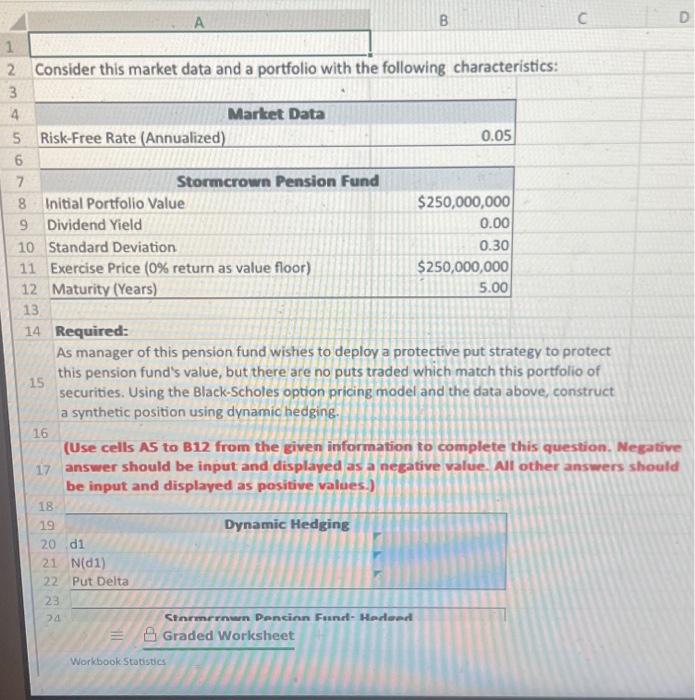

Question: spreadsheet functions please Consider this market data and a portfolio with the following characteristics: begin{tabular}{|l|l|} hline multicolumn{1}{|c|}{ Market Data } hline Risk-Free Rate (Annualized)

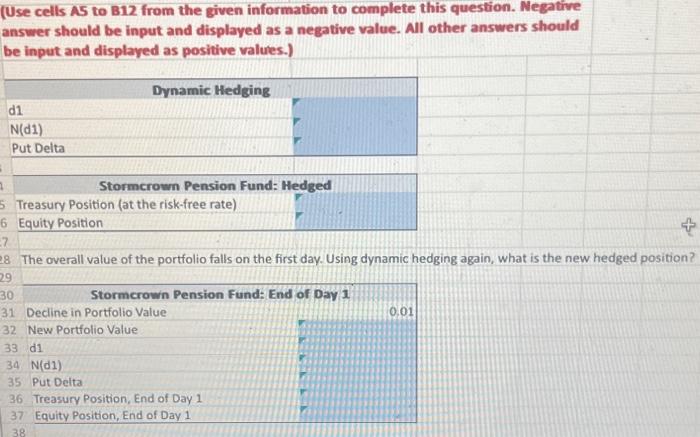

Consider this market data and a portfolio with the following characteristics: \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{ Market Data } \\ \hline Risk-Free Rate (Annualized) & 0.05 \\ \hline \end{tabular} 14 Required: As manager of this pension fund wishes to deploy a protective put strategy to protect 15 this pension fund's value, but there are no puts traded which match this portfolio of securities. Using the Black-Scholes option pricing model and the data above, construct a synthetic position using dynamic hedging. 16 (Use cells AS to B12 from the given information to complete this question. Negativ. 17 answer should be input and displayed as a negative value. All other answers should be input and displayed as positive values.) Use cells AS to B12 from the given information to complete this question. Negative answer should be input and displayed as a negative value. Att other answers shoutd be input and displayed as positive values.) The overall value of the portfolio falls on the first day. Using dynamic hedging again, what is the new hedged position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts