Question: SOS test tomorrow, very lost will someone please help me out and explain/ show work so I know what to do? Styles Question: Acme makes

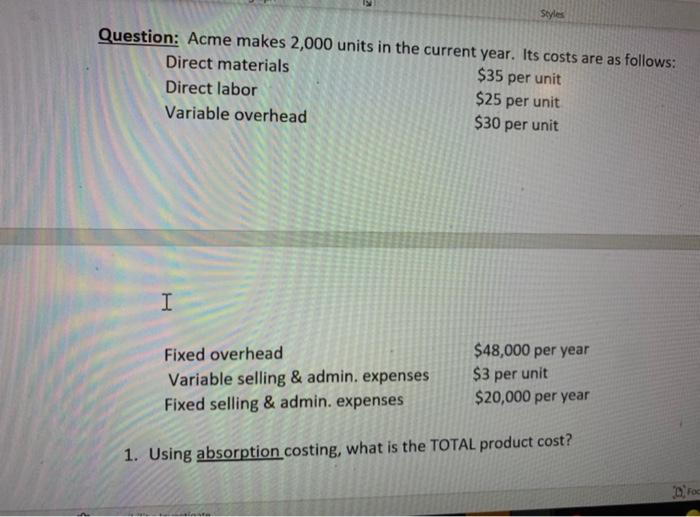

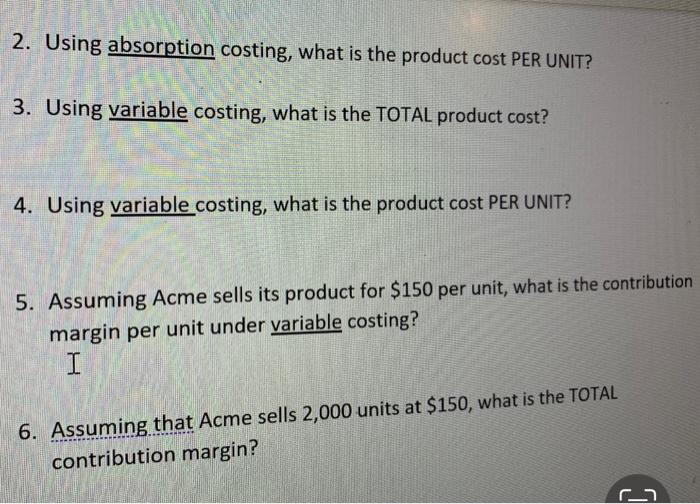

Styles Question: Acme makes 2,000 units in the current year. Its costs are as follows: Direct materials $35 per unit Direct labor $25 per unit Variable overhead $30 per unit I Fixed overhead Variable selling & admin. expenses Fixed selling & admin. expenses $48,000 per year $3 per unit $20,000 per year 1. Using absorption costing, what is the TOTAL product cost? Drop 2. Using absorption costing, what is the product cost PER UNIT? 3. Using variable costing, what is the TOTAL product cost? 4. Using variable costing, what is the product cost PER UNIT? 5. Assuming Acme sells its product for $150 per unit, what is the contribution margin per unit under variable costing? I 6. Assuming that Acme sells 2,000 units at $150, what is the TOTAL contribution margin? r_

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts