Question: SSAY. Write your answer in the space provided or on a separate sheet of paper. 26) A single index model has been estimated on an

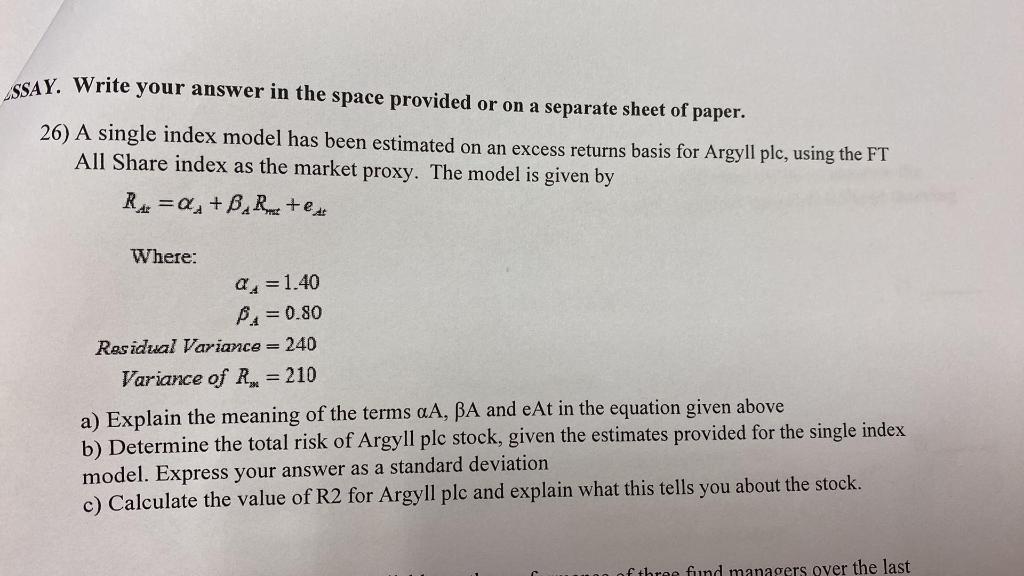

SSAY. Write your answer in the space provided or on a separate sheet of paper. 26) A single index model has been estimated on an excess returns basis for Argyll plc, using the FT All Share index as the market proxy. The model is given by Rx = a,+B.R+ex Where: Q=1.40 Ba=0.80 Residual Variance = 240 Variance of R= 210 a) Explain the meaning of the terms aA, BA and eAt in the equation given above b) Determine the total risk of Argyll plc stock, given the estimates provided for the single index model. Express your answer as a standard deviation c) Calculate the value of R2 for Argyll plc and explain what this tells you about the stock. of three fund managers over the last SSAY. Write your answer in the space provided or on a separate sheet of paper. 26) A single index model has been estimated on an excess returns basis for Argyll plc, using the FT All Share index as the market proxy. The model is given by Rx = a,+B.R+ex Where: Q=1.40 Ba=0.80 Residual Variance = 240 Variance of R= 210 a) Explain the meaning of the terms aA, BA and eAt in the equation given above b) Determine the total risk of Argyll plc stock, given the estimates provided for the single index model. Express your answer as a standard deviation c) Calculate the value of R2 for Argyll plc and explain what this tells you about the stock. of three fund managers over the last

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts