Question: solve Using both the Direct and Indirect method Due: October 14, 2019 SCF Company had the following balance sheet data for 2018 and 2019: zelt

solve Using both the Direct and Indirect method

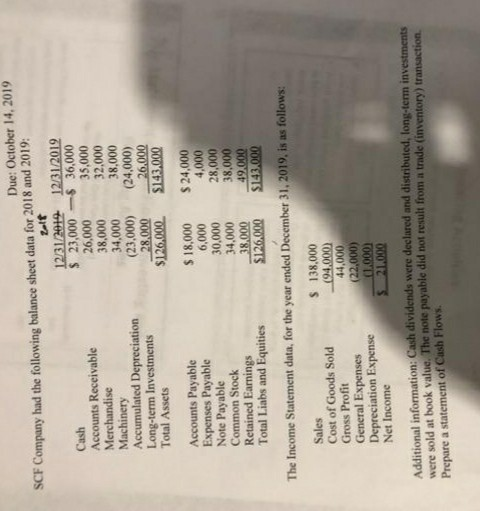

Due: October 14, 2019 SCF Company had the following balance sheet data for 2018 and 2019: zelt 12/31/2014 12/31/2012 Cash $ 23,000 $ 36,000 Accounts Receivable 26,000 35,000 Merchandise 38,000 32.000 34,000 38,000 Machinery Accumulated Depreciation (23,000) (24,000) Long-term Investments 28,000 26,000 Total Assets $126,000 $143.000 Accounts Payable $ 18,000 $ 24,000 Expenses Payable 6,000 4,000 Note Payable 30,000 28,000 Common Stock 34.000 38,000 Retained Earnings 38.000 49.000 Total Liabs and Equities $126.000 $143.000 The Income Statement data, for the year ended December 31, 2019. is as follows. Sales $ 138,000 Cost of Goods Sold (94.000) Gross Profit 44.000 General Expenses (22,000) Depreciation Expense 1.000) Net Income $ 21.000 Additional information: Cash dividends were declared and distributed, long-term investments were sold at book value. The note payable did not result from a trade (inventory) transaction Prepare a statement of Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts