Question: solve with steps 5. You plan to lease (Begin Mode!!!) a new care today. The dealership's finance office quotes you a deal with no money

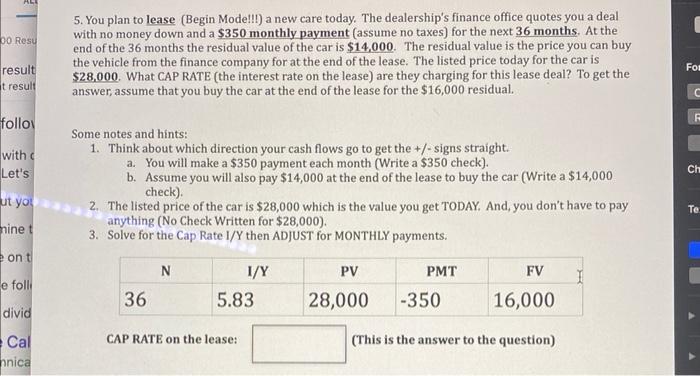

5. You plan to lease (Begin Mode!!!) a new care today. The dealership's finance office quotes you a deal with no money down and a $350 monthly payment (assume no taxes) for the next 36 months. At the end of the 36 months the residual value of the car is $14,000. The residual value is the price you can buy the vehicle from the finance company for at the end of the lease. The listed price today for the car is $28,000. What CAP RATE (the interest rate on the lease) are they charging for this lease deal? To get the answer, assume that you buy the car at the end of the lease for the $16,000 residual. Some notes and hints: 1. Think about which direction your cash flows go to get the +/ signs straight. a. You will make a $350 payment each month (Write a $350 check). b. Assume you will also pay $14,000 at the end of the lease to buy the car (Write a $14,000 check). 2. The listed price of the car is $28,000 which is the value you get TODAY. And, you don't have to pay anything (No Check Written for $28,000 ). 3. Solve for the Cap Rate I/Y then ADJUST for MONTHLY payments. CAP RATE on the lease: (This is the answer to the question)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts