Question: SPIW Dilemma: SPIW Inc. is using a model 700S injection molding machine to make one of its products. The company is expecting to have a

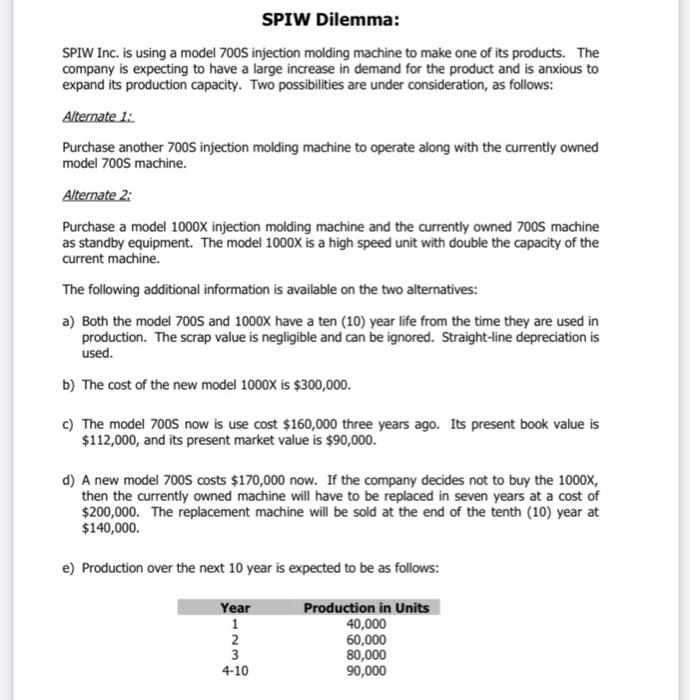

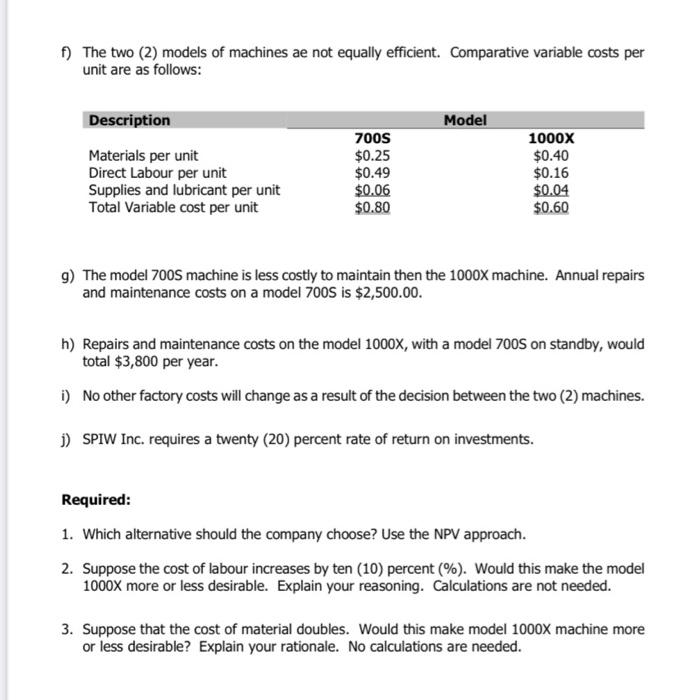

SPIW Dilemma: SPIW Inc. is using a model 700S injection molding machine to make one of its products. The company is expecting to have a large increase in demand for the product and is anxious to expand its production capacity. Two possibilities are under consideration, as follows: Alternate 1: Purchase another 700S injection molding machine to operate along with the currently owned model 700S machine. Alternate 2: Purchase a model 1000x injection molding machine and the currently owned 7005 machine as standby equipment. The model 1000x is a high speed unit with double the capacity of the current machine. The following additional information is available on the two alternatives: a) Both the model 7005 and 1000x have a ten (10) year life from the time they are used in production. The scrap value is negligible and can be ignored. Straight-line depreciation is used. b) The cost of the new model 1000x is $300,000. c) The model 7005 now is use cost $160,000 three years ago. Its present book value is $112,000, and its present market value is $90,000. d) A new model 2005 costs $170,000 now. If the company decides not to buy the 1000x, then the currently owned machine will have to be replaced in seven years at a cost of $200,000. The replacement machine will be sold at the end of the tenth (10) year at $140,000 e) Production over the next 10 year is expected to be as follows: Year 1 2 3 4-10 Production in Units 40,000 60,000 80,000 90,000 f) The two (2) models of machines ae not equally efficient. Comparative variable costs per unit are as follows: Description Model Materials per unit Direct Labour per unit Supplies and lubricant per unit Total Variable cost per unit 7005 $0.25 $0.49 $0.06 $0.80 1000x $0.40 $0.16 $0.04 $0.60 9) The model 2005 machine is less costly to maintain then the 1000x machine. Annual repairs and maintenance costs on a model 7005 is $2,500.00 h) Repairs and maintenance costs on the model 1000x, with a model 700S on standby, would total $3,800 per year. i) No other factory costs will change as a result of the decision between the two (2) machines. j) SPIW Inc. requires a twenty (20) percent rate of return on investments. Required: 1. Which alternative should the company choose? Use the NPV approach. 2. Suppose the cost of labour increases by ten (10) percent (%). Would this make the model 1000x more or less desirable. Explain your reasoning. Calculations are not needed. 3. Suppose that the cost of material doubles. Would this make model 1000x machine more or less desirable? Explain your rationale. No calculations are needed. SPIW Dilemma: SPIW Inc. is using a model 700S injection molding machine to make one of its products. The company is expecting to have a large increase in demand for the product and is anxious to expand its production capacity. Two possibilities are under consideration, as follows: Alternate 1: Purchase another 700S injection molding machine to operate along with the currently owned model 700S machine. Alternate 2: Purchase a model 1000x injection molding machine and the currently owned 7005 machine as standby equipment. The model 1000x is a high speed unit with double the capacity of the current machine. The following additional information is available on the two alternatives: a) Both the model 7005 and 1000x have a ten (10) year life from the time they are used in production. The scrap value is negligible and can be ignored. Straight-line depreciation is used. b) The cost of the new model 1000x is $300,000. c) The model 7005 now is use cost $160,000 three years ago. Its present book value is $112,000, and its present market value is $90,000. d) A new model 2005 costs $170,000 now. If the company decides not to buy the 1000x, then the currently owned machine will have to be replaced in seven years at a cost of $200,000. The replacement machine will be sold at the end of the tenth (10) year at $140,000 e) Production over the next 10 year is expected to be as follows: Year 1 2 3 4-10 Production in Units 40,000 60,000 80,000 90,000 f) The two (2) models of machines ae not equally efficient. Comparative variable costs per unit are as follows: Description Model Materials per unit Direct Labour per unit Supplies and lubricant per unit Total Variable cost per unit 7005 $0.25 $0.49 $0.06 $0.80 1000x $0.40 $0.16 $0.04 $0.60 9) The model 2005 machine is less costly to maintain then the 1000x machine. Annual repairs and maintenance costs on a model 7005 is $2,500.00 h) Repairs and maintenance costs on the model 1000x, with a model 700S on standby, would total $3,800 per year. i) No other factory costs will change as a result of the decision between the two (2) machines. j) SPIW Inc. requires a twenty (20) percent rate of return on investments. Required: 1. Which alternative should the company choose? Use the NPV approach. 2. Suppose the cost of labour increases by ten (10) percent (%). Would this make the model 1000x more or less desirable. Explain your reasoning. Calculations are not needed. 3. Suppose that the cost of material doubles. Would this make model 1000x machine more or less desirable? Explain your rationale. No calculations are needed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts