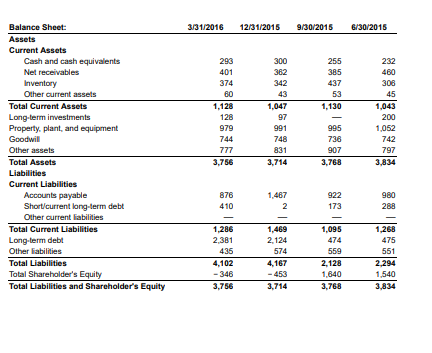

Question: Some balance sheet information is shown here LOADING... (all values in millions of dollars). a. What change in the book value of the company's equity

Some balance sheet information is shown here

LOADING...

(all values in millions of dollars).

a. What change in the book value of the company's equity took place at the end of

2015?

b. Is the company's market-to-book ratio meaningful? Is its book debt-equity ratio meaningful? Explain.

c. Find the company's other financial statements from that time online. What was the cause of the change to its book value of equity at the end of

2015?

d. Does the company's book value of equity in

2016

imply that it is unprofitable? Explain.

.

a. What change in the book value of the company's equity took place at the end of

2015?

The book value of equity

by

$nothing

billion from the end of the previous year, and was

positive

negative

. (Select from the drop-down menus and round to three decimal places.)

b. Is the company's market-to-book ratio meaningful? Is its book debt-equity ratio meaningful? Explain.(Select all the choices that apply.)

A.

Because the book value of equity is negative in this case, the company's market debt-equity ratio may be used in comparison.

B.

Because the book value of equity is negative in this case, the company's market-to-book ratio and its book debt-equity ratio are not meaningful.

C.

Because the book value of equity is positive in this case, the company's market-to-book ratio and its book debt-equity ratio are not meaningful.

D.

Because the book value of equity is positive in this case, the company's market debt-equity ratio may be used in comparison.

c. Find the company's other financial statements from that time online. What was the cause of the change to its book value of equity at the end of

2015?

(Select all the choices that apply.)

A.Information from the statement of cash flows helped explain that the decrease of book value of equity resulted from an decrease in debt that was used to repurchase

$2.093

billion worth of the firm's shares.

B.Information from the statement of cash flows helped explain that the increase of book value of equity resulted from an decrease in debt that was used to repurchase

$2.093

billion worth of the firm's shares.

C.Information from the statement of cash flows helped explain that the increase of book value of equity resulted from an increase in debt that was used to repurchase

$2.093

billion worth of the firm's shares.

D.Information from the statement of cash flows helped explain that the decrease of book value of equity resulted from an increase in debt that was used to repurchase

$2.093

billion worth of the firm's shares.

d. Does the company's book value of equity in

2016

imply that it is unprofitable? Explain.(Select all the choices that apply.)

A.

Negative book value of equity does not necessarily mean the firm is unprofitable.

B.

If a firm borrows to repurchase shares or invest in intangible assets (such as R&D), it can have a negative book value of equity.

C.

Negative book value of equity means the firm will most likely file for bankruptcy.

D.

Negative book value of equity means the firm is unprofitable.

3/31/2016 12/31/2015 9/30/2015 6/30/2015 255 385 437 53 1,130 Balance Sheet: Assets Current Assets Cash and cash equivalents Net receivables Inventory Other current assets Total Current Assets Long-term investments Property, plant, and equipment Goodwill Other assets Total Assets Liabilities Current Liabilities Accounts payable Short/current long-term debt Other current abilities Total Current Liabilities Long-term debt Other abilities Total Liabilities Total Shareholder's Equity Total Liabilities and Shareholder's Equity 293 401 374 60 1,128 128 979 744 777 3,756 300 362 342 43 1,047 97 991 748 831 3,714 232 460 306 45 1,043 200 1,052 742 797 3,834 995 736 907 3,768 876 410 1,467 2 922 173 980 288 1.286 2,381 435 4,102 - 346 3,756 1,469 2.124 574 4.167 - 453 3,714 1,095 474 559 2.128 1,640 3,768 1,268 475 551 2,294 1.540 3,834

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts