Question: solve whole question with explanation Help Save C Cameron Co. established a $166 petty cash fund on January 1, 2020 One week later, on January

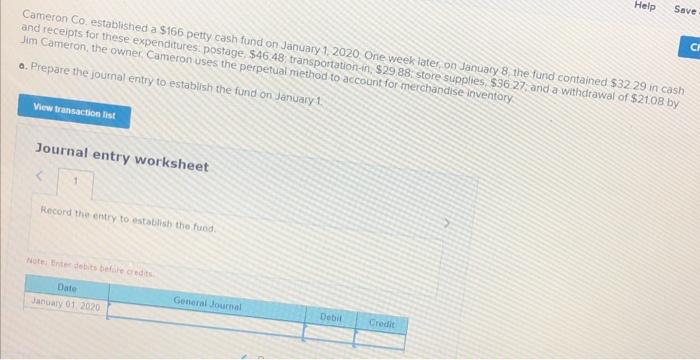

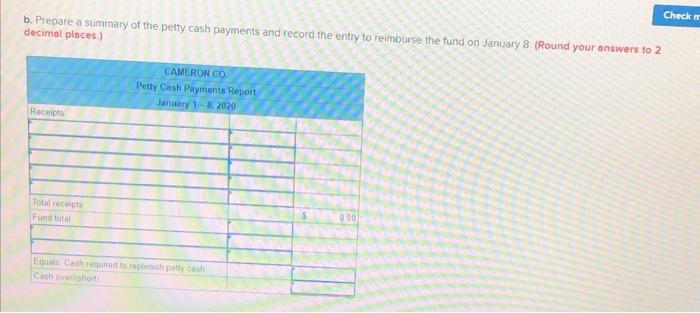

Help Save C Cameron Co. established a $166 petty cash fund on January 1, 2020 One week later, on January 8, the fund contained $32 29 in cash and receipts for these expenditures: postage, $46.48, transportation-in, $29 88, store supplies, $36 27, and a withdrawal of $21.08 by Jim Cameron, the owner, Cameron uses the perpetual method to account for merchandise inventory a. Prepare the journal entry to establish the fund on January 1 View transaction list Journal entry worksheet 1 Record the entry to establish the fund. Note: Enter debits before credits Date Credit January 01, 2020 General Journal Debil Check m b. Prepare a summary of the petty cash payments and record the entry to reimburse the fund on January 8. (Round your answers to 2 decimal places.) CAMERON CO. Petty Cash Payments Report January 1-8, 2020 Receipts 0.00 Total receipts Fund total Equals Cash required to replenish petty cash Cash over short Help Record entry Clear entry View general journal Analysis Component: If the January 8 entry to reimburse the fund were not recorded and financial statements were prepared for the month of January, would profit be over- or understated? OUnderstated OOverstated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts