Question: solving by using Dynamic programming SPARK City: Capacity Expansion. King Salman Energy Park (SPARK) is being developed to capture the full economic value from energy-related

solving by using Dynamic programming

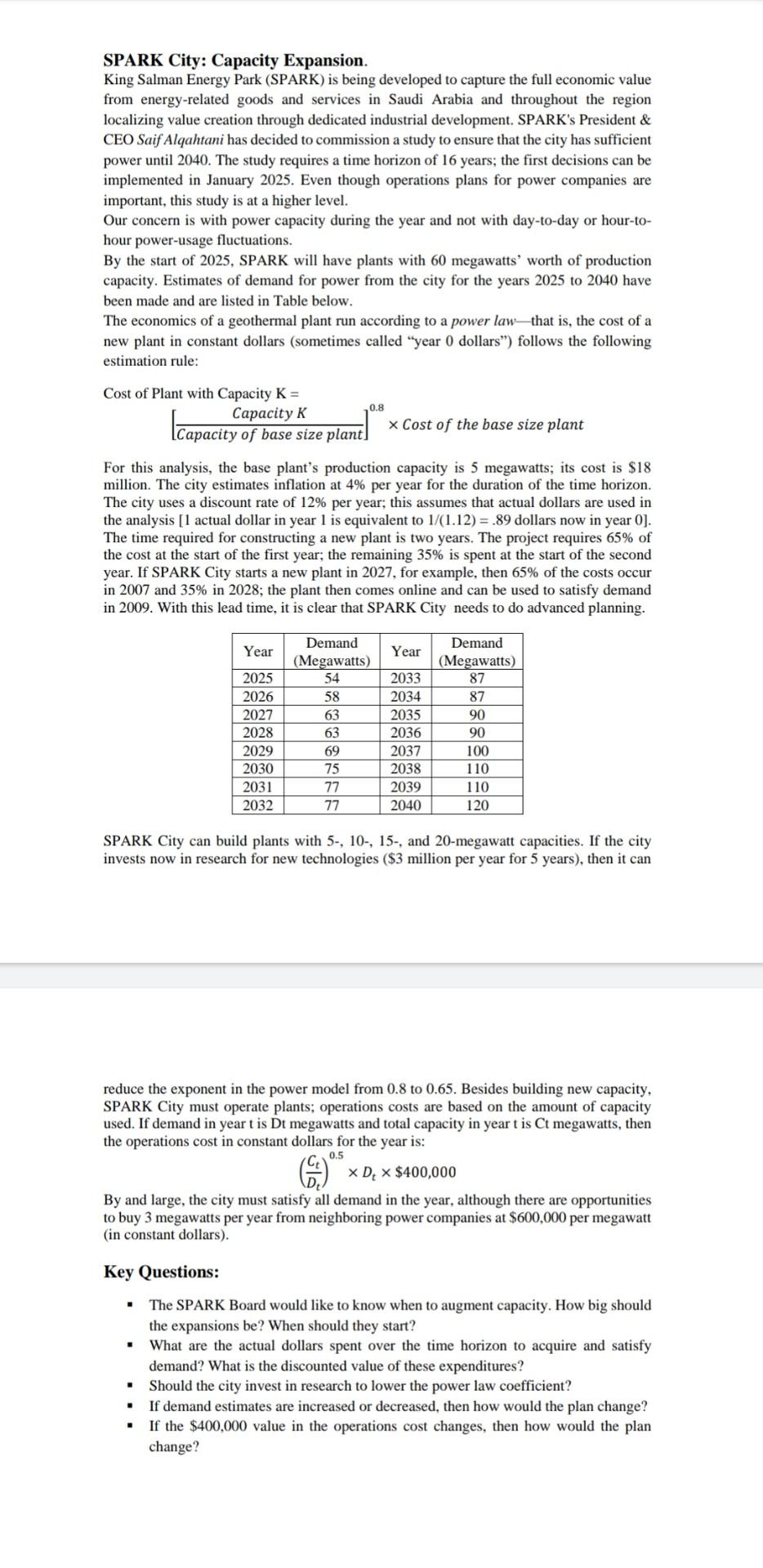

SPARK City: Capacity Expansion. King Salman Energy Park (SPARK) is being developed to capture the full economic value from energy-related goods and services in Saudi Arabia and throughout the region localizing value creation through dedicated industrial development. SPARK's President & CEO Saif Alqahtani has decided to commission a study to ensure that the city has sufficient power until 2040. The study requires a time horizon of 16 years; the first decisions can be implemented in January 2025. Even though operations plans for power companies are important, this study is at a higher level. Our concern is with power capacity during the year and not with day-to-day or hour-to- hour power-usage fluctuations. By the start of 2025, SPARK will have plants with 60 megawatts' worth of production capacity. Estimates of demand for power from the city for the years 2025 to 2040 have been made and are listed in Table below. The economics of a geothermal plant run according to a power law-that is, the cost of a new plant in constant dollars (sometimes called "year 0 dollars) follows the following estimation rule: 0.8 Cost of Plant with Capacity K = Capacity K x Cost of the base size plant Capacity of base size plant] For this analysis, the base plant's production capacity is 5 megawatts; its cost is $18 million. The city estimates inflation at 4% per year for the duration of the time horizon. The city uses a discount rate of 12% per year; this assumes that actual dollars are used in the analysis (1 actual dollar in year 1 is equivalent to 1/(1.12) = .89 dollars now in year 0]. The time required for constructing a new plant is two years. The project requires 65% of the cost at the start of the first year; the remaining 35% is spent at the start of the second year. If SPARK City starts a new plant in 2027, for example, then 65% of the costs occur in 2007 and 35% in 2028; the plant then comes online and can be used to satisfy demand in 2009. With this lead time, it is clear that SPARK City needs to do advanced planning. Year Year 2025 2026 2027 2028 2029 2030 2031 2032 Demand (Megawatts) 54 58 63 63 69 75 77 77 2033 2034 2035 2036 2037 2038 2039 2040 Demand (Megawatts) 87 87 90 90 100 110 110 120 SPARK City can build plants with 5-, 10-, 15-, and 20-megawatt capacities. If the city invests now in research for new technologies ($3 million per year for 5 years), then it can 0.5 reduce the exponent in the power model from 0.8 to 0.65. Besides building new capacity, SPARK City must operate plants; operations costs are based on the amount of capacity used. If demand in year t is Dt megawatts and total capacity in yeart is Ct megawatts, then the operations cost in constant dollars for the year is: xD, $400,000 By and large, the city must satisfy all demand in the year, although there are opportunities to buy 3 megawatts per year from neighboring power companies at $600,000 per megawatt (in constant dollars). Key Questions: The SPARK Board would like to know when to augment capacity. How big should the expansions be? When should they start? What are the actual dollars spent over the time horizon to acquire and satisfy demand? What is the discounted value of these expenditures? Should the city invest in research to lower the power law coefficient? If demand estimates are increased or decreased, then how would the plan change? If the $400,000 value in the operations cost changes, then how would the plan change? SPARK City: Capacity Expansion. King Salman Energy Park (SPARK) is being developed to capture the full economic value from energy-related goods and services in Saudi Arabia and throughout the region localizing value creation through dedicated industrial development. SPARK's President & CEO Saif Alqahtani has decided to commission a study to ensure that the city has sufficient power until 2040. The study requires a time horizon of 16 years; the first decisions can be implemented in January 2025. Even though operations plans for power companies are important, this study is at a higher level. Our concern is with power capacity during the year and not with day-to-day or hour-to- hour power-usage fluctuations. By the start of 2025, SPARK will have plants with 60 megawatts' worth of production capacity. Estimates of demand for power from the city for the years 2025 to 2040 have been made and are listed in Table below. The economics of a geothermal plant run according to a power law-that is, the cost of a new plant in constant dollars (sometimes called "year 0 dollars) follows the following estimation rule: 0.8 Cost of Plant with Capacity K = Capacity K x Cost of the base size plant Capacity of base size plant] For this analysis, the base plant's production capacity is 5 megawatts; its cost is $18 million. The city estimates inflation at 4% per year for the duration of the time horizon. The city uses a discount rate of 12% per year; this assumes that actual dollars are used in the analysis (1 actual dollar in year 1 is equivalent to 1/(1.12) = .89 dollars now in year 0]. The time required for constructing a new plant is two years. The project requires 65% of the cost at the start of the first year; the remaining 35% is spent at the start of the second year. If SPARK City starts a new plant in 2027, for example, then 65% of the costs occur in 2007 and 35% in 2028; the plant then comes online and can be used to satisfy demand in 2009. With this lead time, it is clear that SPARK City needs to do advanced planning. Year Year 2025 2026 2027 2028 2029 2030 2031 2032 Demand (Megawatts) 54 58 63 63 69 75 77 77 2033 2034 2035 2036 2037 2038 2039 2040 Demand (Megawatts) 87 87 90 90 100 110 110 120 SPARK City can build plants with 5-, 10-, 15-, and 20-megawatt capacities. If the city invests now in research for new technologies ($3 million per year for 5 years), then it can 0.5 reduce the exponent in the power model from 0.8 to 0.65. Besides building new capacity, SPARK City must operate plants; operations costs are based on the amount of capacity used. If demand in year t is Dt megawatts and total capacity in yeart is Ct megawatts, then the operations cost in constant dollars for the year is: xD, $400,000 By and large, the city must satisfy all demand in the year, although there are opportunities to buy 3 megawatts per year from neighboring power companies at $600,000 per megawatt (in constant dollars). Key Questions: The SPARK Board would like to know when to augment capacity. How big should the expansions be? When should they start? What are the actual dollars spent over the time horizon to acquire and satisfy demand? What is the discounted value of these expenditures? Should the city invest in research to lower the power law coefficient? If demand estimates are increased or decreased, then how would the plan change? If the $400,000 value in the operations cost changes, then how would the plan changeStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock