Question: Spartan Sofas, Inc. is selling for $50.00 per share today. In one year, Spartan will be selling for $48.00 per share, and the dividend for

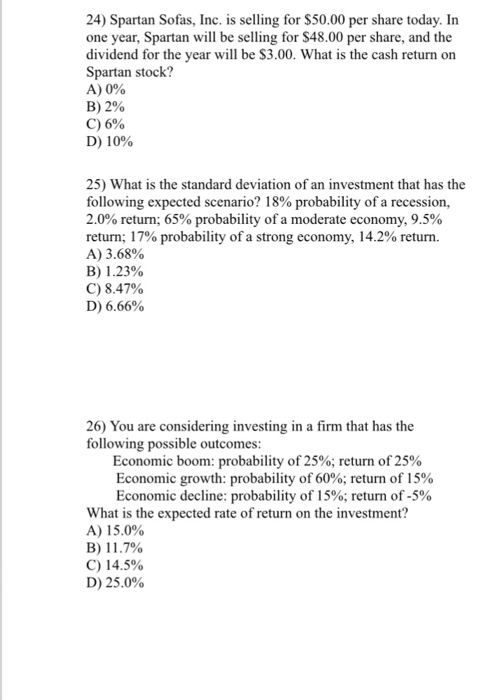

Spartan Sofas, Inc. is selling for $50.00 per share today. In one year, Spartan will be selling for $48.00 per share, and the dividend for the year will be $3.00. What is the cash return on Spartan stock? 0% 2% 6% 10% What is the standard deviation of an investment that has the following expected scenario? 18% probability of a recession, 2.0% return; 65% probability of a moderate economy, 9.5% return; 17% probability of a strong economy, l4.2% return. 3.68% 1.23% 8.47% 6.66% You are considering investing in a firm that has the following possible outcomes: Economic boom: probability of 25% return of 25% Economic growth: probability of 60%; return of 15% Economic decline: probability of 15%; return of -5% What is the expected rate of return on the investment? 15.0% 11.7% 14.5% 25.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts