Question: Spring 2021 - Session B - Online icourse Lexi Bengson : 04/04/21 7:06 PM Homework: Chapter 6 - Apply your knowledge Save Score: 0 of

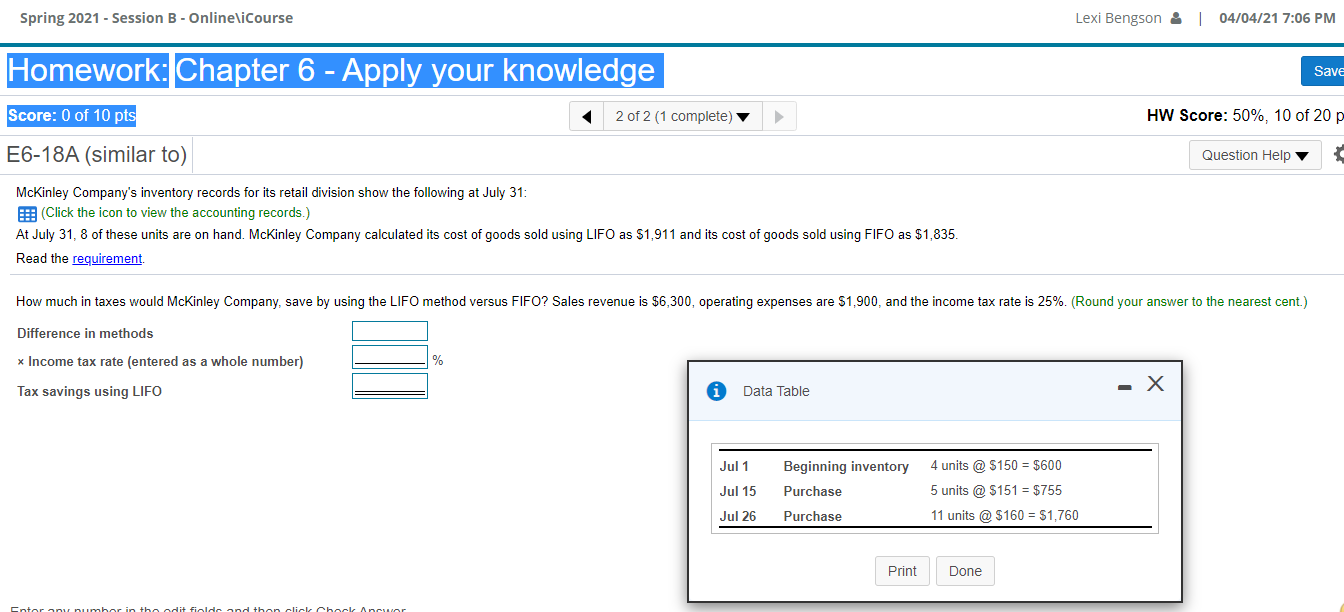

Spring 2021 - Session B - Online icourse Lexi Bengson : 04/04/21 7:06 PM Homework: Chapter 6 - Apply your knowledge Save Score: 0 of 10 pts 2 of 2 (1 complete) HW Score: 50%, 10 of 20 p E6-18A (similar to) Question Help McKinley Company's inventory records for its retail division show the following at July 31: (Click the icon to view the accounting records.) At July 31, 8 of these units are on hand. McKinley Company calculated its cost of goods sold using LIFO as $1,911 and its cost of goods sold using FIFO as $1,835. Read the requirement. How much in taxes would McKinley Company, save by using the LIFO method versus FIFO? Sales revenue is $6,300, operating expenses are $1,900, and the income tax rate is 25%. (Round your answer to the nearest cent.) Difference in methods * Income tax rate (entered as a whole number) Tax savings using LIFO Data Table % Jul 1 Beginning inventory Purchase Jul 15 4 units @ $150 = $600 5 units @ $151 = $755 11 units @ $160 = $1,760 Jul 26 Purchase Print Done cliehock Ancor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts