Question: Solving Style Contract Tracing Set A As a contractor for a construction project you are responsible for planning, coordinating, and controlling the entire construction project.

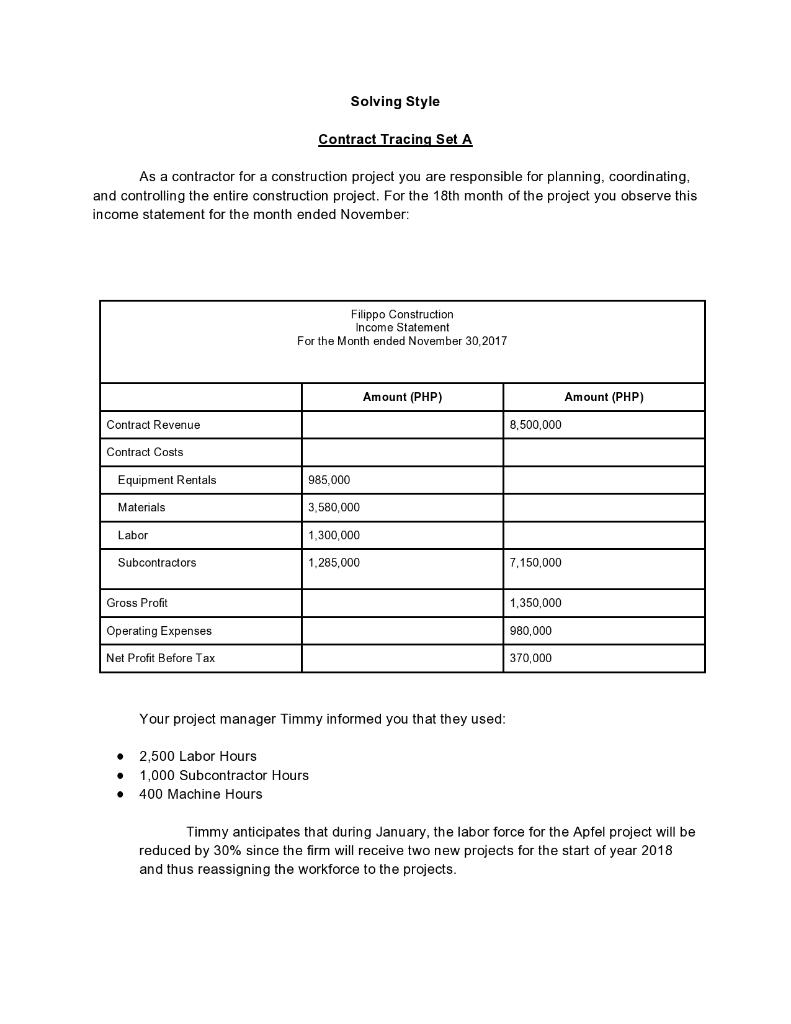

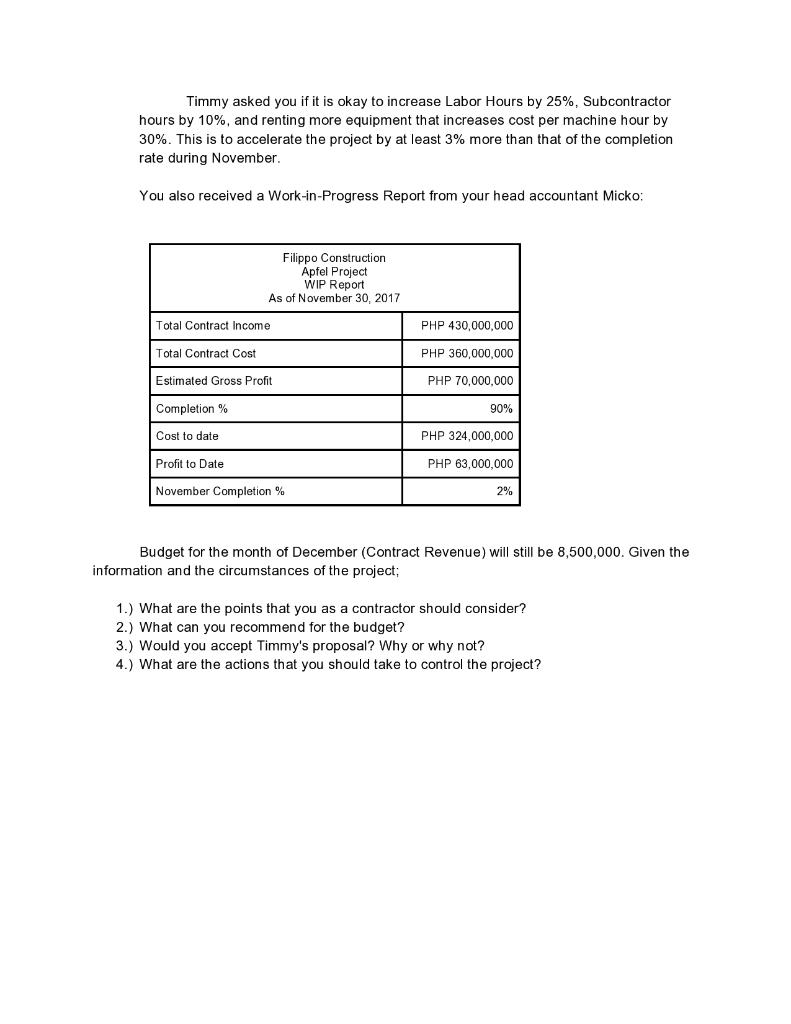

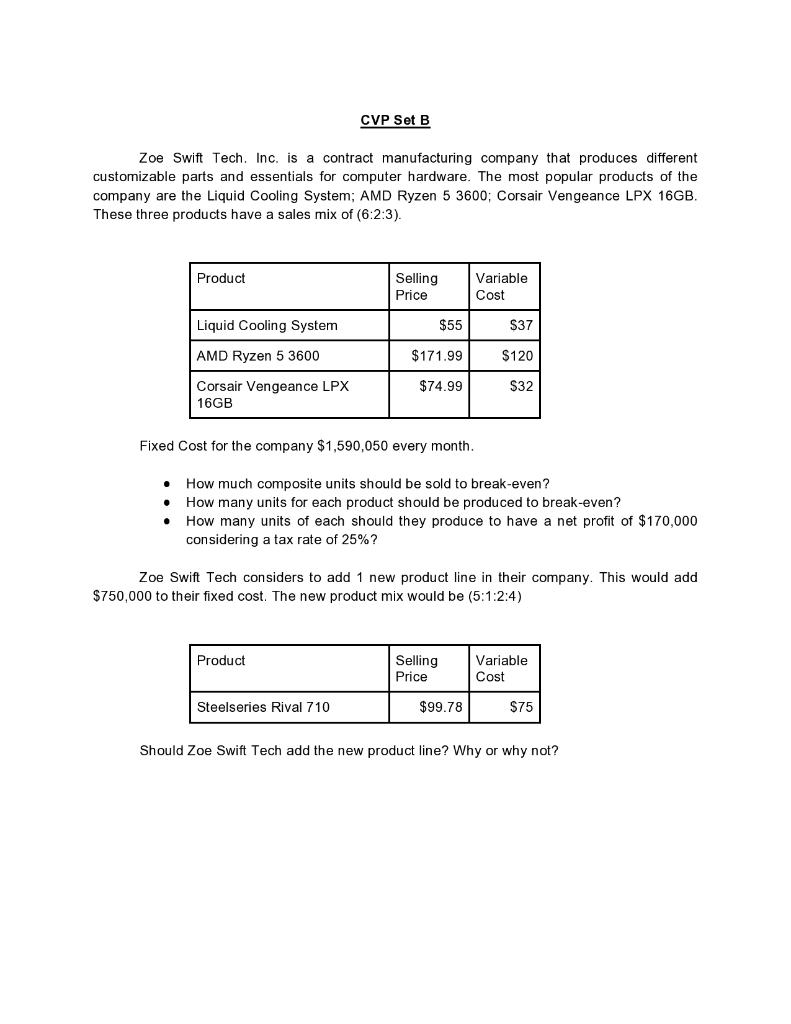

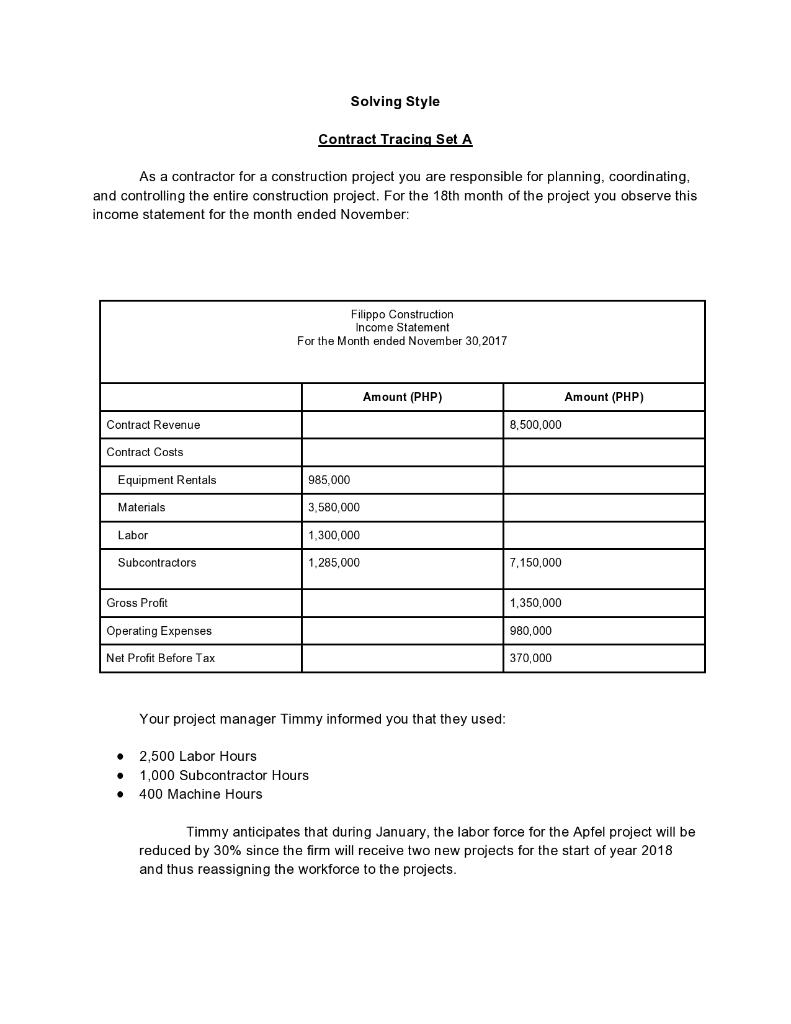

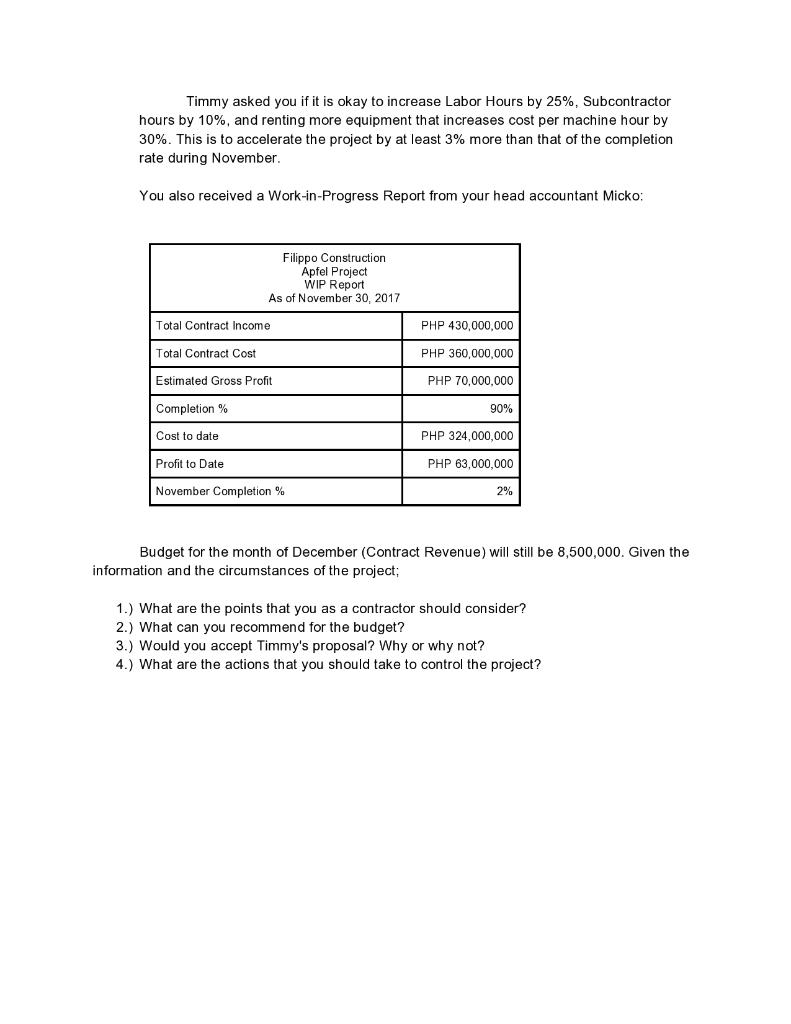

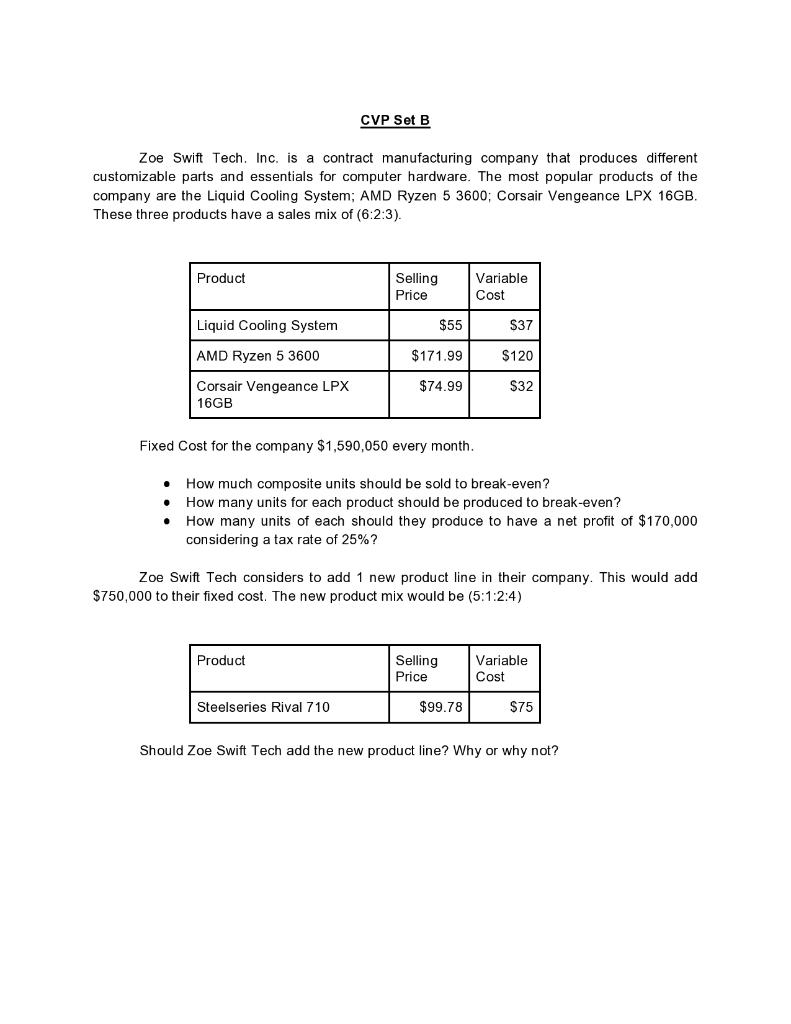

Solving Style Contract Tracing Set A As a contractor for a construction project you are responsible for planning, coordinating, and controlling the entire construction project. For the 18th month of the project you observe this income statement for the month ended November: Filippo Construction Income Statement For the Month ended November 30, 2017 Amount (PHP) Amount (PHP) Contract Revenue 8,500,000 Contract Costs Equipment Rentals 985,000 Materials 3,580,000 Labor 1,300,000 Subcontractors 1,285,000 7,150,000 Gross Profit 1,350,000 Operating Expenses 980,000 Net Profit Before Tax 370,000 Your project manager Timmy informed you that they used: 2,500 Labor Hours 1,000 Subcontractor Hours . 400 Machine Hours Timmy anticipates that during January, the labor force for the Apfel project will be reduced by 30% since the firm will receive two new projects for the start of year 2018 and thus reassigning the workforce to the projects. Timmy asked you if it is okay to increase Labor Hours by 25%, Subcontractor hours by 10%, and renting more equipment that increases cost per machine hour by 30%. This is to accelerate the project by at least 3% more than that of the completion rate during November You also received a Work-in-Progress Report from your head accountant Micko: Filippo Construction Apfel Project WIP Report As of November 30, 2017 Total Contract Income PHP 430,000,000 Total Contract Cost PHP 360,000,000 Estimated Gross Profit PHP 70,000,000 Completion% 90% Cost to date PHP 324,000,000 Profit to Date PHP 63,000,000 November Completion% 2% Budget for the month of December (Contract Revenue) will still be 8,500,000. Given the information and the circumstances of the project; 1.) What are the points that you as a contractor should consider? 2.) What can you recommend for the budget? 3.) Would you accept Timmy's proposal? Why or why not? 4.) What are the actions that you should take to control the project? CVP Set B Zoe Swift Tech, Inc. is a contract manufacturing company that produces different customizable parts and essentials for computer hardware. The most popular products of the company are the Liquid Cooling System; AMD Ryzen 5 3600; Corsair Vengeance LPX 16GB. These three products have a sales mix of (6:2:3). Product Selling Price Variable Cost Liquid Cooling System $55 $37 AMD Ryzen 5 3600 $171.99 $120 $74.99 $32 Corsair Vengeance LPX 16GB Fixed Cost for the company $1,590,050 every month. . How much composite units should be sold to break-even? How many units for each product should be produced to break-even? How many units of each should they produce to have a net profit of $170,000 considering a tax rate of 25%? Zoe Swift Tech considers to add 1 new product line in their company. This would add $750,000 to their fixed cost. The new product mix would be (5:1:2:4) Product Selling Price Variable Cost Steelseries Rival 710 $99.78 $75 Should Zoe Swift Tech add the new product line? Why or why not