Question: ( Sorenson Corp.'s expected year-end dividend is D = $2.90, its required return is rs = 9.00%, its dividend yield is 6.00%, and its growth

( Sorenson Corp.'s expected year-end dividend is D = $2.90, its required return is rs = 9.00%, its dividend yield is 6.00%, and its growth rate is expected to be constant in the future. What is Sorenson's expected stock price in 7 years, i.e., what is P7? Do not round intermediate calculations. a. $57.71 b. $49.78 c. $59.44 d. $88.36 Oe. $72.68

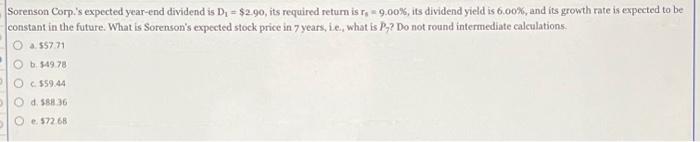

Sorenson Corp.'s expected year-end dividend is D1=$2.90, its required return is r5=9.00%, its dividend yield is 6.00%, and its growth rate is expected to be constant in the future. What is Sorenson's expected stock price in 7 years, ie, what is P7 ? Do not round intermediate calculations. a. 557.71 b. $4978 C. $59.44 d. 58sin e. 57268

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock