Question: Solving for part B (Blank Part) Exercise H-7 (Part Level Submission) At December 31, 2019, the trading debt securities for Sheridan, Inc. are as follows

Solving for part B (Blank Part)

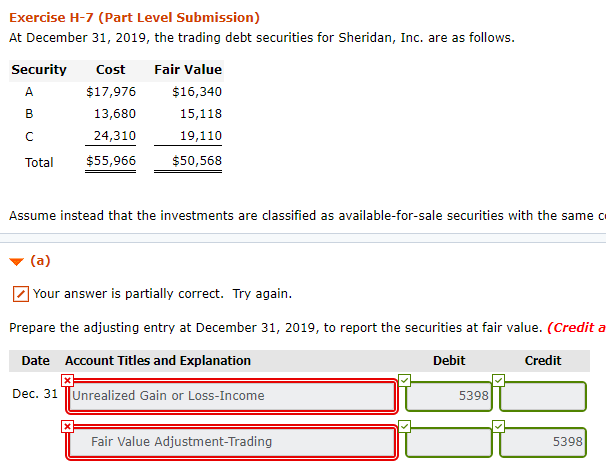

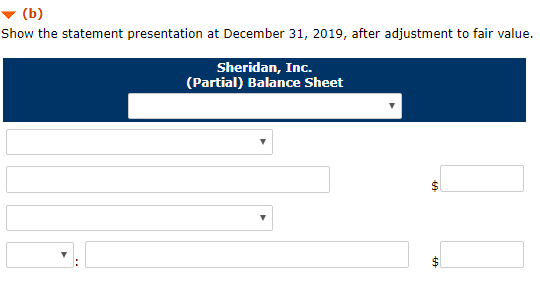

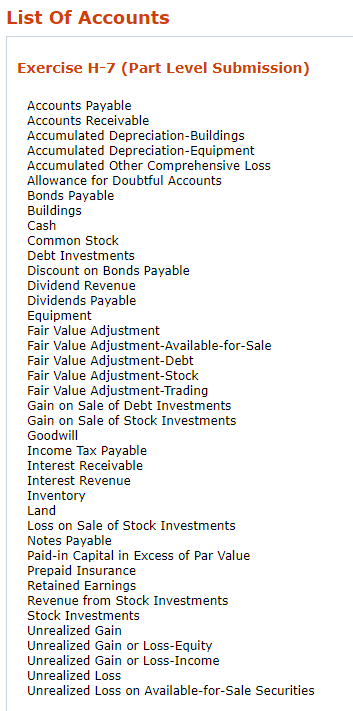

Exercise H-7 (Part Level Submission) At December 31, 2019, the trading debt securities for Sheridan, Inc. are as follows Security Cost Fair Value $16,340 15,118 19,110 $50,568 $17,976 13,680 24,310 $55,966 Total Assume instead that the investments are classified as available-for-sale securities with the same c Your answer is partially correct. Try again Prepare the adjusting entry at December 31, 2019, to report the securities at fair value. (Credit a Date Account Titles and Explanation Debit Credit Dec. 31 Unrealized Gain or Loss-Inco 5398 Fair Value Adjustment-Trading 5398 Show the statement presentation at December 31, 2019, after adjustment to fair value. Sheridan, Inc. (Partial) Balance Sheet List Of Accounts Exercise H-7 (Part Level Submission) Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Accumulated Other Comprehensive Loss Allowance for Doubtful Accounts Bonds Payable Buildings Cash Common Stock Debt Investments Discount on Bonds Payable Dividend Revenue Dividends Payable Equipment Fair Value Adjustment Fair Value Adjustment-Available-for-Sale Fair Value Adjustment-Debt Fair Value Adjustment-Stock Fair Value Adjustment-Trading Gain on Sale of Debt Investments Gain on Sale of Stock Investments Goodwill Income Tax Payable Interest Receivable Interest Revenue Inventory Land Loss on Sale of Stock Investments Notes Payable Paid-in Capital in Excess of Par Value Prepaid Insurance Retained Earnings Revenue from Stock Investments Stock Investments Unrealized Gain Unrealized Gain or Loss-Equity Unrealized Gain or Loss-Income Unrealized Loss Unrealized Loss on Available-for-Sale Securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts