Question: Please compare the listed ratios as explained in the right column. Please do not answer if not completing all ratios. No external sources such as

Please compare the listed ratios as explained in the right column. Please do not answer if not completing all ratios. No external sources such as connecting via email is accepted.

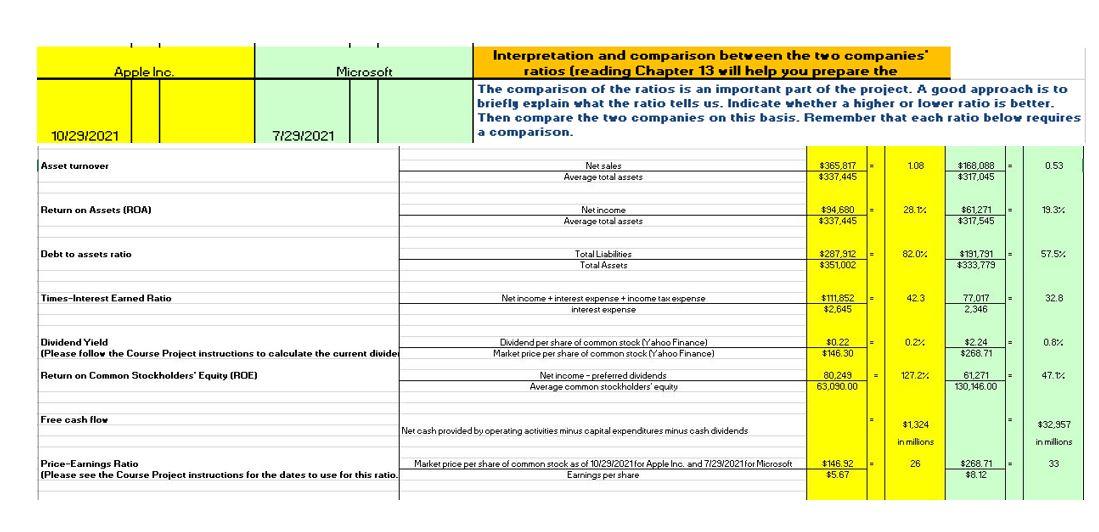

10/29/2021 Asset turnover Apple Inc. Return on Assets (ROA) Debt to assets ratio Times-Interest Earned Ratio Free cash flow 7/29/2021 Microsoft Dividend Yield (Please follow the Course Project instructions to calculate the current divide Return on Common Stockholders' Equity (ROE) Price-Earnings Ratio (Please see the Course Project instructions for the dates to use for this ratio. Interpretation and comparison between the two companies ratios (reading Chapter 13 will help you prepare the The comparison of the ratios is an important part of the project. A good approach is to briefly explain what the ratio tells us. Indicate whether a higher or lower ratio is better. Then compare the two companies on this basis. Remember that each ratio below requires a comparison. Net sales Average total assets Net income Average total assets Total Liabilities Total Assets Net income + interest expense + income tax expense interest expense Dividend per share of common stock (Yahoo Finance) Market price per share of common stock (Yahoo Finance) Net income-preferred dividends Average.common stockholders' equity Net cash provided by operating activities minus capital expenditures minus cash dividends Market price per share of common stock as of 10/29/2021 for Apple Inc. and 7/29/2021 for Microsoft Earnings per share $365,817 $337,445 $94,680 $337.445 $287.912 $351,002 $111,852 $2,645 $0.22 $146.30 80,249 63,090.00 $146.92 $5.67 1.08 28.1% 82.0% 42.3 0.2% 127.2% $1,324 in millions 26 $168,088 $317,045 $61,271 $317,545 $191,791 $333,779 77,017 2,346 = $2.24 = $268.71 61,271 = 130,146.00 $268.71 $8.12 0.53 19.3% 57.5% 32.8 0.8% 47.1% $32,957 in millions 33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts