Question: Some help and explanation will be great Question 7 4 points Save Answer (4 points) Assume perfect capital markets (assumptions of Modigliani & Miller without

Some help and explanation will be great

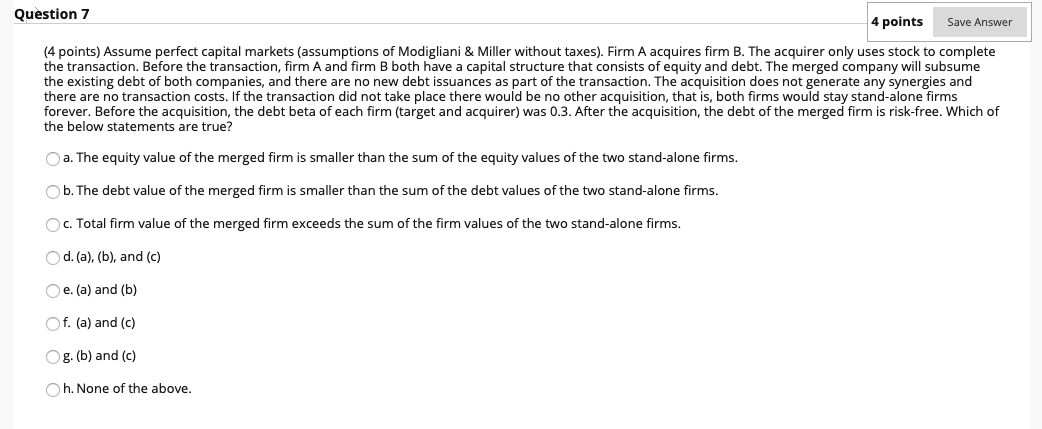

Question 7 4 points Save Answer (4 points) Assume perfect capital markets (assumptions of Modigliani & Miller without taxes). Firm A acquires firm B. The acquirer only uses stock to complete the transaction. Before the transaction, firm A and firm B both have a capital structure that consists of equity and debt. The merged company will subsume the existing debt of both companies, and there are no new debt issuances as part of the transaction. The acquisition does not generate any synergies and there are no transaction costs. If the transaction did not take place there would be no other acquisition, that is, both firms would stay stand-alone firms forever. Before the acquisition, the debt beta of each firm (target and acquirer) was 0.3. After the acquisition, the debt of the merged firm is risk-free. Which of the below statements are true? a. The equity value of the merged firm is smaller than the sum of the equity values of the two stand-alone firms. Ob. The debt value of the merged firm is smaller than the sum of the debt values of the two stand-alone firms. c. Total firm value of the merged firm exceeds the sum of the firm values of the two stand-alone firms. d. (a), (b), and (c) e. (a) and (b) Of. (a) and (c) Og. (b) and (c) h. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts