Question: solve WITHOUT FINANCIAL CALCULATOR OR EXCEL PLEASE 1. Bond Valuation. Assume the following information for an existing bond that provides annual coupon payments: Par value

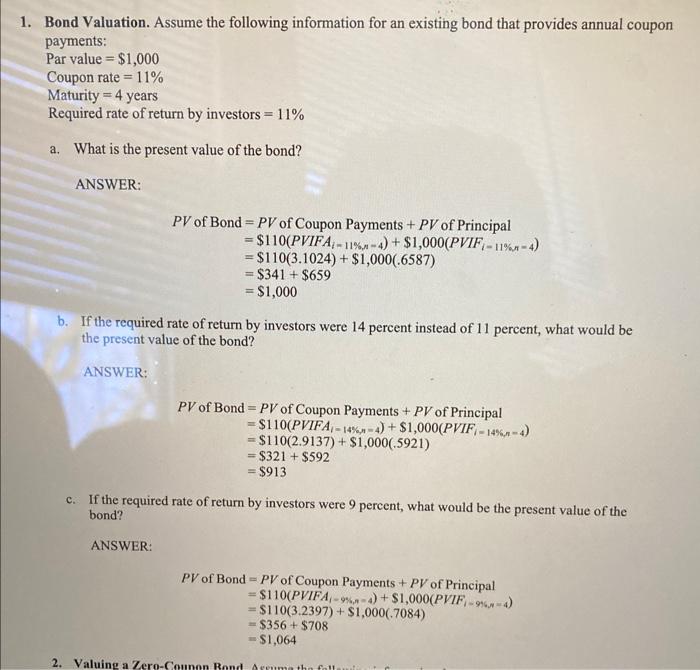

1. Bond Valuation. Assume the following information for an existing bond that provides annual coupon payments: Par value = $1,000 Coupon rate = 11% Maturity = 4 years Required rate of return by investors = 11% a. What is the present value of the bond? ANSWER: - PV of Bond = PV of Coupon Payments + PV of Principal = $110(PVIFA - 11%. 4) + $1,000(PVIF - 11%-4) = $110(3.1024) + $1,000(.6587) -$341 + $659 = $1,000 b. If the required rate of return by investors were 14 percent instead of 11 percent, what would be the present value of the bond? ANSWER: PV of Bond = PV of Coupon Payments + PV of Principal = $110(PVIFA -14% -4)+ $1,000(PVIF - 14%- $110(2.9137) + $1,000(.5921) $321 + $592 = $913 c. If the required rate of return by investors were 9 percent, what would be the present value of the bond? ANSWER: PV of Bond = PV of Coupon Payments + PV of Principal $110(PVIFA-9%-a) +$1,000(PVIF-94.) $110(3.2397) + $1,000(.7084) $356 + $708 $1,064 2. Valuing a Zero-Counan Rand Arrume the foll

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts