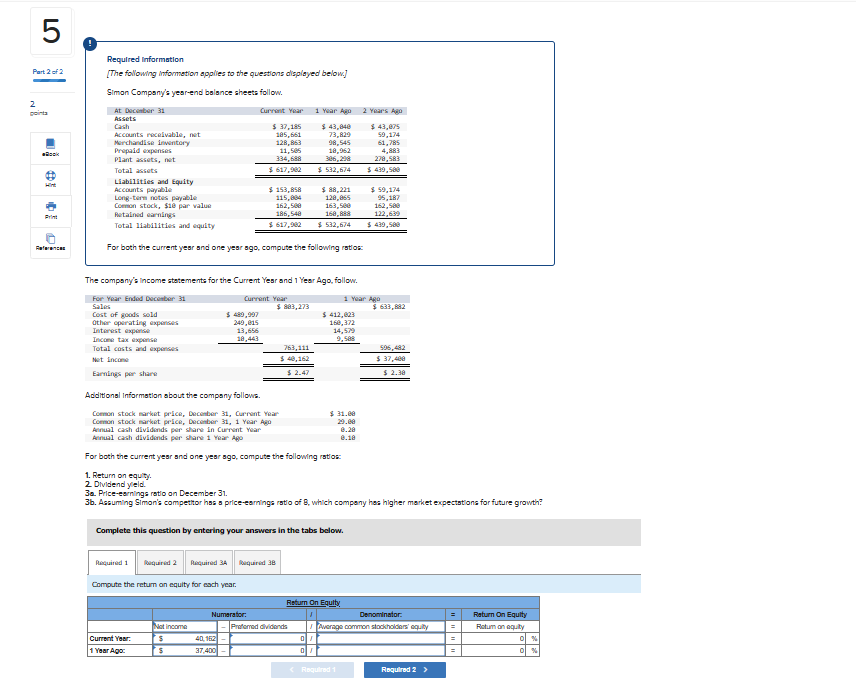

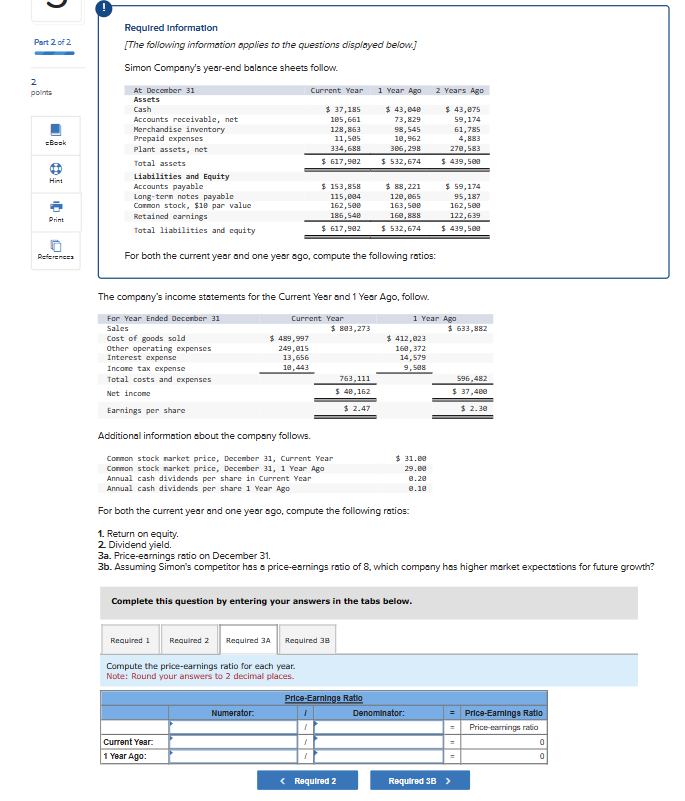

Question: Someone please help. I am stuggling hard!!! Required Information [The following information applies to the questions displayed below.] Siman Compony's year-end bolance sheets follow. For

![applies to the questions displayed below.] Siman Compony's year-end bolance sheets follow.](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f929511fe45_07266f92950932e8.jpg)

Someone please help. I am stuggling hard!!!

Required Information [The following information applies to the questions displayed below.] Siman Compony's year-end bolance sheets follow. For both the current year snd one year sgo, compute the following ration: The compony's income statements for the Current Year and 1 Year Ago, follow. Additionsl Information about the company follows. For both the current year and one year sog, compute the following ration: 1. Return on equity. 2 Drvidend yleid. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has s price-earnings ratio of B, which company has higher market expectstions for future growth? Complete this question by entering your answers in the tabs below. Compute the retum on equity for each vear. Required Information [The following information opplies to the questions displayed below.] Simon Compony's year-end bolance sheets follow. For both the current year and one year ago, compute the following rotios: The company's income statements for the Current Year and 1 Year Ago, follow. For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2 Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings rotio of 8 , which company hos higher market expectotions for future growth? Complete this question by entering your answers in the tabs below. Compute the price-earnings ratio for each year. Note: Round your answers to 2 decimal places. Required Information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. For both the current year and one year ago, compute the following ratios: The company's Income statements for the Current Year and 1 Year Ago, follow. Additional Information about the company follows. For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yleid. 3a. Price-earnings ratlo on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of g, which company has higher market expectatlons for future growth? Complete this question by entering your answers in the tabs below. Compute the dividend yield for each year. Nate: Round your answers to 2 decimal places. Required Information [The following information applies to the questions displayed below.] Siman Compony's year-end bolance sheets follow. For both the current year snd one year sgo, compute the following ration: The compony's income statements for the Current Year and 1 Year Ago, follow. Additionsl Information about the company follows. For both the current year and one year sog, compute the following ration: 1. Return on equity. 2 Drvidend yleid. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has s price-earnings ratio of B, which company has higher market expectstions for future growth? Complete this question by entering your answers in the tabs below. Compute the retum on equity for each vear. Required Information [The following information opplies to the questions displayed below.] Simon Compony's year-end bolance sheets follow. For both the current year and one year ago, compute the following rotios: The company's income statements for the Current Year and 1 Year Ago, follow. For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2 Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings rotio of 8 , which company hos higher market expectotions for future growth? Complete this question by entering your answers in the tabs below. Compute the price-earnings ratio for each year. Note: Round your answers to 2 decimal places. Required Information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. For both the current year and one year ago, compute the following ratios: The company's Income statements for the Current Year and 1 Year Ago, follow. Additional Information about the company follows. For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yleid. 3a. Price-earnings ratlo on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of g, which company has higher market expectatlons for future growth? Complete this question by entering your answers in the tabs below. Compute the dividend yield for each year. Nate: Round your answers to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts