Question: sorry to occupy your time, please help me do this question and please step by step so I can understand A capital investment project will

sorry to occupy your time, please help me do this question and please step by step so I can understand

sorry to occupy your time, please help me do this question and please step by step so I can understand

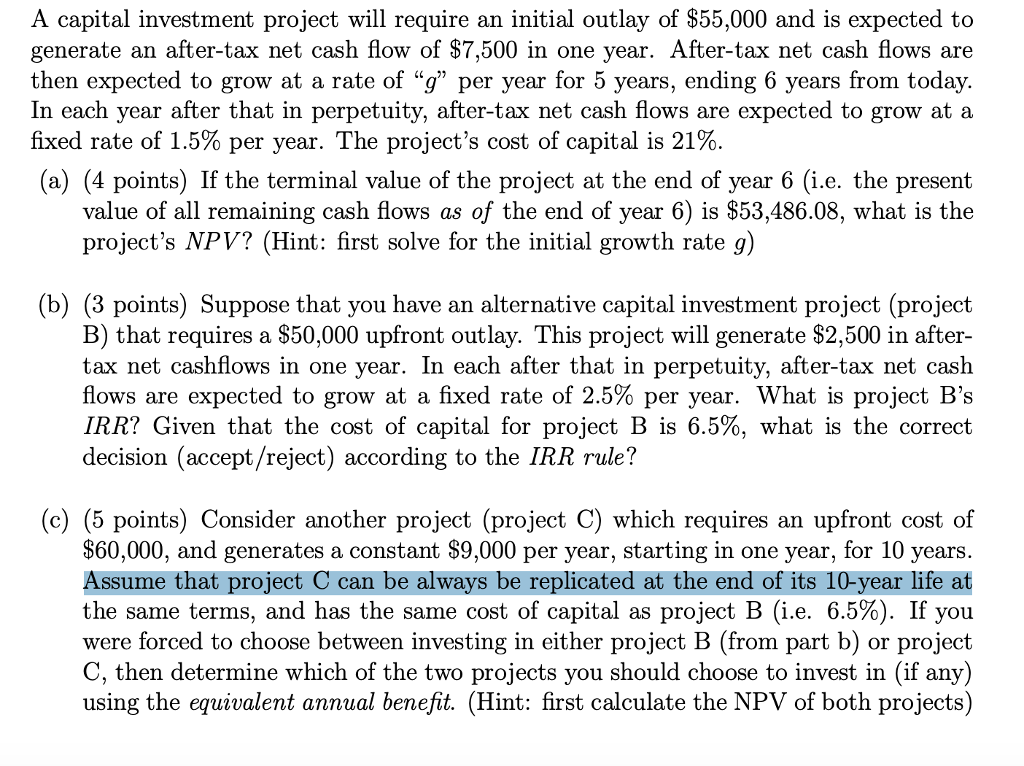

A capital investment project will require an initial outlay of $55,000 and is expected to generate an after-tax net cash flow of $7,500 in one year. After-tax net cash flows are then expected to grow at a rate of "g" per year for 5 years, ending 6 years from today In each year after that in perpetuity, after-tax net cash flows are expected to grow at a fixed rate of 1.5% per year. The project's cost of capital is 21%. (a) (4 points) If the terminal value of the project at the end of year 6 (i.e. the present value of all remaining cash flows as of the end of year 6) is $53,486.08, what is the project's NPV? (Hint: first solve for the initial growth rate g) (b) (3 points) Suppose that you have an alternative capital investment project (project B) that requires a $50,000 upfront outlay. This project will generate $2,500 in after- tax net cashflows in one year. In each after that in perpetuity, after-tax net cash flows are expected to grow at a fixed rate of 2.5% per year, what is project B's IRR? Given that the cost of capital for project B is 6.5%, what is the correct decision (accept/reject) according to the IRR rule1? (c) (5 points) Consider another project (project C) which requires an upfront cost of $60,000, and generates a constant S9,000 per year, starting in one year, for 10 years. Assume that project C can be always be replicated at the end of its 10-year life at the same terms, and has the same cost of capital as project B (ie, 6.5%). If you were forced to choose between investing in either project B (from part b) or project C, then determine which of the two projects you should choose to invest in (if any) using the equivalent annual benefit. (Hint: first calculate the NPV of both projects)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts