Question: Some information is provided below about five different investment funds, each investing in a different portfolio of assets. The funds are based in the United

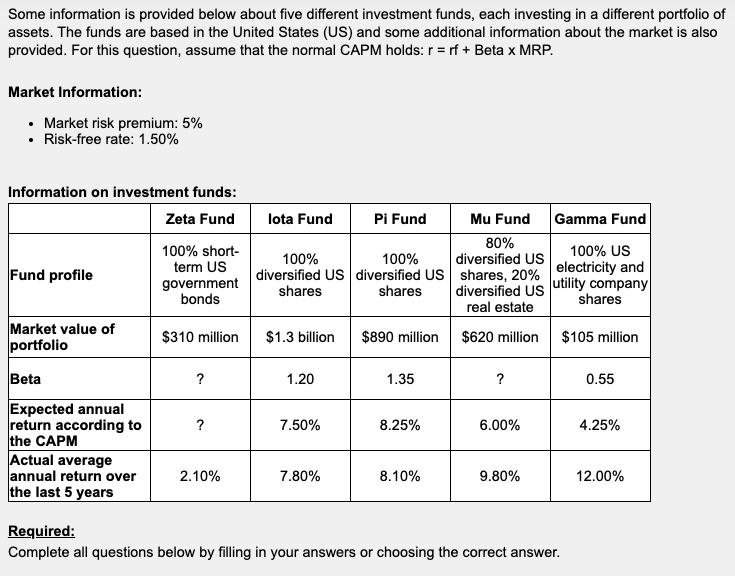

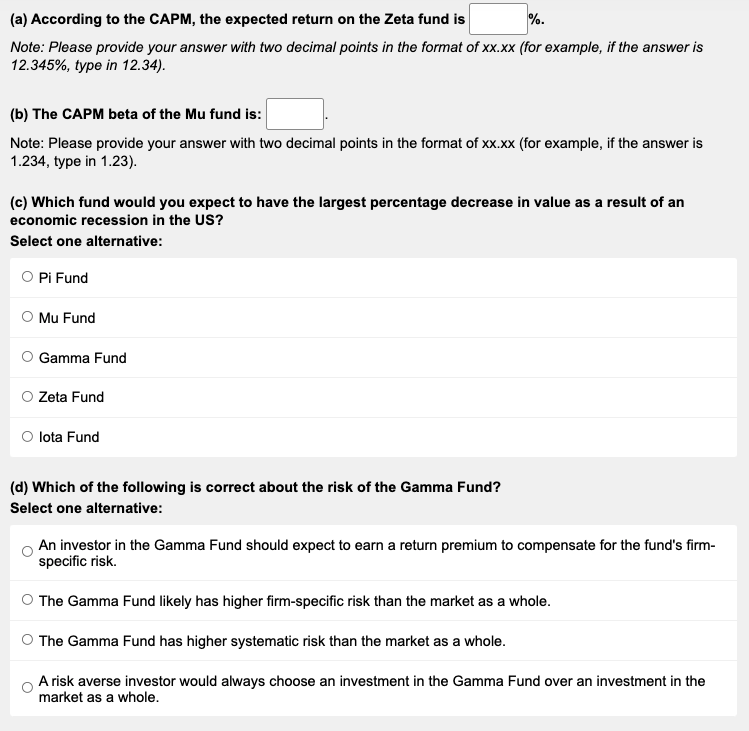

Some information is provided below about five different investment funds, each investing in a different portfolio of assets. The funds are based in the United States (US) and some additional information about the market is also provided. For this question, assume that the normal CAPM holds: r = rf + Beta x MRP. Market Information: Market risk premium: 5% Risk-free rate: 1.50% Information on investment funds: Zeta Fund 100% short- Fund profile term US government bonds lota Fund Pi Fund Mu Fund Gamma Fund 80% 100% US 100% 100% diversified US diversified US diversified US shares, 20% electricity and shares shares diversified US utility company shares real estate $1.3 billion $890 million $620 million $105 million Market value of portfolio $310 million Beta ? 1.20 1.35 ? 0.55 ? 7.50% 8.25% 6.00% 4.25% Expected annual return according to the CAPM Actual average annual return over the last 5 years 2.10% 7.80% 8.10% 9.80% 12.00% Required: Complete all questions below by filling in your answers or choosing the correct answer. (a) According to the CAPM, the expected return on the Zeta fund is %. Note: Please provide your answer with two decimal points in the format of xx.xx (for example, if the answer is 12.345%, type in 12.34). (b) The CAPM beta of the Mu fund is: Note: Please provide your answer with two decimal points in the format of xx.xx (for example, if the answer is 1.234, type in 1.23). (c) Which fund would you expect to have the largest percentage decrease in value as a result of an economic recession in the US? Select one alternative: O Pi Fund O Mu Fund Gamma Fund Zeta Fund O lota Fund (d) Which of the following is correct about the risk of the Gamma Fund? Select one alternative: An investor in the Gamma Fund should expect to earn a return premium to compensate for the fund's firm- specific risk. The Gamma Fund likely has higher firm-specific risk than the market as a whole. The Gamma Fund has higher systematic risk than the market as a whole. A risk averse investor would always choose an investment in the Gamma Fund over an investment in the market as a whole

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts