Question: Spreadsheet Exercise. Create a spreadsheet that duplicates Table 4-1. Make it flexible enough that you can investigate the impact of different interest rates and principal

Spreadsheet Exercise. Create a spreadsheet that duplicates Table 4-1. Make it flexible enough that you can investigate the impact of different interest rates and principal loan amounts without changing the structure of the spreadsheet.

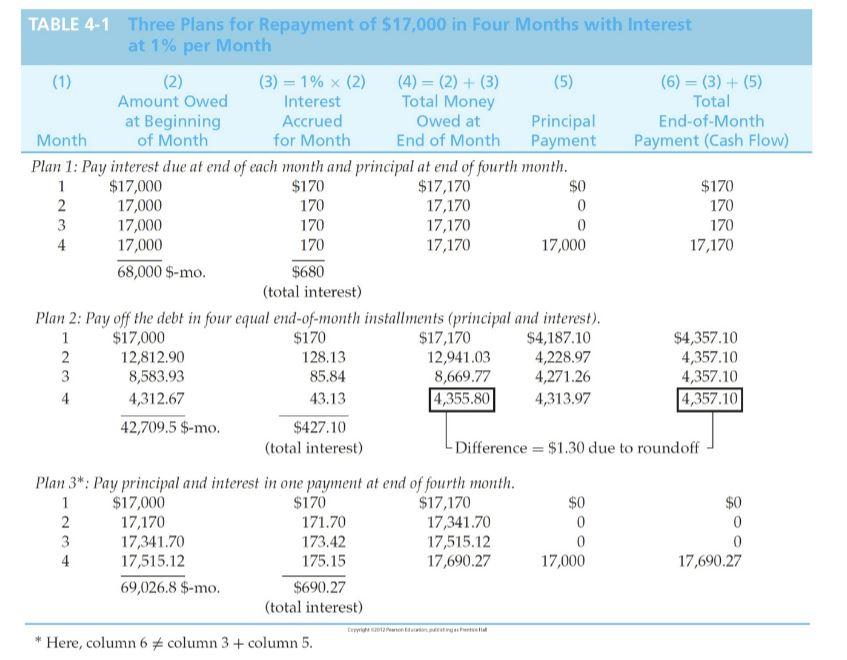

TABLE 4.1 Three Plans for Repayment of $17,000 in Four Months with Interest at 1% per Month (1) (2) (3) = 1% x (2) (4) = (2) + (3) (5) (6) = (3) + (5) Amount Owed Interest Total Money Total at Beginning Accrued Owed at Principal End-of-Month Month of Month for Month End of Month Payment Payment (Cash Flow) Plan 1: Pay interest due at end of each month and principal at end of fourth month. 1 $17,000 $170 $17,170 $0 $170 2 17,000 170 17,170 0 170 3 17,000 170 17,170 0 170 4 17,000 170 17,170 17,000 17,170 68,000 $-mo. $680 (total interest) Plan 2: Pay off the debt in four equal end-of-month installments (principal and interest). 1 $17,000 $170 $17,170 $4,187.10 $4,357.10 2 12,812.90 128.13 12,941.03 4,228.97 4,357.10 3 8,583.93 85.84 8,669.77 4,271.26 4,357.10 4 4,312.67 43.13 4,355.80 4,313.97 4,357.10 42,709,5 $-mo. $427.10 (total interest) -Difference = $1.30 due to roundoff Plan 3*: Pay principal and interest in one payment at end of fourth month. 1 $17,000 $170 $17,170 $0 $0 2 17,170 171.70 17,341.70 0 0 3 17,341.70 173.42 17,515.12 0 0 4 17,515.12 175.15 17,690.27 17,000 17,690.27 69,026.8 $-mo. $690.27 (total interest) Here, column 6 column 3 + column 5. TABLE 4.1 Three Plans for Repayment of $17,000 in Four Months with Interest at 1% per Month (1) (2) (3) = 1% x (2) (4) = (2) + (3) (5) (6) = (3) + (5) Amount Owed Interest Total Money Total at Beginning Accrued Owed at Principal End-of-Month Month of Month for Month End of Month Payment Payment (Cash Flow) Plan 1: Pay interest due at end of each month and principal at end of fourth month. 1 $17,000 $170 $17,170 $0 $170 2 17,000 170 17,170 0 170 3 17,000 170 17,170 0 170 4 17,000 170 17,170 17,000 17,170 68,000 $-mo. $680 (total interest) Plan 2: Pay off the debt in four equal end-of-month installments (principal and interest). 1 $17,000 $170 $17,170 $4,187.10 $4,357.10 2 12,812.90 128.13 12,941.03 4,228.97 4,357.10 3 8,583.93 85.84 8,669.77 4,271.26 4,357.10 4 4,312.67 43.13 4,355.80 4,313.97 4,357.10 42,709,5 $-mo. $427.10 (total interest) -Difference = $1.30 due to roundoff Plan 3*: Pay principal and interest in one payment at end of fourth month. 1 $17,000 $170 $17,170 $0 $0 2 17,170 171.70 17,341.70 0 0 3 17,341.70 173.42 17,515.12 0 0 4 17,515.12 175.15 17,690.27 17,000 17,690.27 69,026.8 $-mo. $690.27 (total interest) Here, column 6 column 3 + column 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts