Question: Solve with these numbers in Excel showing how to get those exact correct numbers. Every one I can find on Chegg has a wrong answer.

Solve with these numbers in Excel showing how to get those exact correct numbers. Every one I can find on Chegg has a wrong answer.

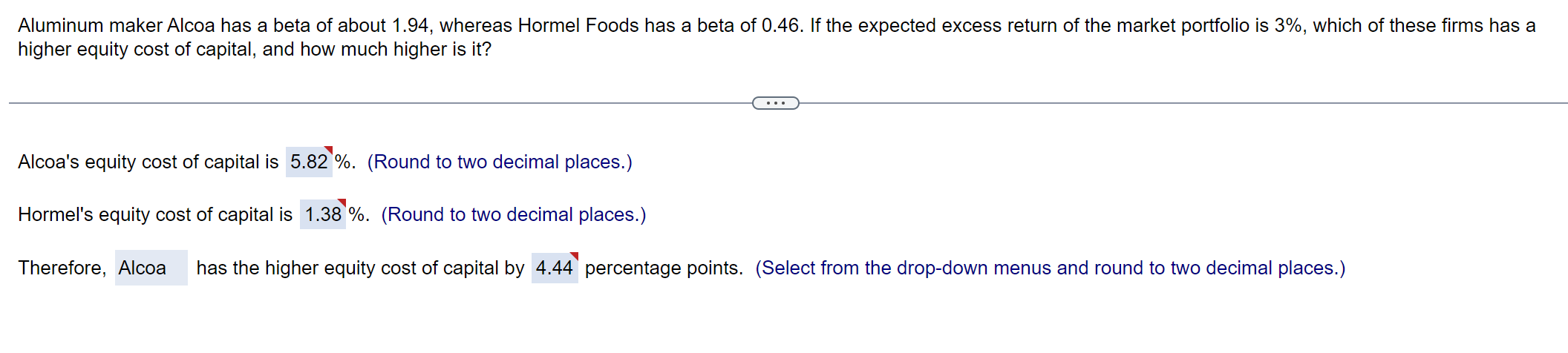

Aluminum maker Alcoa has a beta of about 1.94, whereas Hormel Foods has a beta of 0.46. If the expected excess return of the market portfolio is 3%, which of these firms has a higher equity cost of capital, and how much higher is it? Alcoa's equity cost of capital is j. (Round to two decimal places.) Hormel's equity cost of capital is %. (Round to two decimal places.) Therefore, has the higher equity cost of capital by percentage points. (Select from the drop-down menus and round to two decimal places.) Aluminum maker Alcoa has a beta of about 1.94, whereas Hormel Foods has a beta of 0.46. If the expected excess return of the market portfolio is 3%, which of these firms has a higher equity cost of capital, and how much higher is it? Alcoa's equity cost of capital is j. (Round to two decimal places.) Hormel's equity cost of capital is %. (Round to two decimal places.) Therefore, has the higher equity cost of capital by percentage points. (Select from the drop-down menus and round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts