Question: Split Horiz Split Verticalerau Spreadsheet Calculator Submit T Corporate Formation (AICPA Adapted) Shareholder Contributions Help t Cut CopyPaste contributions and stock ownership is provided in

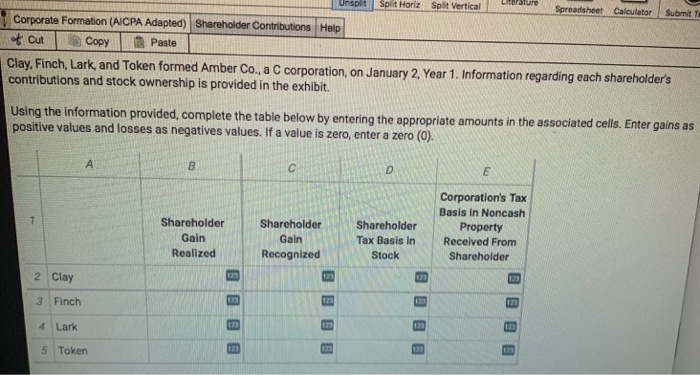

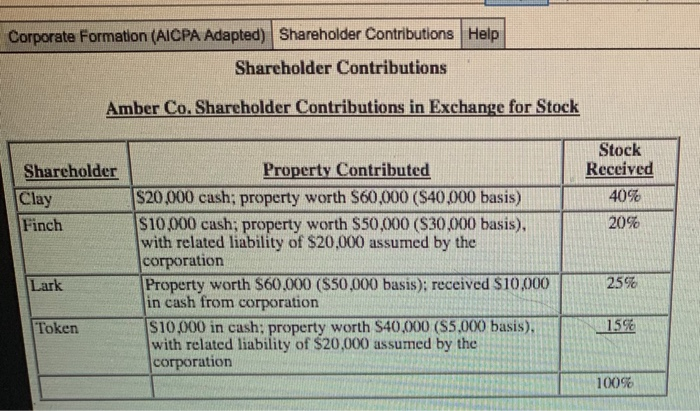

Split Horiz Split Verticalerau Spreadsheet Calculator Submit T Corporate Formation (AICPA Adapted) Shareholder Contributions Help t Cut CopyPaste contributions and stock ownership is provided in the exhibit. Using the information provided, complete the table below by entering the appropriate amounts in the Clay, Finch, Lark and Token formed Amber Co. a C corporation, on January 2, Year 1. Information regarding each shareholder's associated cells. Enter gains as positive values and losses as negatives values. If a value is zero, enter a zero (o). Shareholder Gain Realized Shareholder Gain Recognized Shareholder Tax Basis in Stock Corporation's Tax Basis in Noncash Property Received From Shareholder 2 Clay 3 Finch 4 Lark 5 Token

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts