Question: solve using Excel, please (don't copy from previous) FINAL PART B (TAKE HOME) (30 points) 1. The managers of a company are considering an investment

solve using Excel, please (don't copy from previous)

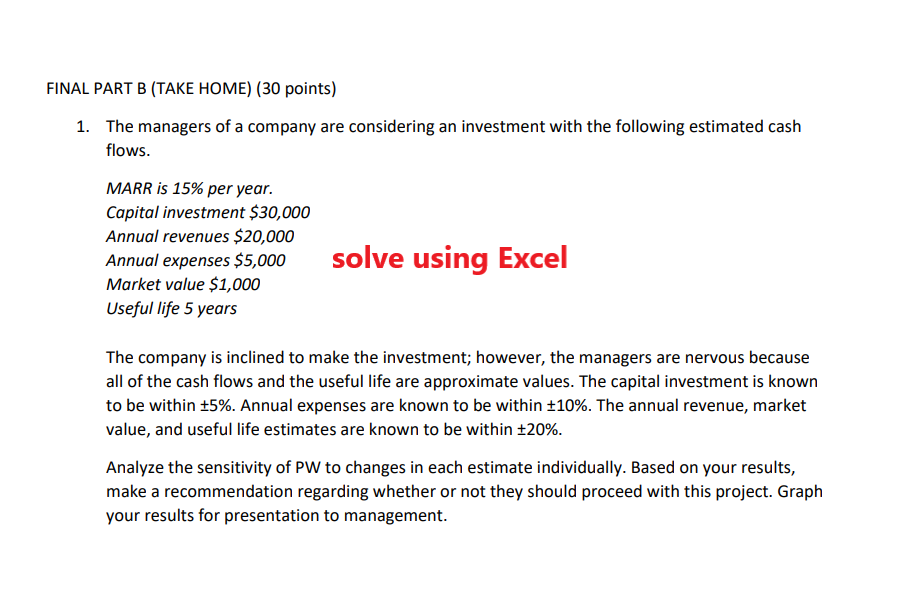

FINAL PART B (TAKE HOME) (30 points) 1. The managers of a company are considering an investment with the following estimated cash flows. MARR is 15% per year. Capital investment $30,000 Annual revenues $20,000 Annual expenses $5,000 Market value $1,000 Useful life 5 years solve using Excel The company is inclined to make the investment; however, the managers are nervous because all of the cash flows and the useful life are approximate values. The capital investment is known to be within 5%. Annual expenses are known to be within +10%. The annual revenue, market value, and useful life estimates are known to be within +20%. Analyze the sensitivity of PW to changes in each estimate individually. Based on your results, make a recommendation regarding whether or not they should proceed with this project. Graph your results for presentation to management

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts