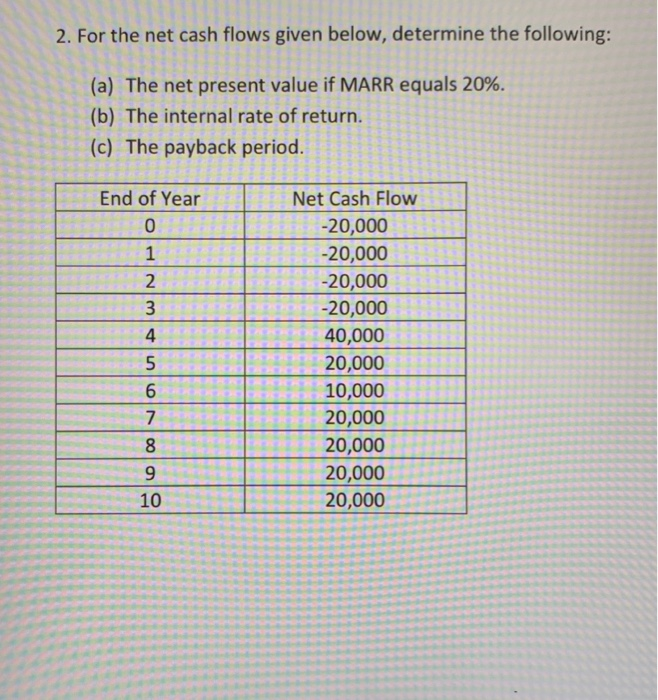

Question: Solve using equation sheet 2. For the net cash flows given below, determine the following: (a) The net present value if MARR equals 20%. (b)

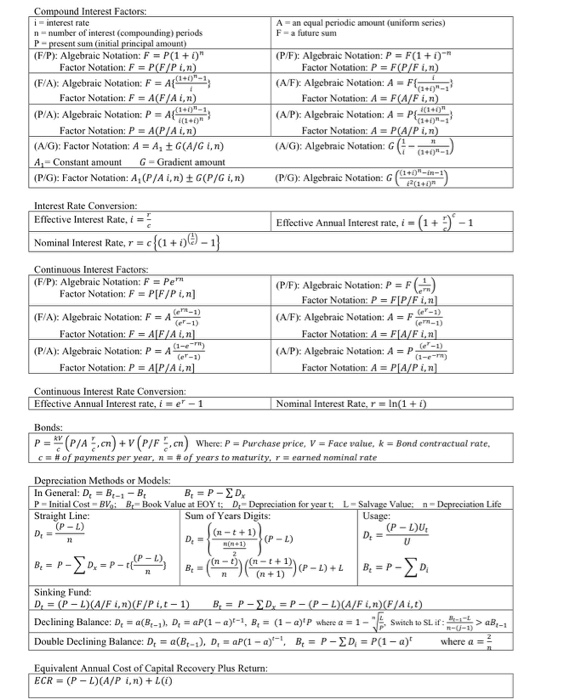

2. For the net cash flows given below, determine the following: (a) The net present value if MARR equals 20%. (b) The internal rate of return. (c) The payback period. ONE End of Year 0 1 20 000 ZUUUU 3 Net Cash Flow -20,000 -20,000 -20,000 -20,000 -20.000 40,000 20,000 10,000 20,000 20,000 20,000 20,000 10,000 7 10 i A-an qual periodic amount (uniform series) F-a future sum Compound Interest Factors: nterest rate number of interest (compounding) periods P-present sum initial principal amount) (F/P): Algebraic Notation: F = P(1+1) Factor Notation: F = PCF/P.) (F/A): Algebraic Notation: F = A 0-1 Factor Notation: F = A(FAR) (P/A): Algebraic Notation: P = A * Factor Notation: P = APA ) (AG): Factor Notation: A = A, G(A/Gi.n) 4.- Constant amount G - Gradient amount (PG): Factor Notation: A (P/Ain) (P/Gi,n) (P/F) Algebraic Notation: P = F(1+0) Factor Notation: P = F(P/Fin) (A/F) Algebraic Notation: A F Factor Notation: A = F(A/Fin) (A/P): Algebraic Notation: A = P Factor Notation: A = P(A/Pin) (AIG): Algebraic Notation: -.-) (P/G): Algebraic Notation: om) Interest Rate Conversion: Effective Interest Rate,i = Effective Annual Interest rate, - 1 + 3 - 1 Nominal Interest Rate, r = c{{1+ 0-1} Continuous Interest Factors: (F/P): Algebraic Notation: F = Pe" Factor Notation: F =P[F/Pin] (F/A): Algebraic Notation: F = 1 0 Factor Notation: F = AF/An (PA): Algebraic Notation: P = A -1) Factor Notation: P = A[P/Ain (P/F): Algebraic Notation: P = Factor Notation: P = FP/F, (A/F): Algebraic Notation: A = F Factor Notation: A = FA/F1,2) (A/P): Algebraic Notation: A =P Factor Notation: A - PLA/P in Continuous Interest Rate Conversion: Effective Annual Interest rate, ine-1 Nominal Interest Rate, r=In(1+1) P Bonds: P /A.cn) + V (P/F of payments per year, cn) Where: P = Purchase price. V = Face value, k of years to maturity, r earned nominal rate Bond contractual rate, Depreciation Methods or Models: In General: D. - B-1-B B = P- D P-Initial Cost - BV B -Book Value at EOY: D-Depreciation for yeart: L- Salvage Value: Straight Line: Sum of Years Digits: Usage: (P-LU D. = Depreciation Life 0,-P-L B, EP-D-P-HOP - -+ 1)) (P-1)+L B=P-D Sinking Fund: D. - (P-1)(A/F ) (F/Pi.t-1) B = P-ED=P-(P-1) (A/Fin) (FALt) Declining Balance: D, (B-1), D. = P(1-2)-1.B. = (1-2)' where a = 1 - Switch to Sit -> B-1 Double Declining Balance: D. = a(B-1). D. =aP(1 - 1)! B=P-ED = P(1 - a) where a = Equivalent Annual Cost of Capital Recovery Plus Return: ECR-(P-)(A/P in)+L(1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts