Question: sorry cancel for this question, i will post again :) Required a. Rearrange these data into classified balance sheets. b. Find the missing Retained Earnings

sorry cancel for this question, i will post again :)

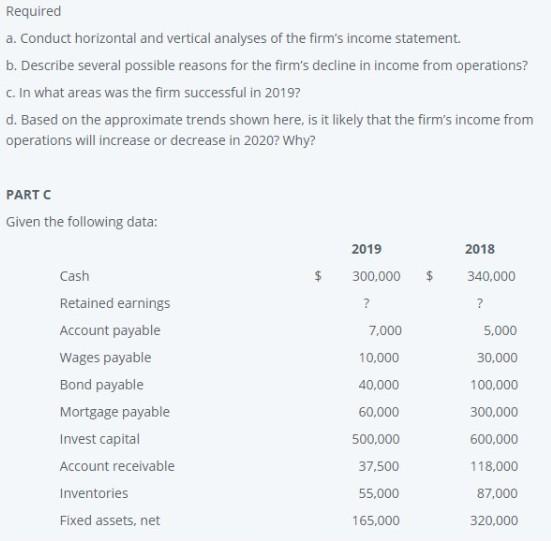

Required a. Rearrange these data into classified balance sheets. b. Find the missing Retained Earnings amounts necessary to balance each balance sheet. C. Evaluate the firm's liquidity, using the ratios described in this chapter. d. Calculate the firm's asset management and debt management ratios. Evaluate the results. TOTAL SCORE: 100 Stud No Name contribution Required a. Conduct horizontal and vertical analyses of the firm's income statement b. Describe several possible reasons for the firm's decline in income from operations? c. In what areas was the firm successful in 2019? d. Based on the approximate trends shown here, is it likely that the firm's income from operations will increase or decrease in 2020? Why? PARTC Given the following data: 2019 2018 $ $ 340,000 300,000 ? ? 5,000 30,000 100,000 Cash Retained earnings Account payable Wages payable Bond payable Mortgage payable Invest capital Account receivable Inventories Fixed assets, net 7,000 10,000 40,000 60,000 500,000 37,500 300,000 600,000 118,000 55,000 87,000 165,000 320,000 Required a. Rearrange these data into classified balance sheets. b. Find the missing Retained Earnings amounts necessary to balance each balance sheet. C. Evaluate the firm's liquidity, using the ratios described in this chapter. d. Calculate the firm's asset management and debt management ratios. Evaluate the results. TOTAL SCORE: 100 Stud No Name contribution Required a. Conduct horizontal and vertical analyses of the firm's income statement b. Describe several possible reasons for the firm's decline in income from operations? c. In what areas was the firm successful in 2019? d. Based on the approximate trends shown here, is it likely that the firm's income from operations will increase or decrease in 2020? Why? PARTC Given the following data: 2019 2018 $ $ 340,000 300,000 ? ? 5,000 30,000 100,000 Cash Retained earnings Account payable Wages payable Bond payable Mortgage payable Invest capital Account receivable Inventories Fixed assets, net 7,000 10,000 40,000 60,000 500,000 37,500 300,000 600,000 118,000 55,000 87,000 165,000 320,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts