Solve this problem by hand without using Excel please.

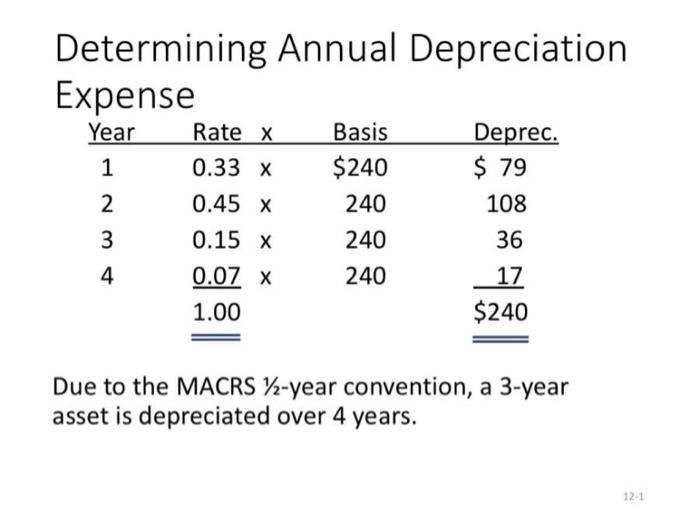

You are the analyst for a Pistol Petes Pizza Palace, a restaurant that is thinking of expanding their business to include catering for at least the next three years. To take on this project, the restaurant would need to purchase a van to transport food to customer locations. The price of the van is $42,000, and there would be a customization expense of $10,000 to modify the van for this special use. The vehicle would be depreciated using the 3-year MACRS SchedulePreview the document (33%, 45%, 15%, and 7%) and be sold at the end of 3 years for $5,500. This project would increase sales by $25,000 annually and increase food costs by $5,000. There would also be an increase in net operating working capital of $2,500. The restaurants current tax rate is 21%, and their WACC is 10%.

Based on the Capital Budgeting Techniques were learning about in class, should the restaurant expand their business to include catering services? Why or why not? Once you have calculated the cash flows for this project, you will also need to calculate the projects payback period, discounted payback period, NPV, IRR and MIRR.

Now assume the restaurant's WACC falls to 7.5% and calculate the NPV, IRR, MIRR, payback period and discounted payback period. Would this change your recommendation? Why or why not?

Determining Annual Depreciation Expense Year 1 2 3 Basis $240 240 Deprec. $ 79 108 Rate X 0.33 X 0.45 X 0.15 X 0.07 X 1.00 240 36 4 240 17 $240 Due to the MACRS 12-year convention, a 3-year asset is depreciated over 4 years. 12-1