Question: first problem you must use Excel and second problem you may use. FINAL PART B (TAKE HOME) (30 points) 1. The managers of a company

first problem you must use Excel and second problem you may use.

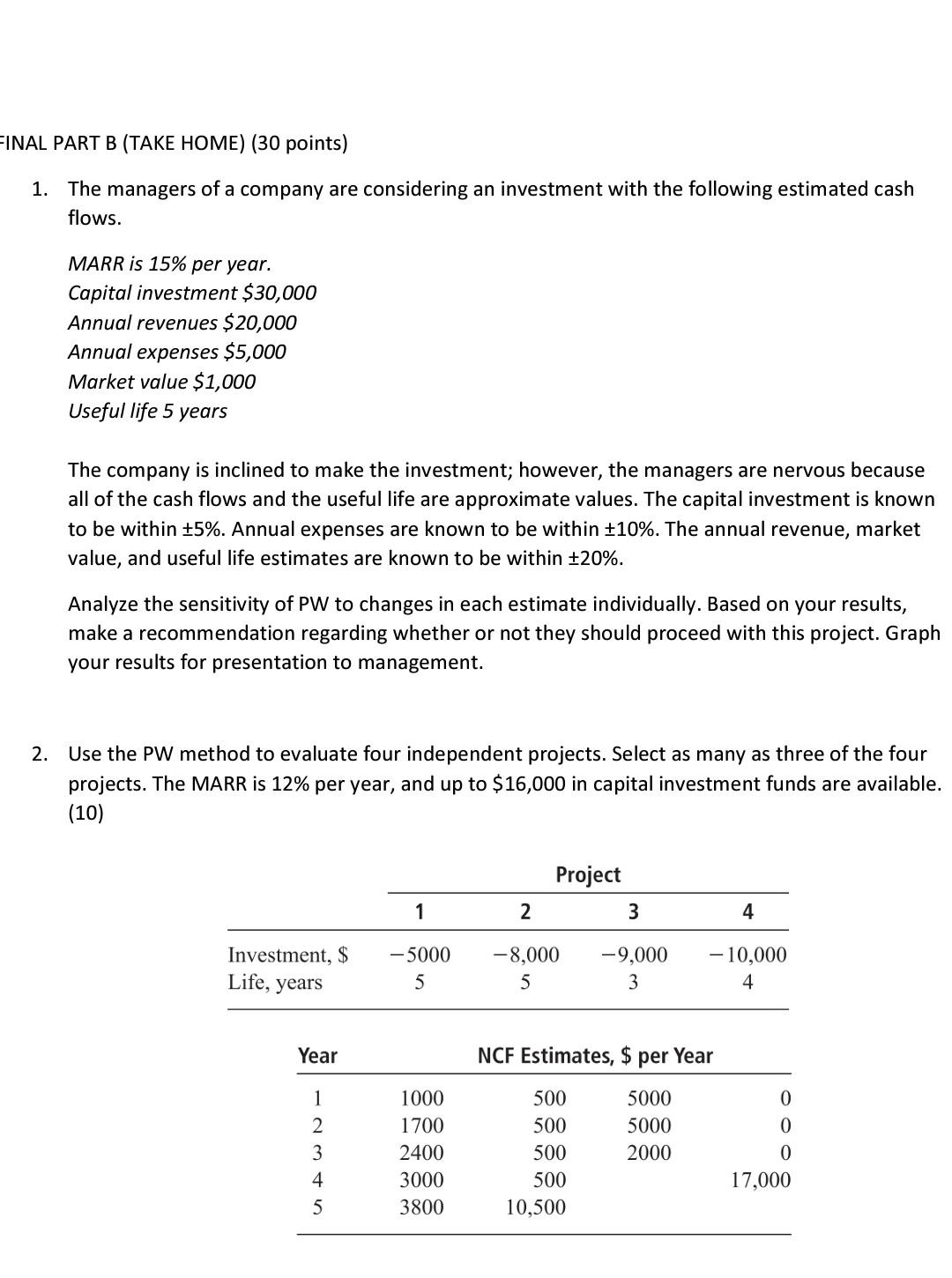

FINAL PART B (TAKE HOME) (30 points) 1. The managers of a company are considering an investment with the following estimated cash flows. MARR is 15% per year. Capital investment $30,000 Annual revenues $20,000 Annual expenses $5,000 Market value $1,000 Useful life 5 years The company is inclined to make the investment; however, the managers are nervous because all of the cash flows and the useful life are approximate values. The capital investment is known to be within +5%. Annual expenses are known to be within +10%. The annual revenue, market value, and useful life estimates are known to be within +20%. Analyze the sensitivity of PW to changes in each estimate individually. Based on your results, make a recommendation regarding whether or not they should proceed with this project. Graph your results for presentation to management. 2. Use the PW method to evaluate four independent projects. Select as many as three of the four projects. The MARR is 12% per year, and up to $16,000 in capital investment funds are available. (10) Project 1 2 3 4 Investment, $ Life, years -5000 5 -8,000 5 -9,000 3 - 10,000 4 Year NCF Estimates, $ per year 0 1 2 3 4 5 1000 1700 2400 3000 3800 500 500 500 500 10,500 5000 5000 2000 0 0 17,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts