Question: solve this questions including part A&B please for a thumbs up THIS QUESTION HAS TWO PARTS After a retiring from a successful business career, you

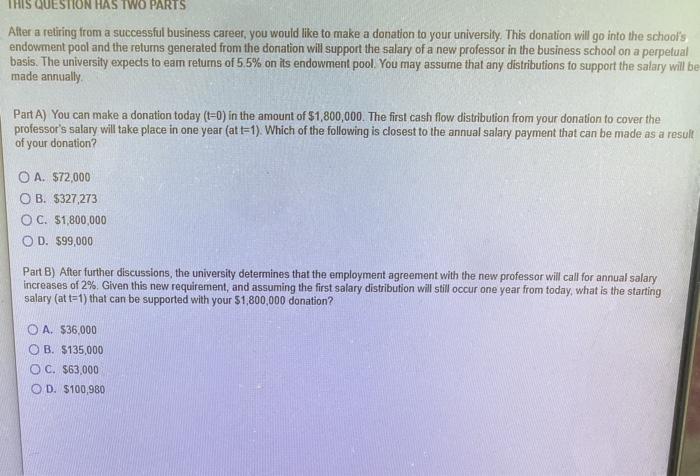

THIS QUESTION HAS TWO PARTS After a retiring from a successful business career, you would like to make a donation to your university. This donation will go into the school's endowment pool and the returns generated from the donation will support the salary of a new professor in the business school on a perpetual basis. The university expects to eam returns of 5.5% on its endowment pool. You may assume that any distributions to support the salary will be made annually Part A) You can make a donation today (t=0) in the amount of $1,800,000. The first cash flow distribution from your donation to cover the professor's salary will take place in one year (at t=1). Which of the following is closest to the annual salary payment that can be made as a result of your donation O A. $72,000 O B. $327 273 O C. $1,800,000 OD. $99,000 Part B) After further discussions, the university determines that the employment agreement with the new professor will call for annual salary increases of 2%. Given this new requirement, and assuming the first salary distribution will still occur one year from today, what is the starting salary (at t=1) that can be supported with your $1,800,000 donation? OA. $36.000 OB. $135,000 OC. $63.000 OD $100,980

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts