Question: Spindler, Incorporated ( a U . S . - based company ) , imports surfboards from a supplier in Brazil and sells them in the

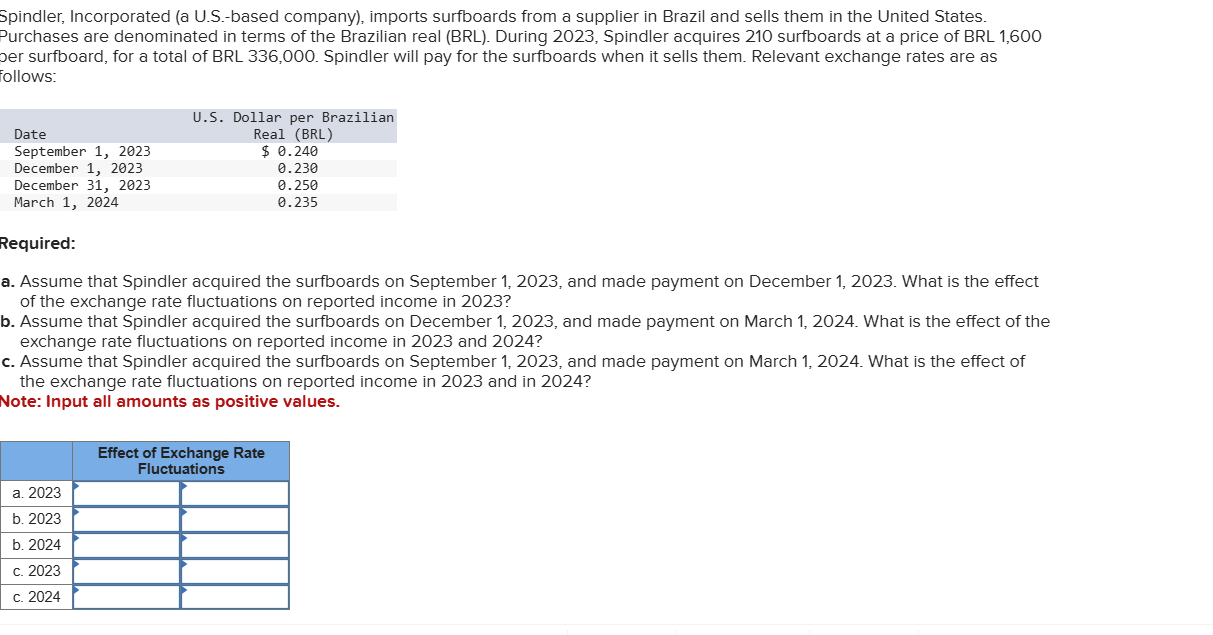

Spindler, Incorporated a USbased company imports surfboards from a supplier in Brazil and sells them in the United States.

Purchases are denominated in terms of the Brazilian real BRL During Spindler acquires surfboards at a price of BRL

oer surfboard, for a total of BRL Spindler will pay for the surfboards when it sells them. Relevant exchange rates are as

ollows:

Required:

a Assume that Spindler acquired the surfboards on September and made payment on December What is the effect

of the exchange rate fluctuations on reported income in

b Assume that Spindler acquired the surfboards on December and made payment on March What is the effect of the

exchange rate fluctuations on reported income in and

c Assume that Spindler acquired the surfboards on September and made payment on March What is the effect of

the exchange rate fluctuations on reported income in and in

Note: Input all amounts as positive values.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock