Question: **Solve Using Excel** Condor Spread (16 points total): A Condor Spread is a trade involving puts with 4 different strike prices and the same maturities.

**Solve Using Excel**

**Solve Using Excel**

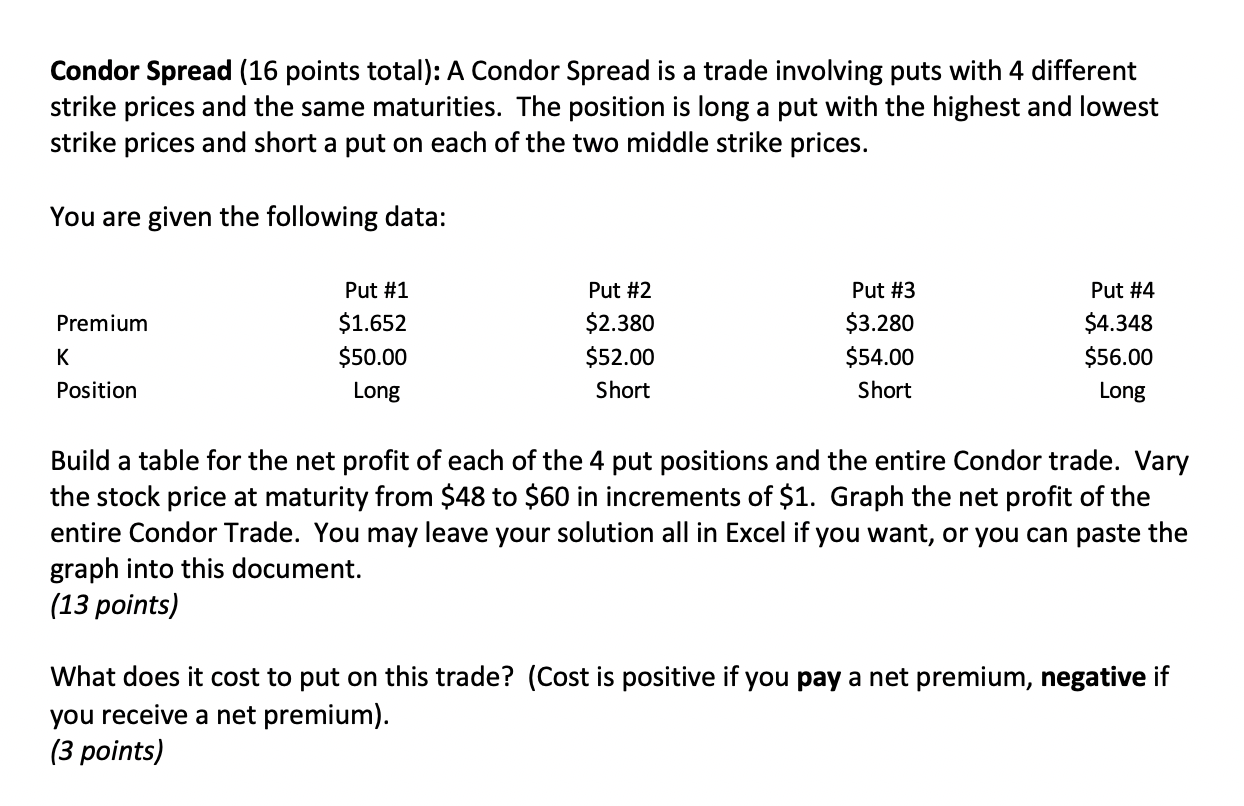

Condor Spread (16 points total): A Condor Spread is a trade involving puts with 4 different strike prices and the same maturities. The position is long a put with the highest and lowest strike prices and short a put on each of the two middle strike prices. You are given the following data: Premium Put #1 $1.652 $50.00 Long Put #2 $2.380 $52.00 Short Put #3 $3.280 $54.00 Short Put #4 $4.348 $56.00 Long K Position Build a table for the net profit of each of the 4 put positions and the entire Condor trade. Vary the stock price at maturity from $48 to $60 in increments of $1. Graph the net profit of the entire Condor Trade. You may leave your solution all in Excel if you want, or you can paste the graph into this document. (13 points) What does it cost to put on this trade? (Cost is positive if you pay a net premium, negative if you receive a net premium). (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts