Question: SOMEONE PLEASE HELP ME MY TEACHER WANTS THE ANSWERS IN 10 minutes On January 1, 20x1 of the current year, Barber Company issues for $505.000

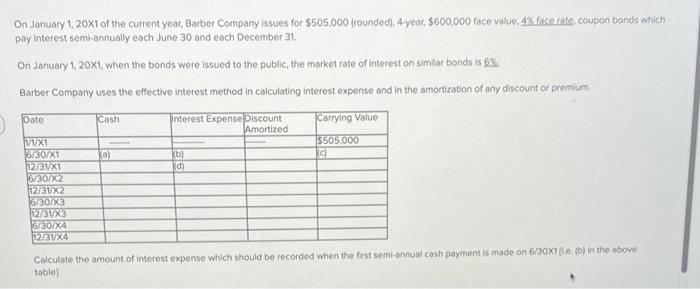

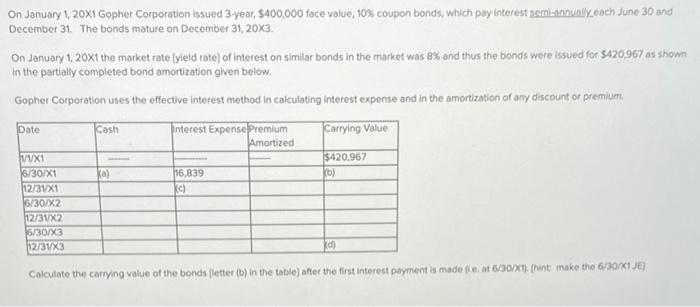

On January 1, 20x1 of the current year, Barber Company issues for $505.000 frounded), 4 year, $600,000 face value, 45 facere, coupon bonds which pay interest semi-annually each June 30 and each December 31, On January 1, 20x1, when the bonds were issued to the public, the market rate of interest on similar bonds (8 6% Barber Company uses the effective interest method in calculating interest expense and in the amortization of any discount or premium Date Cash Interest Expense piscount Amortized Carrying Value $505,000 c a ale [b] d V1X1 6/30/X1 12731x1 6/30/X2 12/31/X2 6/30/X3 12/31X3 6/30/X4 12/31X4 Calculate the amount of interest expense which should be recorded when the first semi-annual cash payment is made on 6/30X1(b) in the above table) On January 1, 20X1 Gopher Corporation issued 3-year, $400,000 face value, 10% coupon bonds, which pay interest semi-annualy.eoch Juno 30 and December 31. The bonds mature on December 31, 20X3. On January 1, 20x1 the market rate lyield rote) of interest on similar bonds in the market was 8% and thus the bonds were issued for $420,967 as shown In the partially completed bond amortization given below. Gopher Corporation uses the effective interest method in calculating Interest expense and in the amortization of any discount or premium Date Cash interest Expense Premium Amortized Carrying Value $420,967 (b) a) 16,839 (c) 11/X1 6/30/X1 12/31X1 6/30/X2 12/31X2 6/30/X3 12/31X3 Calculate the carrying value of the bonds letter (b) in the table) after the first interest payment is made it 6/30/Xt): (hint make the 6/30/X1JE)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts