Question: split into two just in case first is too blurry pls help Os 2023. Samningar pyment for 600.000 Theated met sy The stated residual value

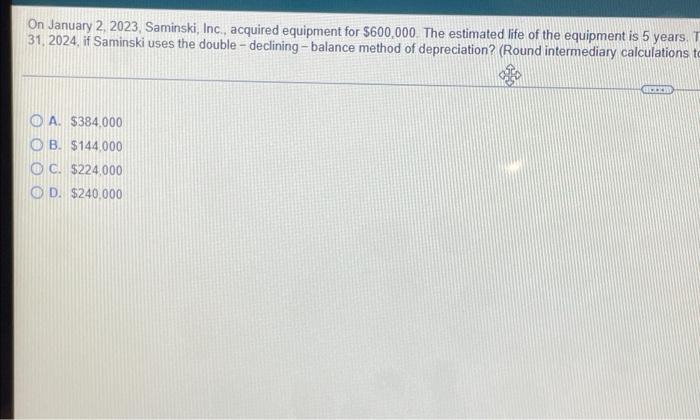

Os 2023. Samningar pyment for 600.000 Theated met sy The stated residual value is $40.000. What is the Accumulated Depreciation of the equipment December 31, 2024 Sami e doubledning - balance depui? Pound diary calculations to the decimal places and your finalitat delar A 114000 O 314400 OC 3224.000 005200 On January 2, 2023Saminski, Inc., acquired equipment for $600,000 The estimated life of the equipment is 5 years. T 31, 2024, if Saminski uses the double - declining - balance method of depreciation? (Round intermediary calculations to A. $384.000 O B. $144,000 C. $224,000 D. $240,000 ment is 5 years. The estimated residual value is $40,000 What is the Accumulated Depreciation of the equipment on Decembe ary calculations to two decimal places and your final answer to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts