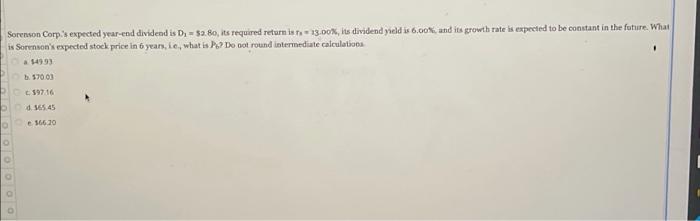

Question: Sorenson Corp.'s expected year-end dividend is D. - $2.80, its required return is, - 13.00, its dividend yield is 6.00, and its growth rate is

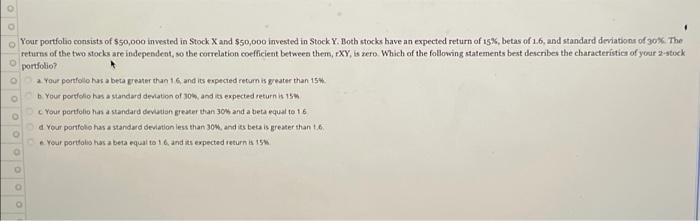

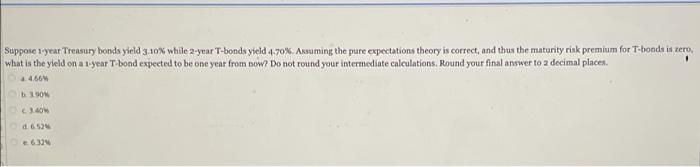

Sorenson Corp.'s expected year-end dividend is D. - $2.80, its required return is, - 13.00, its dividend yield is 6.00, and its growth rate is expected to be constant in the future. What is Sorenson's expected stock price in 6 years, ie, what is Do not round intermediate calculation 54999 57001 59716 1.365.45 16620 OOOOOO OOO OOO Your portfolio consists of $50,000 invested in Stock X and $50,000 invested in Stock Y. Both stocks have an expected return of 15%, betas of 1.6, and standard deviation of 30%. The returns of the two stocks are independent, so the correlation coefficient between them, EXY, is zero Which of the following statements best describes the characteristics of your 2-stock portfolio? 2. Your portfolio has a beta greater than 16 and its expected return is greater than 15% b. Your portfolio has a standard deviation of 30, and is expected return 115 Your portfolio is a standard devotion greater than 30% and a beta equal to 16 a Your portfolio has a standard deviation less than 30%, and its beta is greater than to Your portfolio has a beta equal to 16, and its expected return a 15% Suppose 1-year Treasury bonda yield 3.10% while 2-year T-bonds yield 4.70%. Assuming the pure expectations theory is correct, and thus the maturity risk premium for T-bonds is zero what is the yield on a 1-year T-bond expected to be one year from now? Do not round your intermediate calculations. Round your final answer to a decimal places. 4.66 SON 30 63

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts