Question: solved parts 1-3 already, please answer 4-6 Intro The current level of a broad stock market index is 1,221. Its dividend yield is 2% and

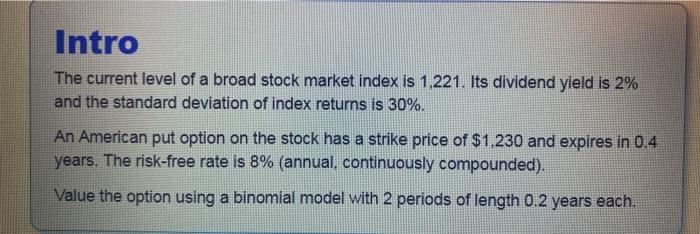

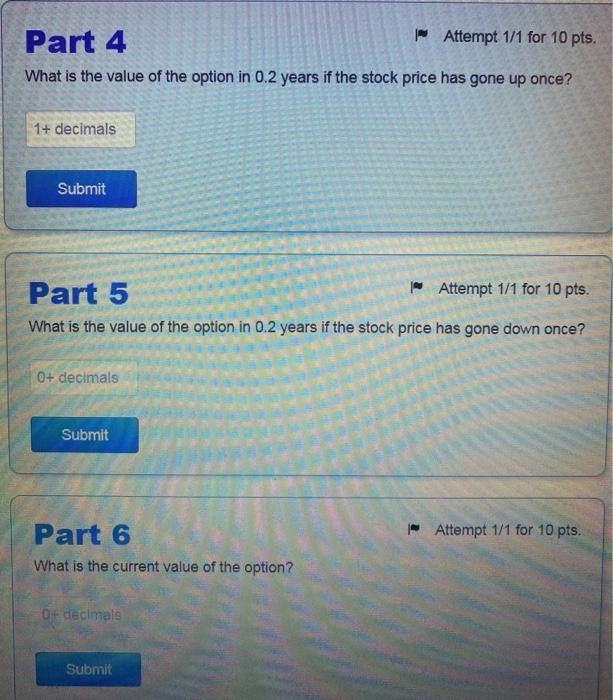

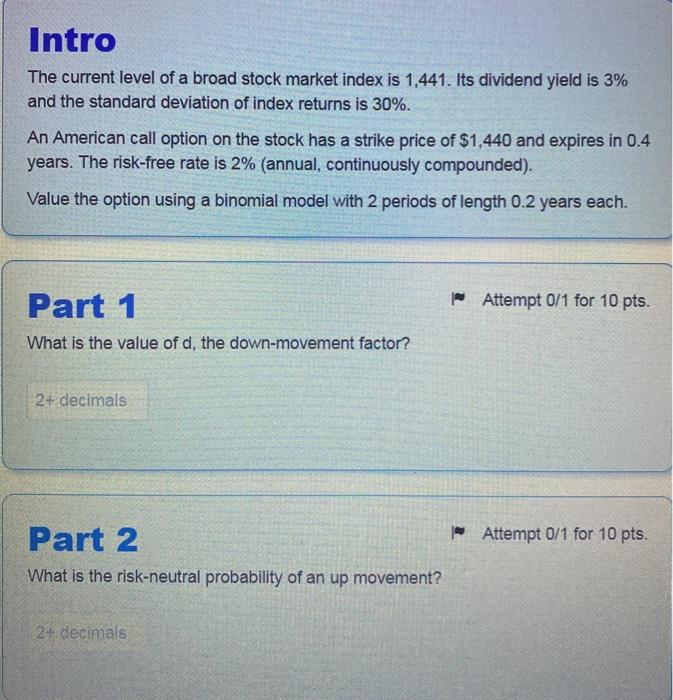

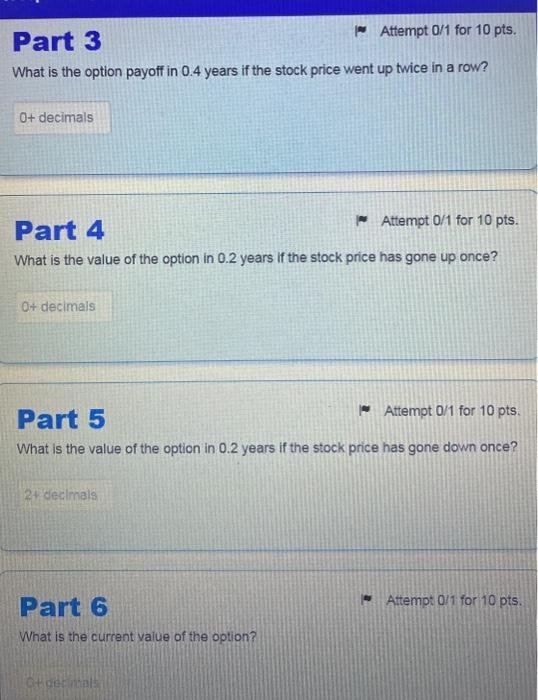

Intro The current level of a broad stock market index is 1,221. Its dividend yield is 2% and the standard deviation of index returns is 30%. An American put option on the stock has a strike price of $1,230 and expires in 0.4 years. The risk-free rate is 8% (annual, continuously compounded). Value the option using a binomial model with 2 periods of length 0.2 years each. Part 4 - Attempt 1/1 for 10 pts. What is the value of the option in 0.2 years if the stock price has gone up once? 1+ decimals Submit Part 5 - Attempt 1/1 for 10 pts. What is the value of the option in 0.2 years if the stock price has gone down once? 0+ decimals Submit Attempt 1/1 for 10 pts. Part 6 What is the current value of the option? 04 decimals Submit Intro The current level of a broad stock market index is 1,441. Its dividend yield is 3% and the standard deviation of index returns is 30%. An American call option on the stock has a strike price of $1,440 and expires in 0.4 years. The risk-free rate is 2% (annual, continuously compounded). Value the option using a binomial model with 2 periods of length 0.2 years each. Attempt 0/1 for 10 pts. Part 1 What is the value of d, the down-movement factor? 2+ decimals Attempt 0/1 for 10 pts. Part 2 What is the risk-neutral probability of an up movement? 2. decimals Part 3 Attempt 0/1 for 10 pts. What is the option payoff in 0.4 years if the stock price went up twice in a row? 0+ decimals Part 4 Attempt 0/1 for 10 pts. What is the value of the option in 0.2 years if the stock price has gone up once? O+ decimals Part 5 Attempt 0/1 for 10 pts. What is the value of the option in 0.2 years if the stock price has gone down once? 21 declinals Attempt 0/1 for 10 pts. Part 6 What is the current value of the option? Chidea Intro The current level of a broad stock market index is 1,221. Its dividend yield is 2% and the standard deviation of index returns is 30%. An American put option on the stock has a strike price of $1,230 and expires in 0.4 years. The risk-free rate is 8% (annual, continuously compounded). Value the option using a binomial model with 2 periods of length 0.2 years each. Part 4 - Attempt 1/1 for 10 pts. What is the value of the option in 0.2 years if the stock price has gone up once? 1+ decimals Submit Part 5 - Attempt 1/1 for 10 pts. What is the value of the option in 0.2 years if the stock price has gone down once? 0+ decimals Submit Attempt 1/1 for 10 pts. Part 6 What is the current value of the option? 04 decimals Submit Intro The current level of a broad stock market index is 1,441. Its dividend yield is 3% and the standard deviation of index returns is 30%. An American call option on the stock has a strike price of $1,440 and expires in 0.4 years. The risk-free rate is 2% (annual, continuously compounded). Value the option using a binomial model with 2 periods of length 0.2 years each. Attempt 0/1 for 10 pts. Part 1 What is the value of d, the down-movement factor? 2+ decimals Attempt 0/1 for 10 pts. Part 2 What is the risk-neutral probability of an up movement? 2. decimals Part 3 Attempt 0/1 for 10 pts. What is the option payoff in 0.4 years if the stock price went up twice in a row? 0+ decimals Part 4 Attempt 0/1 for 10 pts. What is the value of the option in 0.2 years if the stock price has gone up once? O+ decimals Part 5 Attempt 0/1 for 10 pts. What is the value of the option in 0.2 years if the stock price has gone down once? 21 declinals Attempt 0/1 for 10 pts. Part 6 What is the current value of the option? Chidea

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts