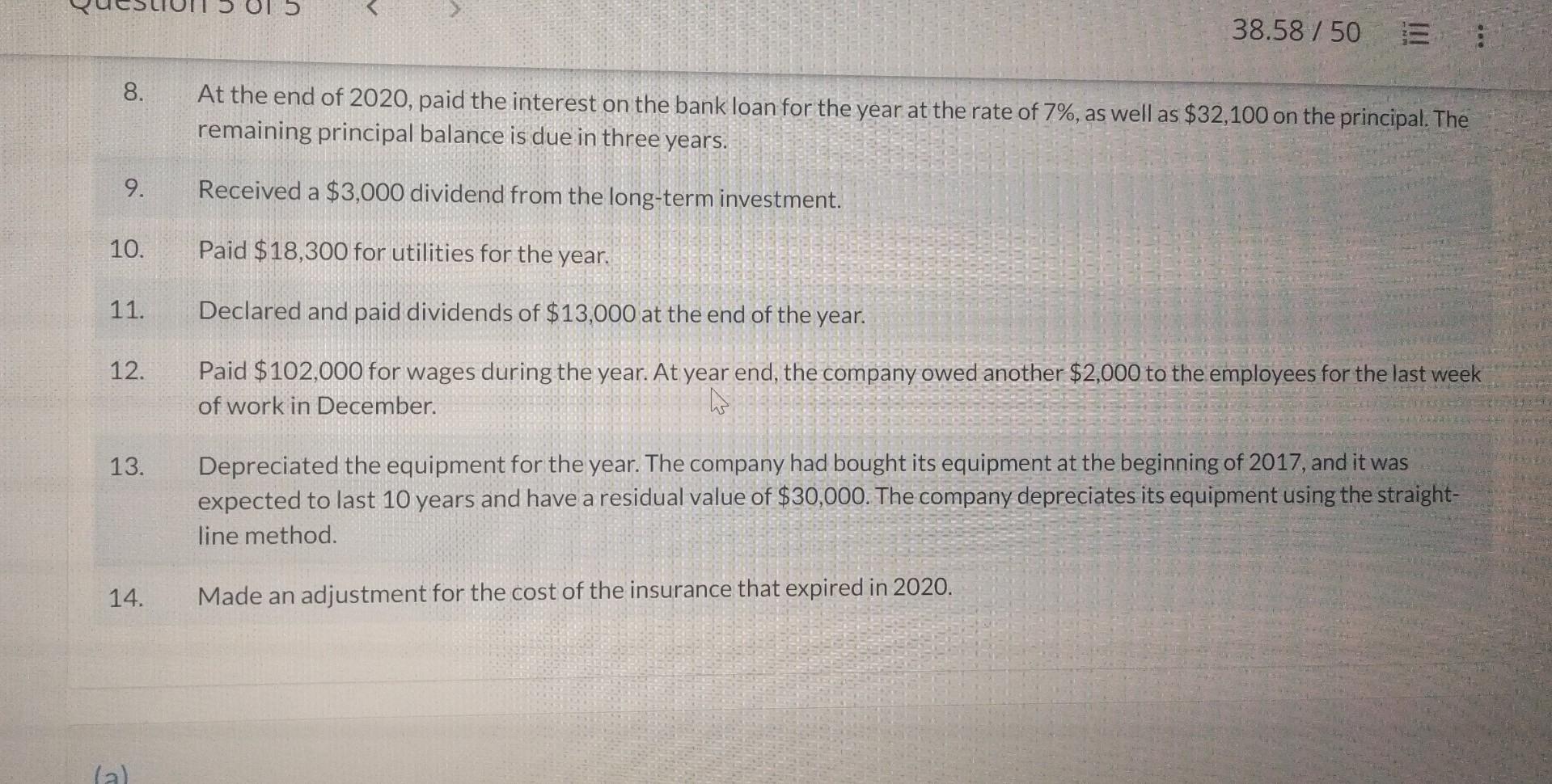

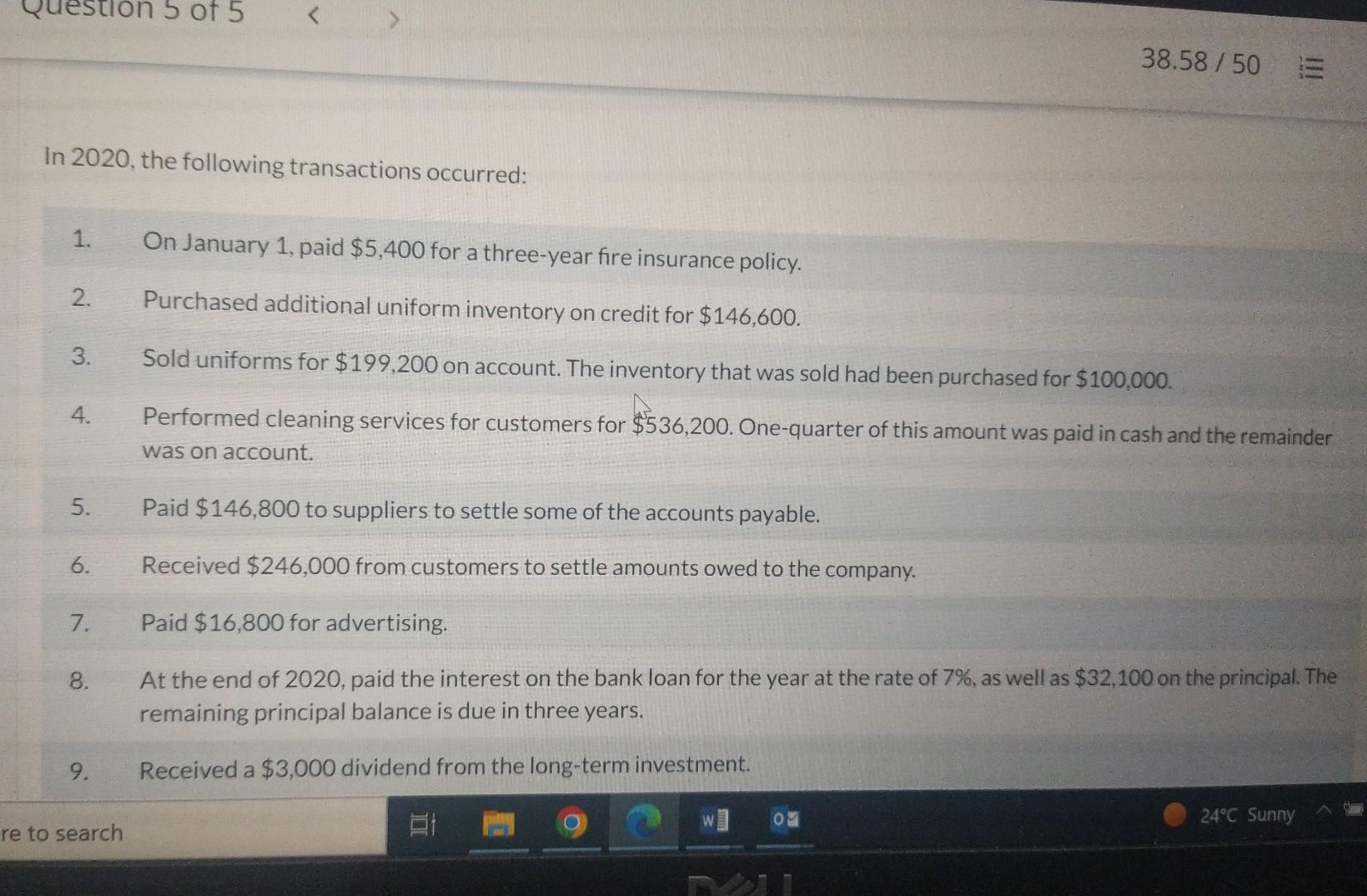

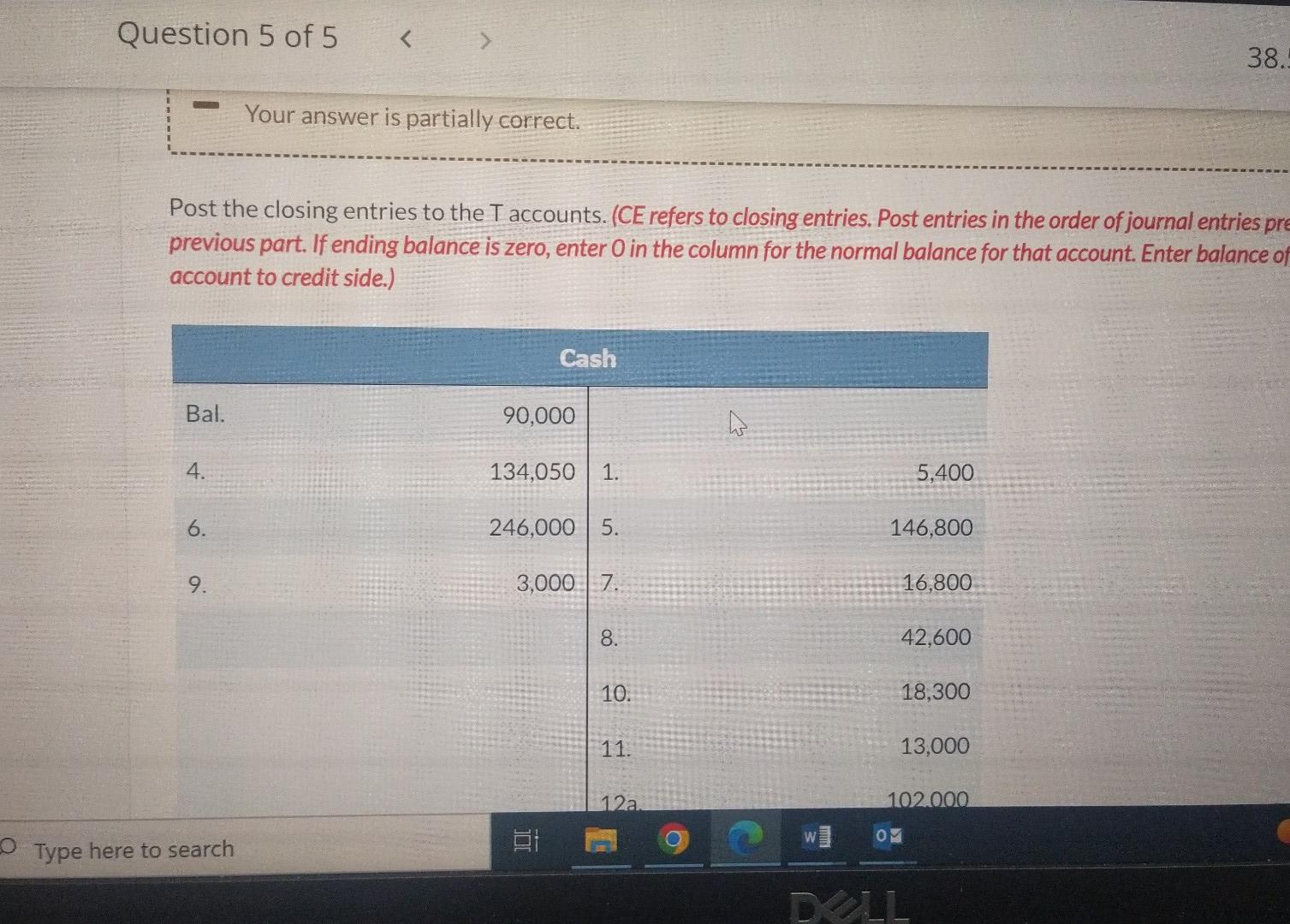

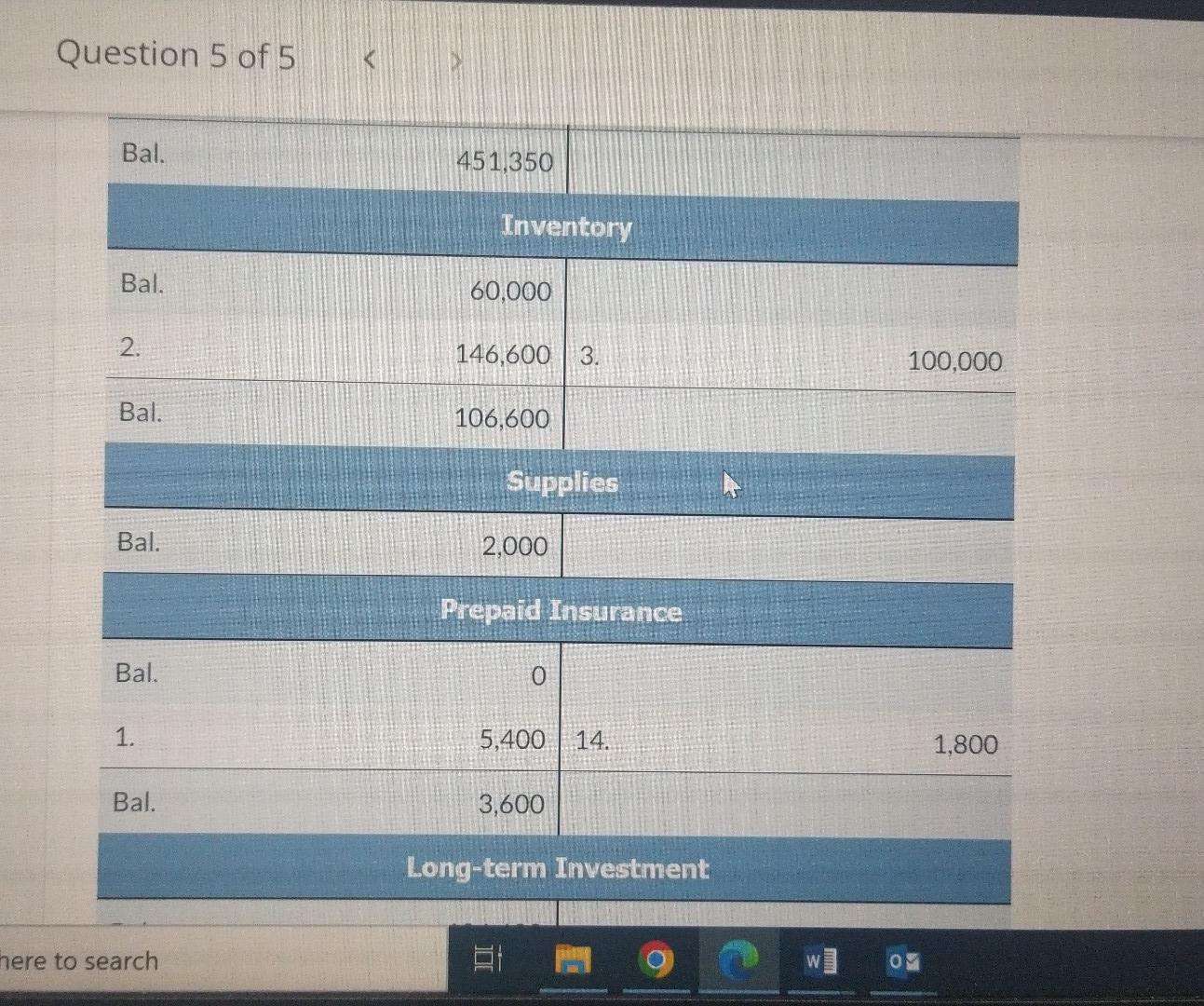

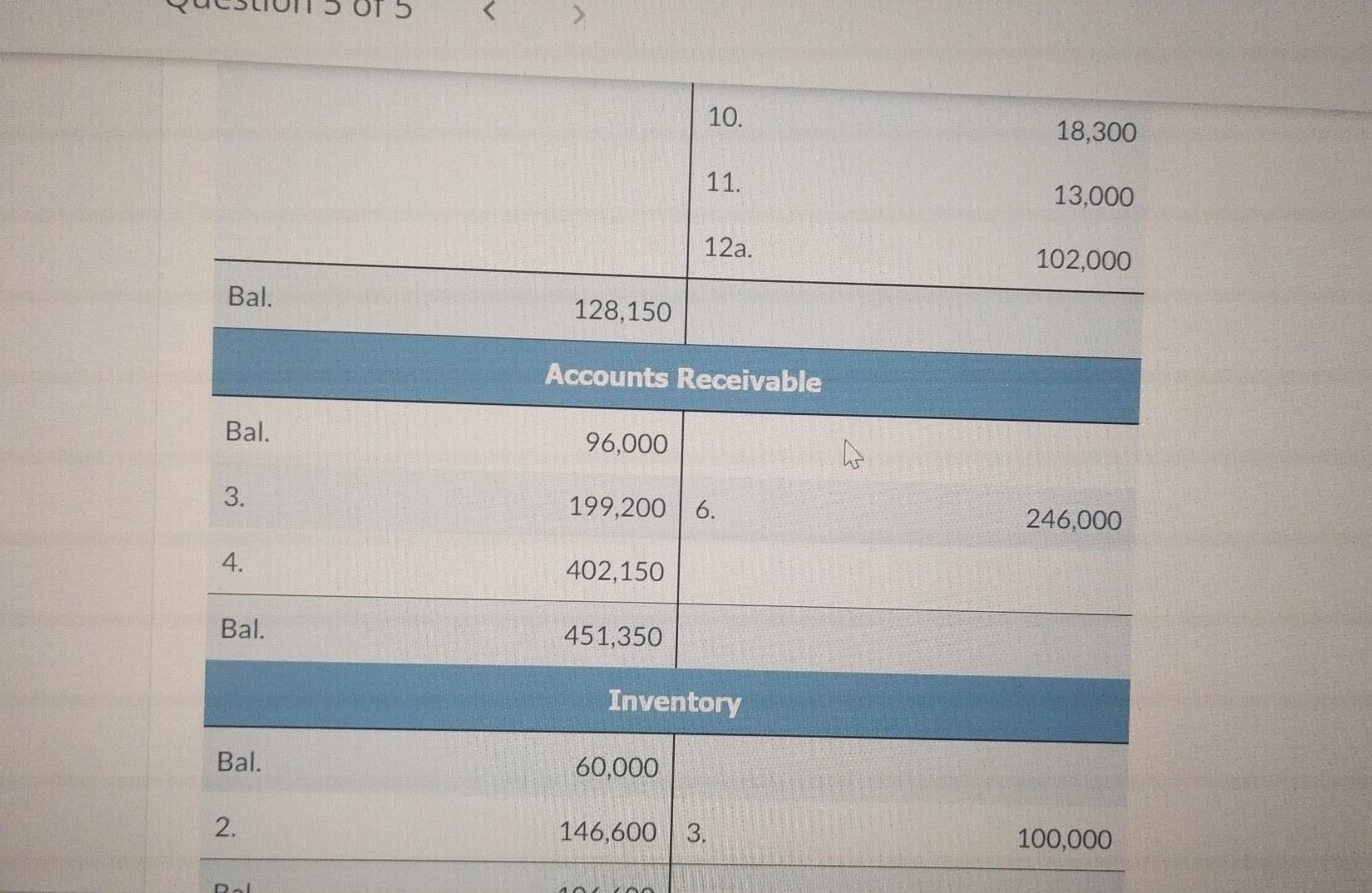

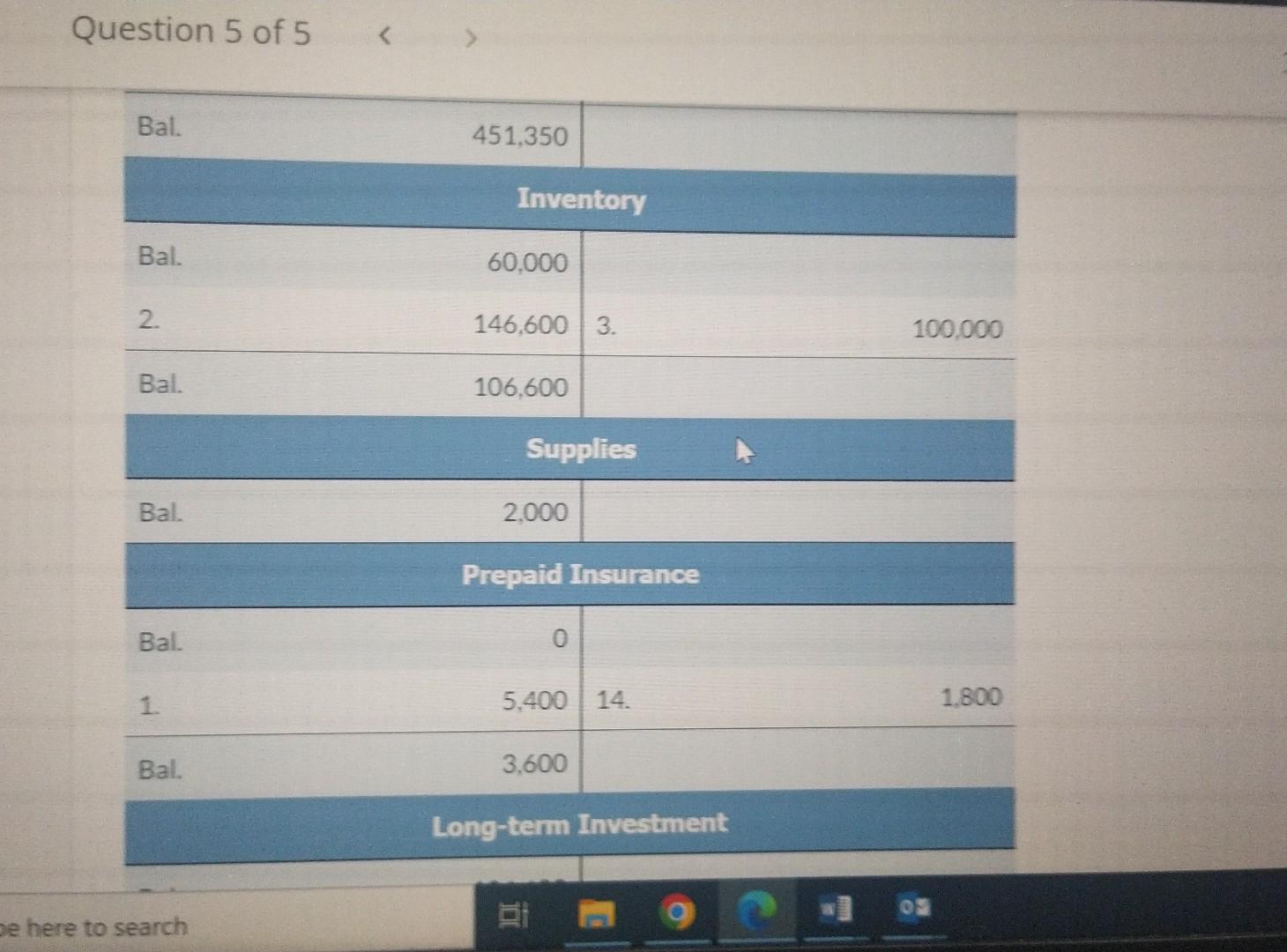

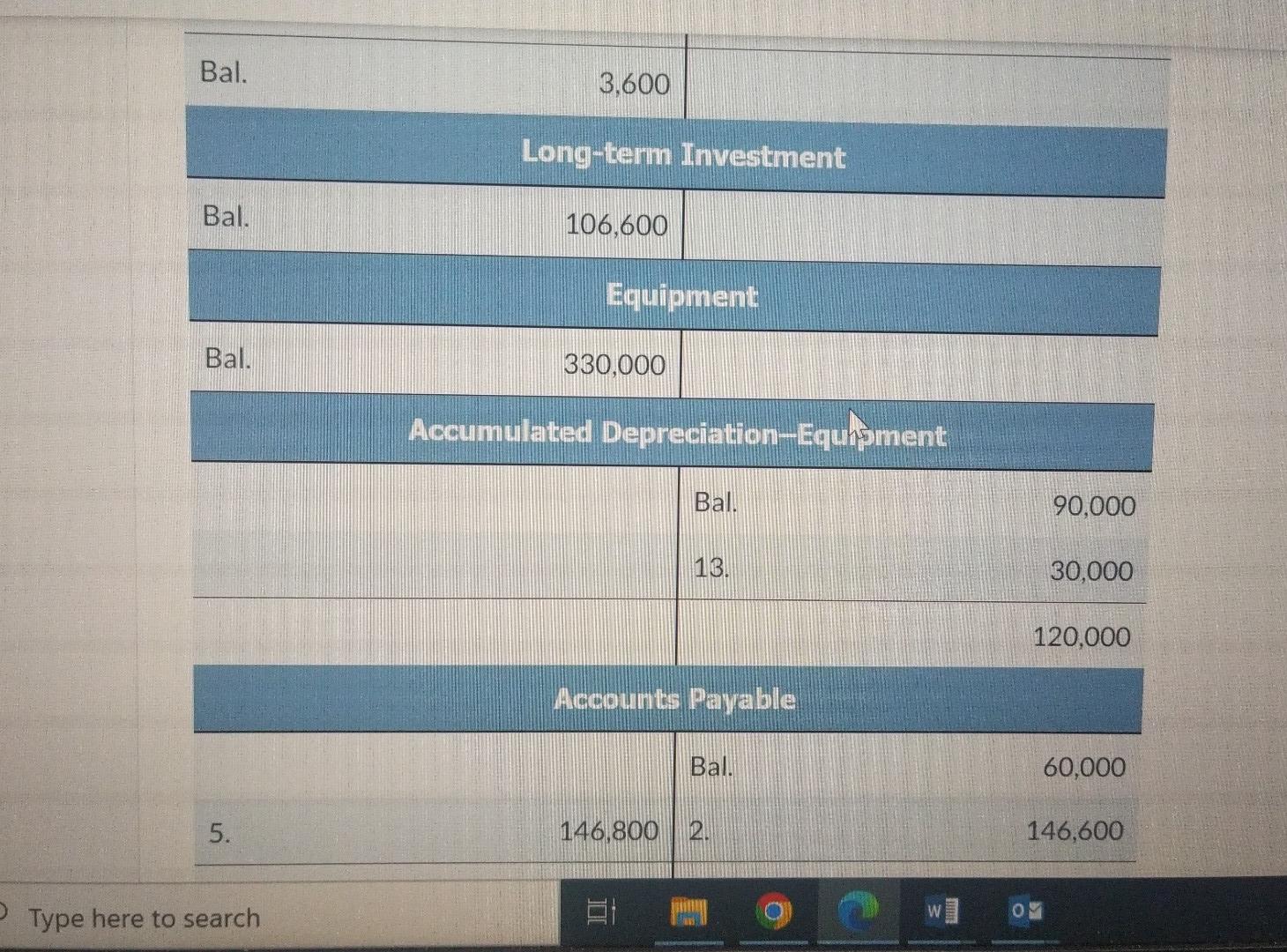

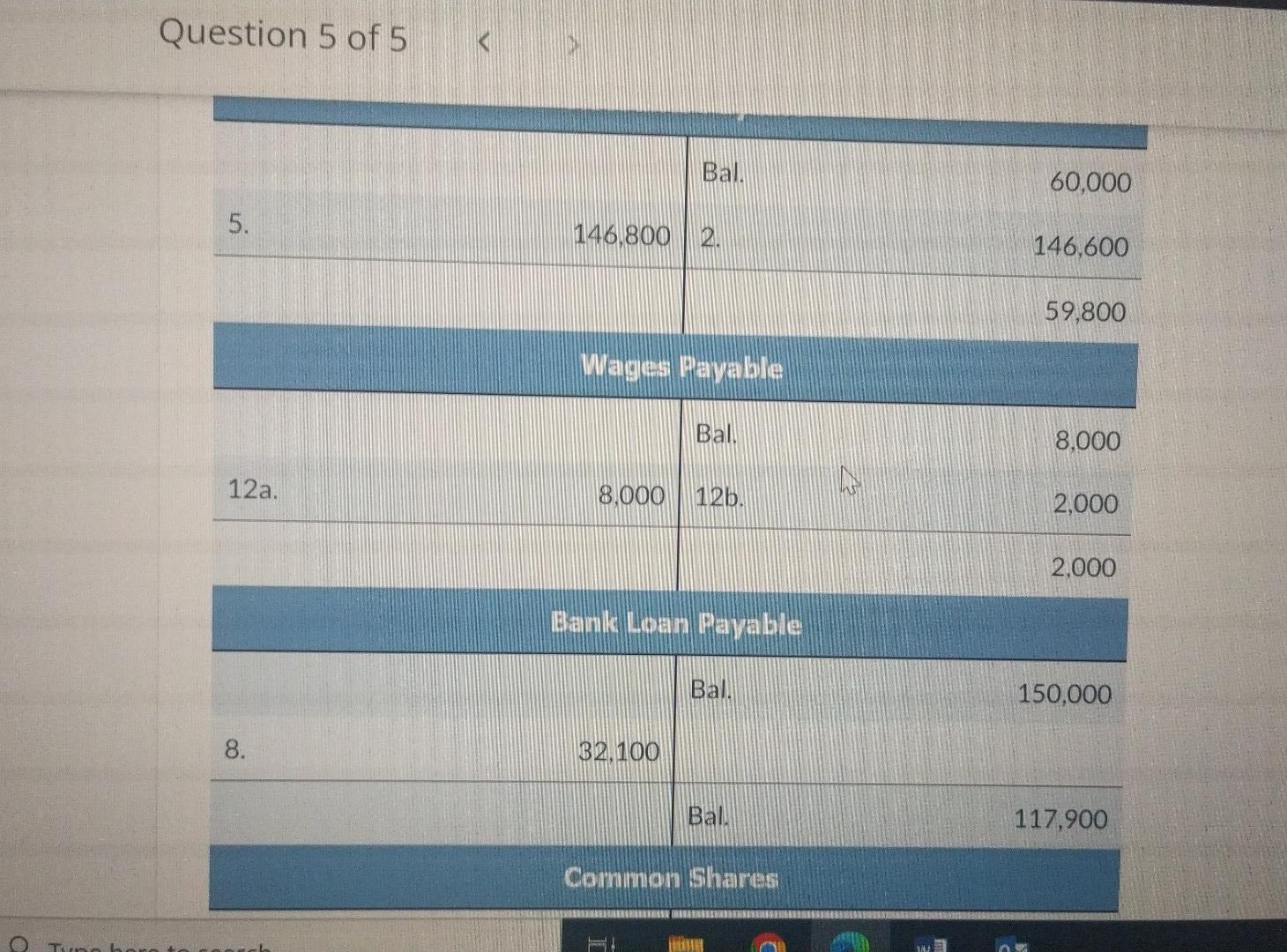

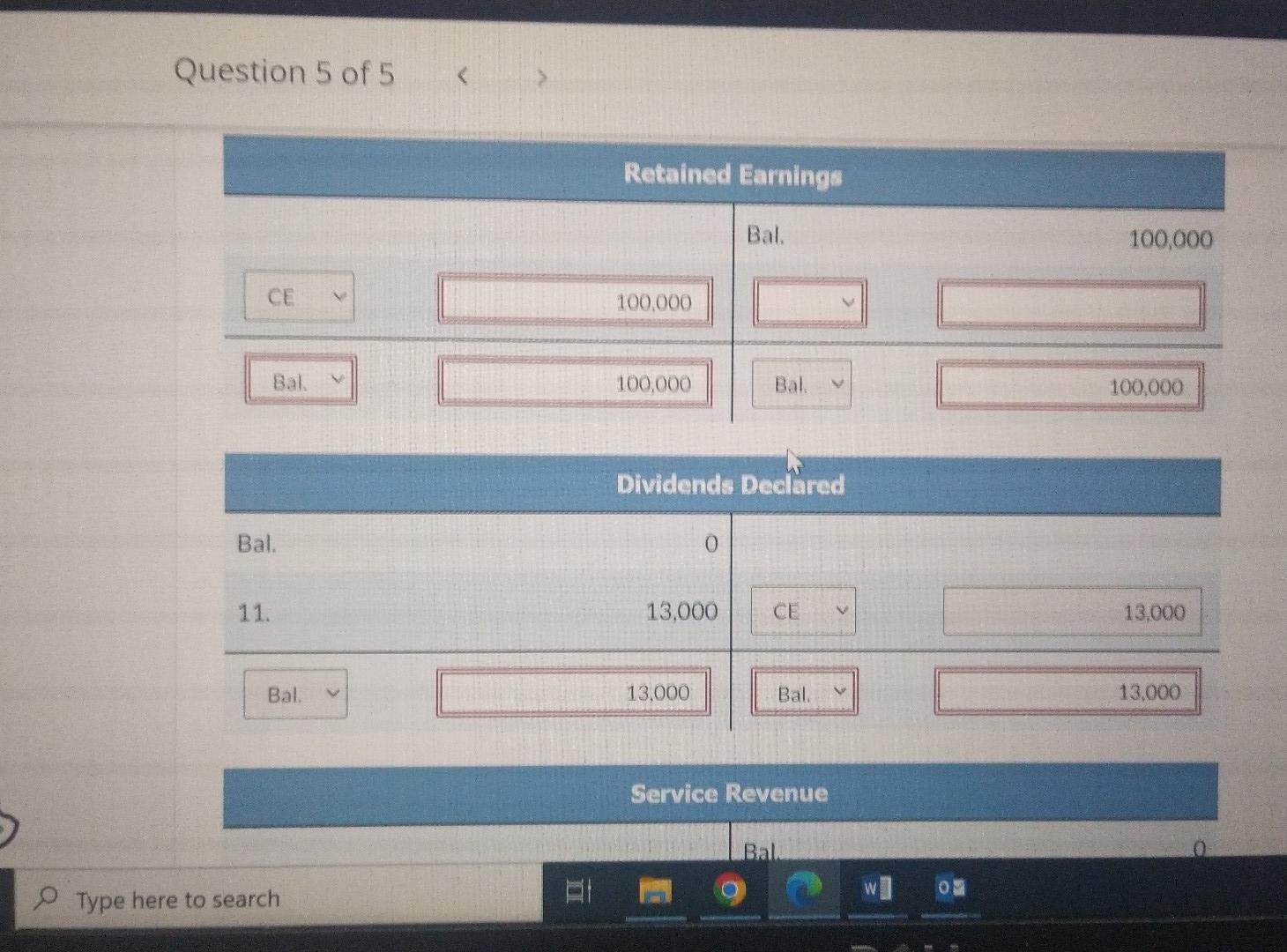

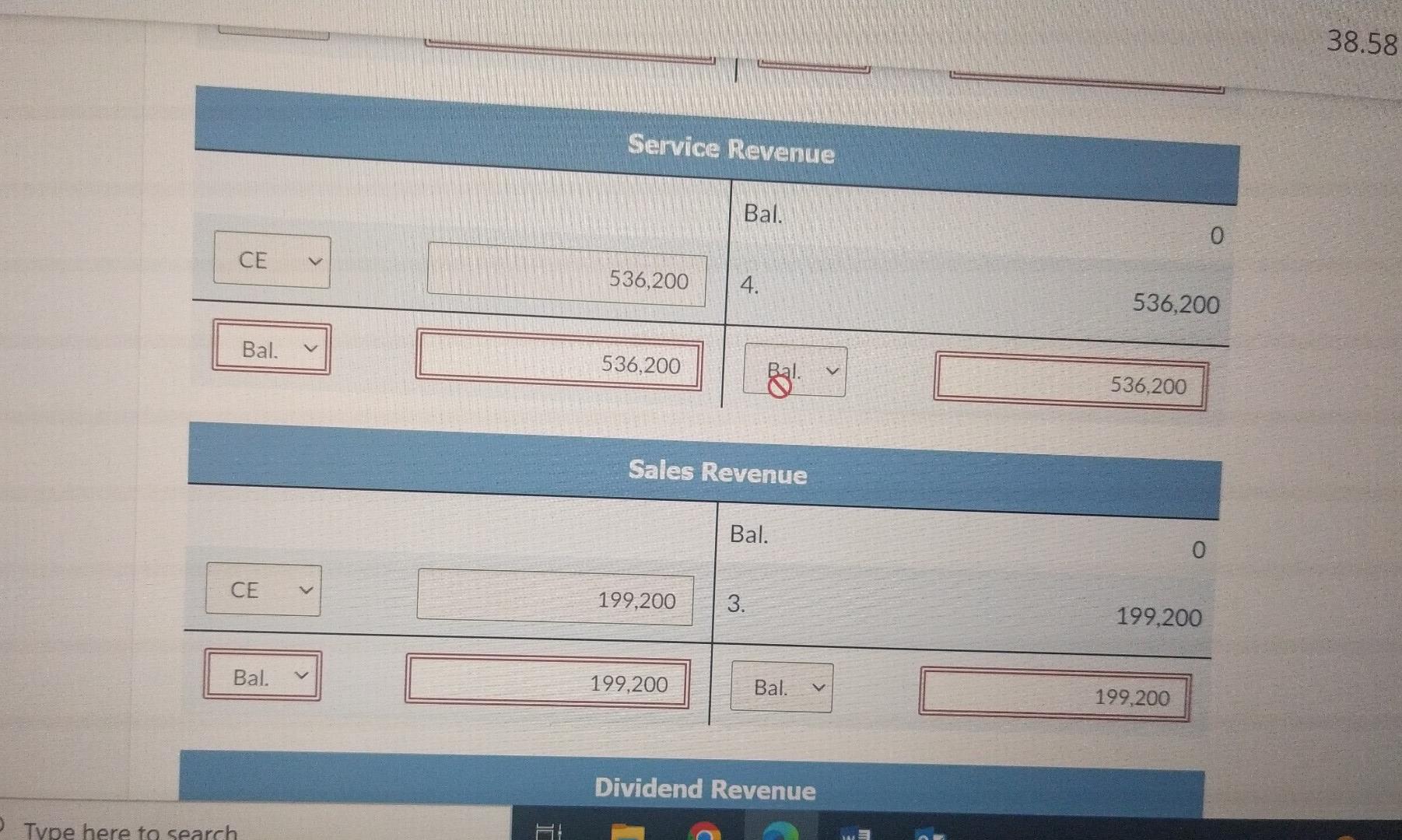

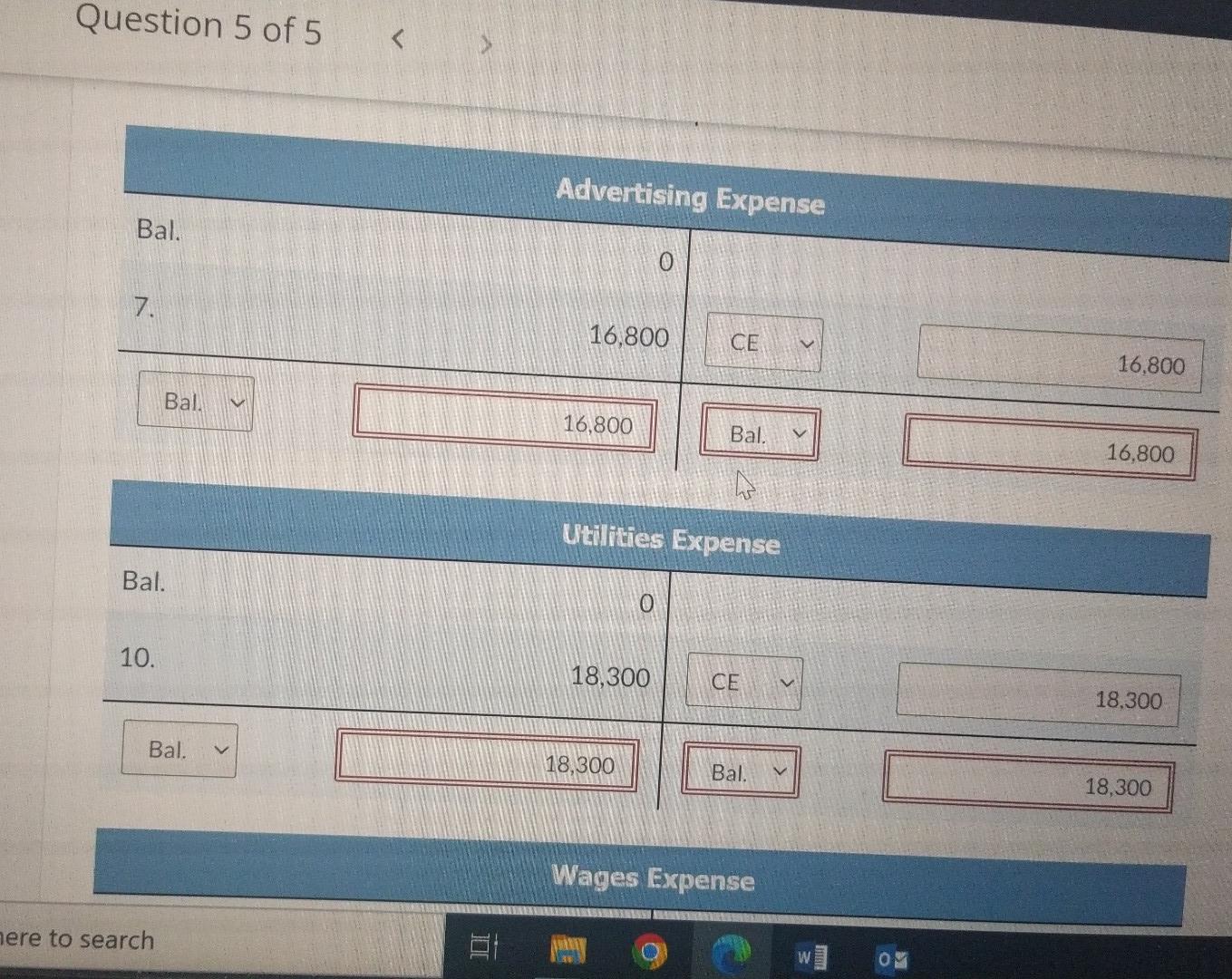

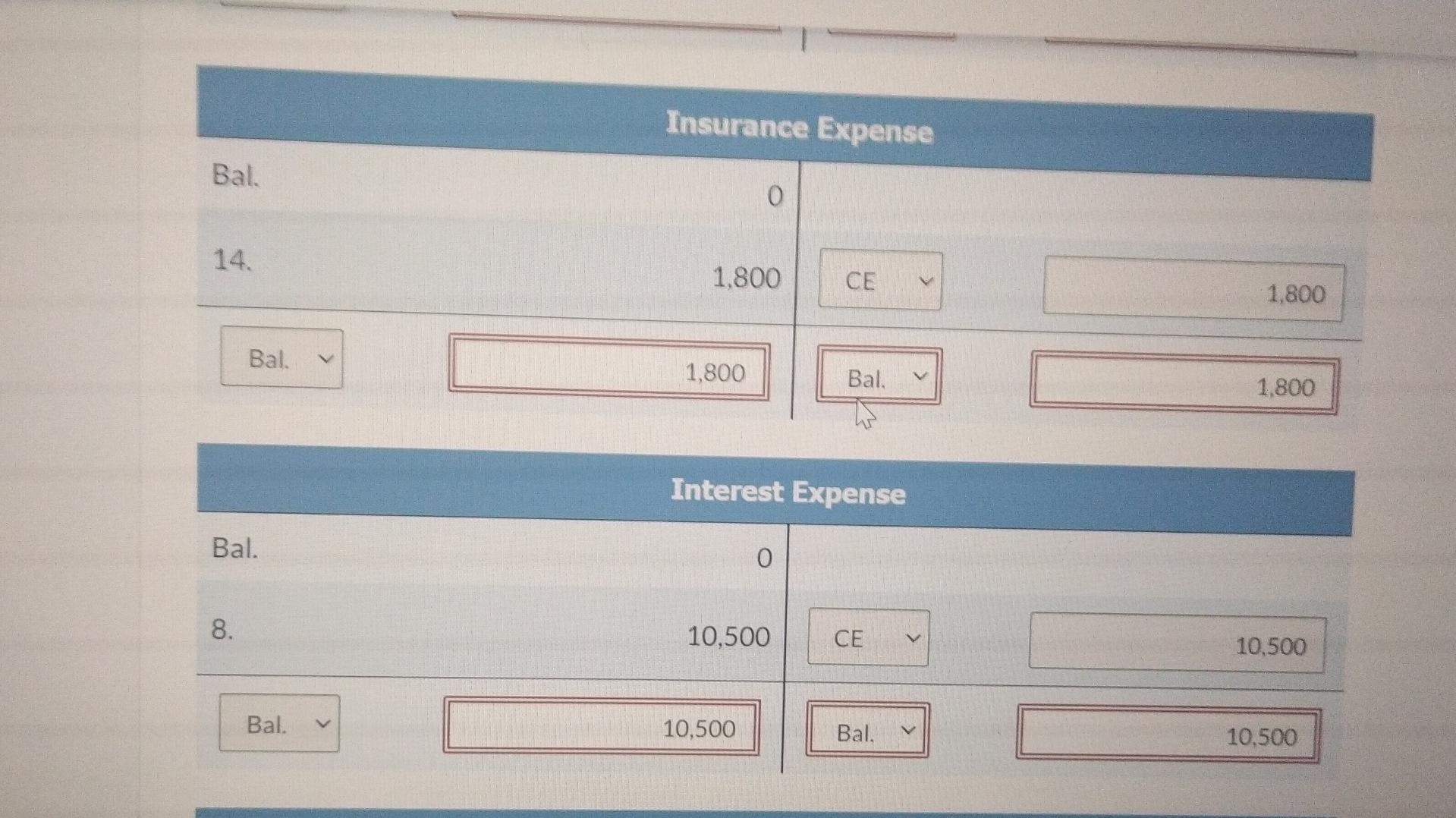

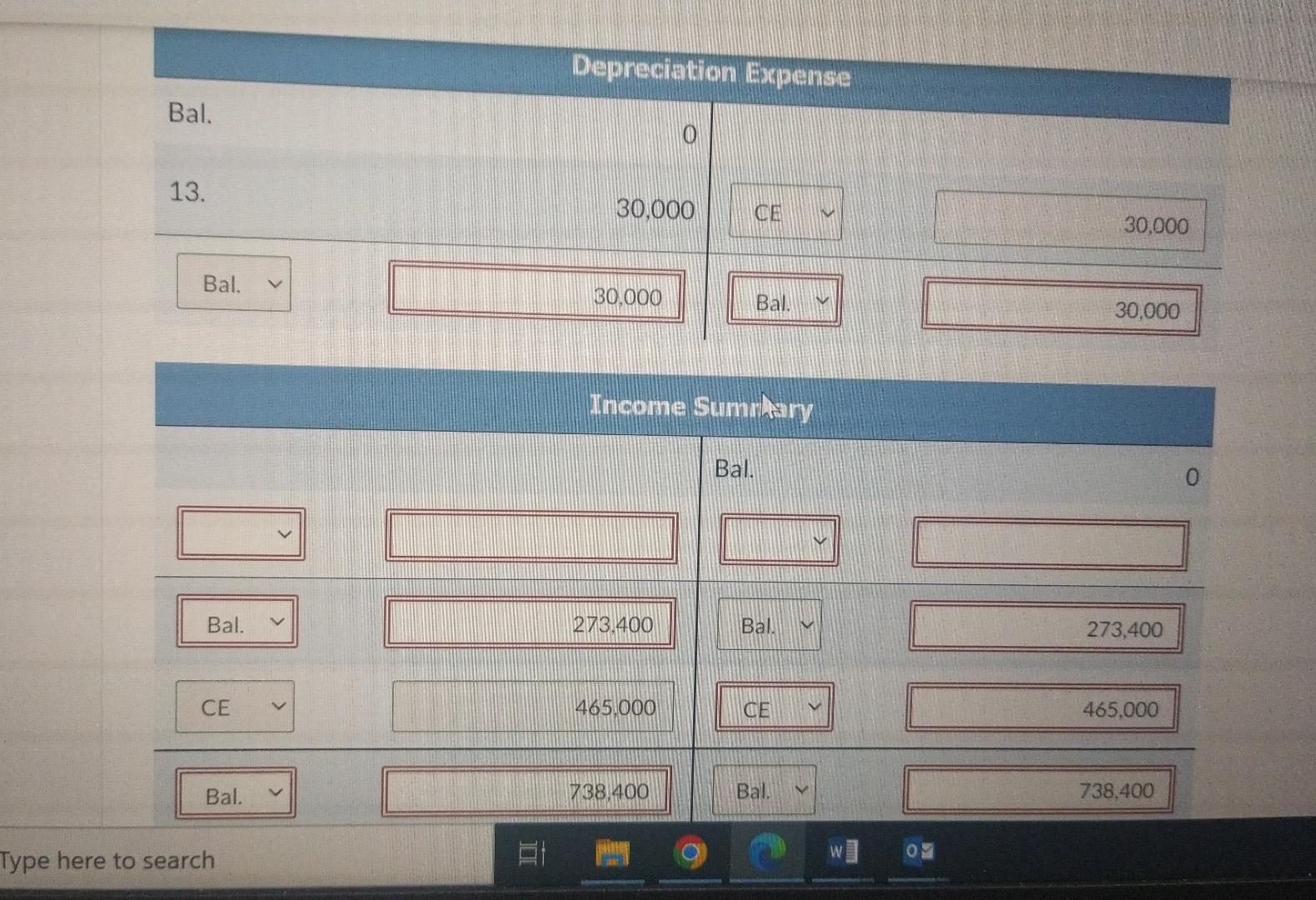

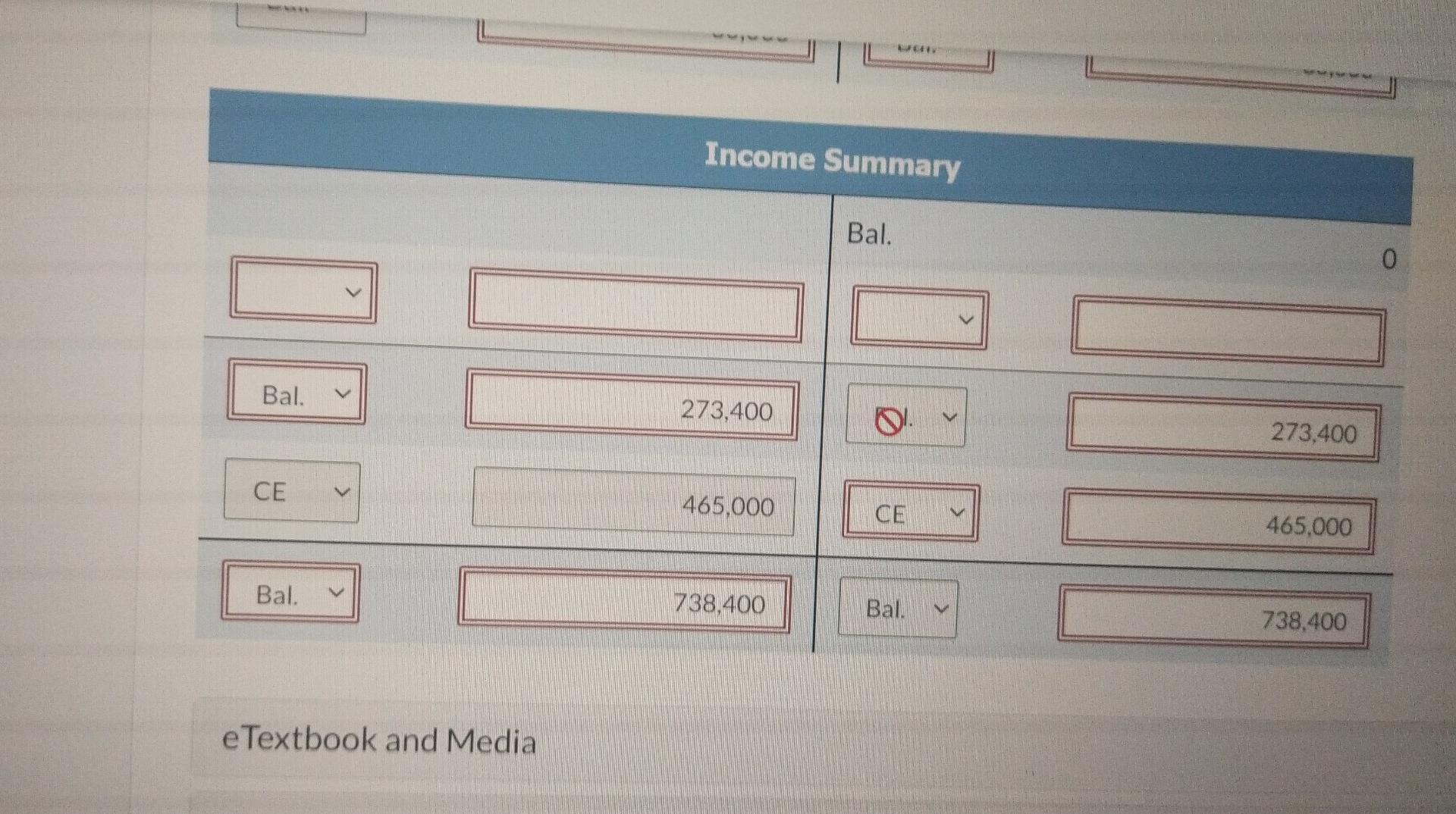

Current Attempt in Progress On December 31, 2019, Clean and White Linen Supplies Ltd. had the following account balances: In 2020 , the following transactions occurred: 8. At the end of 2020 , paid the interest on the bank loan for the year at the rate of 7%, as well as $32,100 on the principal. The remaining principal balance is due in three years. 9. Received a $3,000 dividend from the long-term investment. 10. Paid $18,300 for utilities for the year. 11. Declared and paid dividends of $13,000 at the end of the year. 12. Paid $102,000 for wages during the year. At year end, the company owed another $2,000 to the employees for the last week of work in December. 13. Depreciated the equipment for the year. The company had bought its equipment at the beginning of 2017 , and it was expected to last 10 years and have a residual value of $30,000. The company depreciates its equipment using the straightline method. 14. Made an adjustment for the cost of the insurance that expired in 2020. In 2020, the following transactions occurred: 1. On January 1 , paid $5,400 for a three-year fire insurance policy. 2. Purchased additional uniform inventory on credit for $146,600. 3. Sold uniforms for $199,200 on account. The inventory that was sold had been purchased for $100,000. 4. Performed cleaning services for customers for $536,200. One-quarter of this amount was paid in cash and the remainder was on account. 5. Paid $146,800 to suppliers to settle some of the accounts payable. 6. Received $246,000 from customers to settle amounts owed to the company. 7. Paid $16,800 for advertising. 8. At the end of 2020 , paid the interest on the bank loan for the year at the rate of 7%, as well as $32,100 on the principal. The remaining principal balance is due in three years. 9. Received a $3,000 dividend from the long-term investment. Post the closing entries to the T accounts. (CE refers to closing entries. Post entries in the order of journal entries pr previous part. If ending balance is zero, enter O in the column for the normal balance for that account. Enter balance 0 account to credit side.) Questinn 5 afi 5 \begin{tabular}{lr|rr} & & 10. & 18,300 \\ & & 11. & 13,000 \\ & & 12 a. & 102,000 \\ \hline Bal. & 128,150 & & \\ \hline & Accounts Receivable & 246,000 \\ \hline Bal. & 96,000 & & 100,000 \\ \hline 3. & 199,200 & 6. & \\ \hline 4. & 402,150 & & \\ \hline Bal. & 451,350 & & \\ \hline & Inventory & \\ \hline Bal. & 60,000 & & \\ \hline 2. & 146,600 & 3. & \\ \hline \end{tabular} ie here to search Question 5 of 5 5. 12a. Wages Payable Question 5 of 5 Service Revenue Type here to search \begin{tabular}{|l|lr} \multicolumn{2}{c|}{ Sales Revenue } \\ \hline & Bal. & 0 \\ \hline 199,200 & 3. & 199,200 \\ \hline 199,200 & & \\ \hline Bal. & 199,200 \\ \hline \end{tabular} Dividend Revenue Question 5 of 5 Wages Expense \begin{tabular}{lr} & Interest \\ Bal. & 0 \\ 8. & 10,500 \\ \hline Bal. v & 10,500 \\ \hline \end{tabular} \begin{tabular}{lr} \hline & Wages \\ \hline Bal. & 0 \\ 12a. & 94,000 \\ 12b. & 2,000 \\ \hline & 96,000 \\ \hline Bal. & 102,000 \\ \hline \end{tabular} Expense Bal. Bal. 14. Insurance Expense Income Sumnaria Type here to search Bal. eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts