Question: solve this question as soon as possible. URGENT HELP REQUIRED. i'll surely give u Thumbs up. 2.3 Performance Products Corporation makes two products, titanium Rims

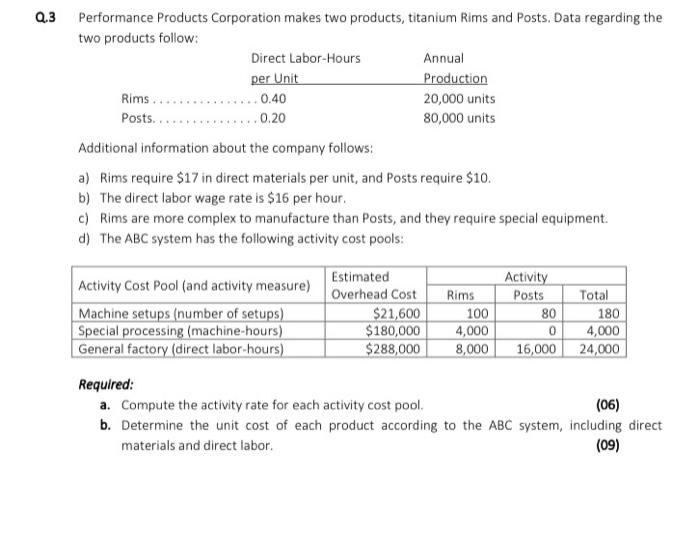

2.3 Performance Products Corporation makes two products, titanium Rims and Posts. Data regarding the two products follow: Direct Labor-Hours Annual per Unit Production Rims ...0.40 20,000 units Posts 0.20 80,000 units Additional information about the company follows: a) Rims require $17 in direct materials per unit, and Posts require $10. b) The direct labor wage rate is $16 per hour. c) Rims are more complex to manufacture than Posts, and they require special equipment. d) The ABC system has the following activity cost pools: Activity Cost Pool (and activity measure) Machine setups (number of setups) Special processing (machine-hours) General factory (direct labor-hours) Estimated Overhead Cost $21,600 $180,000 $288,000 Rims 100 4,000 8,000 Activity Posts Total 80 180 0 4,000 16,000 24,000 Required: a. Compute the activity rate for each activity cost pool. (06) b. Determine the unit cost of each product according to the ABC system, including direct materials and direct labor. (09)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts